Four Mobile Money Trends from the IMF Financial Access Survey

There is a new source of data in the world of mobile money – the recently expanded, IMF Financial Access Survey.

Back in 2011, GSMA launched its annual Global Survey of Mobile Financial Services to complement its Mobile Money Deployment tracker to capture key data from Mobile Financial Services providers on the performance of their services. This effort was one of the first to capture comparable data from multiple mobile money deployments globally and greatly improved the field’s ability to analyze trends in the mobile money space. While it was a huge step forward, this data has limitations. In particular, because data is provided voluntarily to the GSMA, the results only cover survey participants. In addition, because the data provided is confidential, it has only been aggregated at the regional level so far. The GSMA has also recently launched a new online database that will publish all historic data as well as forecasts on mobile money transactions, products, customers and agent distribution networks.

Now there is a new trove of data that will generate a fresh round of insights. Last year, the Bill and Melinda Gates foundation provided funding to expand the annual Financial Access Survey (FAS) conducted by the IMF. The FAS is supply-side data provided by bank regulators in over 180 markets globally. It has now been expanded to include basic mobile money indicators.

This new data contributes to the field in a number of ways. First, it allows a country level view of mobile money markets in a large set of countries for which there was limited data before. It has the benefit of making the data set publicly available, adding countries where little data was previously available, enabling disaggregation at the country level, and is linked to other data points.

This rich dataset can be used to calculate many different indicators, including account balances, number of active users, number of active agents, and volume and number of transactions.

Below are a few preliminary observations from the dataset.

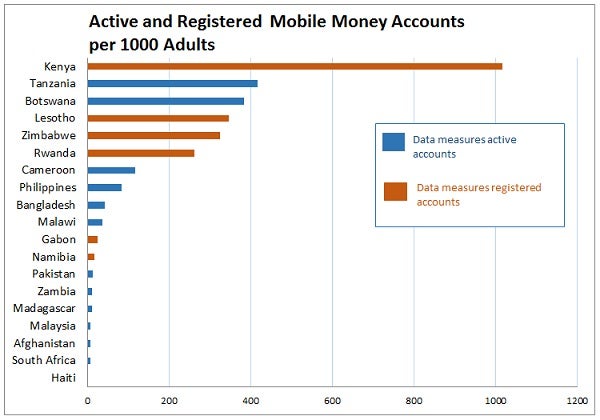

Kenya has more registered* mobile money accounts than adults

Data Source: IMF FAS

It is interesting to note (as the Economist did in September) that Kenya now has more registered mobile money accounts than adults. The data also reveals deep penetration in some of the well-known “follower” markets like Tanzania (Uganda would be similar, but unfortunately “active accounts” was not reported) but also the less celebrated Botswana, Rwanda, Lesotho, and Zimbabwe. It should be noted that some countries have not reported on active agents and active accounts but only on registered including countries such as Gabon, Kenya, Lesotho, Namibia, Rwanda, and Zimbabwe.

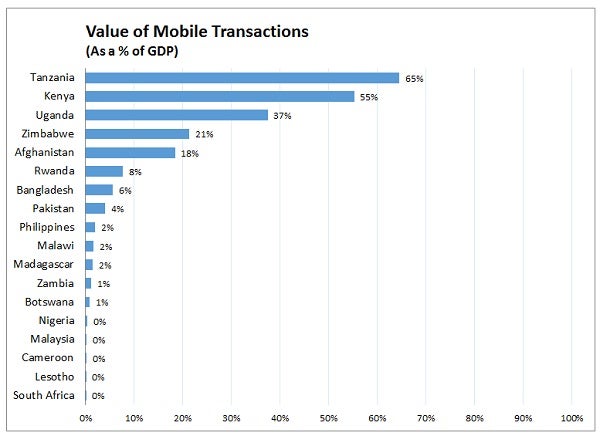

Tanzania leads in total transaction value

Data Source: IMF FAS

Given Kenya’s dominance, it is interesting that Tanzania is in the lead in terms of total transaction value as percent of GDP. Some of this may have to do with the fact that there are 2-3 very active mobile money deployments in Tanzania generating a greater volume.

Deposits are higher than expected in some countries

Data Source: IMF FAS

In general there is a higher amount of deposits in each mobile money account on average than you would expect from a purely transactional account. Madagascar stands out with over $100 per active account.

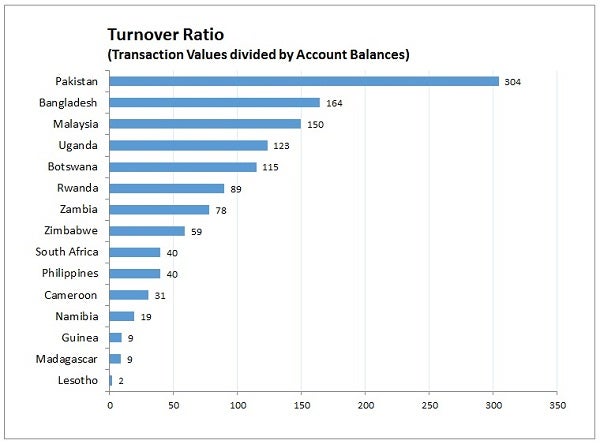

Turnover Ratios Indicate How People Use the Mobile Money System

Data Source: IMF FAS

The new dataset also allows you to calculate the “turnover ratio”, which is the amount of transactions relative to the amount held on accounts. This is a rough proxy for velocity and the degree to which people use the system as a store of value as opposed to unit of account. The highest turnover ratio occurs in markets like Pakistan, Bangladesh, and Uganda, where lots of people use the system without having any account at all. Also also referred to as “over the counter” (OTC) transactions, people will, for example, give money to agents and ask them to send it to someone directly without first putting the money into an account. Pakistan’s Easypaisa has an official OTC product, in other places it is an informal practice.

These were just a few observations we had on the data. We encourage you to take a look and see what interesting trends you can spot and share them in the comments field below!

*Note - this post has been updated since it was originally published to reflect that data for some countries measures "active" mobile money accounts, while data for others measures "registered" accounts.

Comments

As a leading mobile money

As a leading mobile money implementation, not entirely sure why Wing in Cambodia is not listed in these charts; here are the the rough stats for those curious:

Active accounts per 1,000 adults: 63

% GDP: 26%

Deposits/account: $60

Turnover: 133

I think it is because the

I think it is because the report was not talking about a provider but the country as a whole.

Thanks Anthony for the

Thanks Anthony for the information about Wing. You make a good point. We are definitely aware of Wing’s achievements in Cambodia, and I’m not sure why the IMF didn’t collect MFS data for Cambodia. I would recommend that you reach out to them directly to find out more. For the provider specific data GSMA will have the data - although confidential for each provider.

Add new comment