Regulating for Inclusive Insurance Markets in Ghana

Three pioneering insurance supervisors from Ghana, Pakistan and South Africa were asked to share their experience regulating inclusive insurance vis-à-vis the work of the A2ii and the IAIS, around the A2ii, IAIS, CGAP Expert Symposium on proportional regulatory approaches in inclusive insurance markets. The author of this blog, Lydia Lariba Bawa, is the Commissioner of Insurance for the National Insurance Commission in Ghana.

In 2010, the findings of a FinScope Survey in Ghana revealed that only 5% of adults have access to either formal or informal insurance services. The findings of the survey pointed to an urgent need to take some action to improve insurance inclusion. The low coverage was mainly due to the fact that the majority of Ghanaians operate in the informal sector as small-scale farmers, carpenters, artisans, petty traders or fishermen. Even though these people face significant social and economic risks, they struggled to access insurance because providers had not figured out a business and operational model to reach this mass market.

The National Insurance Commission of Ghana (NIC) collaborated with the German Development Corporation (GIZ) to develop the microinsurance market and help improve access to insurance for low -income earners, as well as adults working in the informal sector.

The project had four main components:

1. Develop a regulatory framework that defines microinsurance, specifies the regulatory approach and lays out the product and consumer protection requirements. It has been difficult to apply a quantitative approach to defining microinsurance. The NIC now applies a qualitative approach with very clear criteria. The definition now states that a product may be designated as a microinsurance product if it is designed to meet the needs of a particular target market, is affordable to that target market, and is accessible to that target market. The onus is on insurance companies to prove that their products meet the criteria.

2. Increase the technical capacity of insurance providers to develop and market microinsurance. This was used to build capacity in the areas of product development, pricing, reserving, marketing and back office administration. For example in 2013, the UK Government Actuary’s Department conducted a training workshop on the Microinsurance Actuarial Toolkit.. An Actuarial Capacity Development Strategy is also currently going through stakeholder consultation prior to finalization and implementation by 2015.

3. Increase consumer awareness. This entailed several activities including the development of movies in local dialects (with English subtitles) using local content. The movies and other materials were then showcased on road shows to educate various communities. The movies are available on YouTube (see here or here).

4. Conduct research into various issues that pose challenges to financial inclusion. This has included research into the impact of insurance awareness measures on the behavior of low- income households and market surveys on both the demand and supply sides of microinsurance. In addition, a proposal for an insurance industry database has been prepared and discussed with relevant stakeholders for implementation.

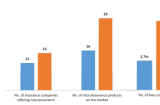

The NIC launched the legal framework in the form of Microinsurance Market Conduct Rules in February 2013. Since then tremendous gains have been made in the microinsurance market. The figure below highlights some of the key changes from 2011 to 2014:

Source: MicroInsurance Centre, The Landscape of Microinsurance in Africa 2014 (forthcoming)

Mobile phones are one of the most popular modes of microinsurance distribution in Ghana (the number of deployments worldwide is growing fast as well). Providers are developing innovative products to use with this channel. Three out of the four major telecommunications companies in Ghana offer microinsurance on their networks. This includes loyalty schemes whereby consumers of airtime get rewarded with free insurance policies, fully paid schemes where consumers can pay with either airtime or mobile money; or a combination of loyalty and paid schemes. These products have proven extremely popular – a CGAP blog from last year estimated that a single product (Tigo Family Care) had doubled the number of people in Ghana with insurance cover.

Although the strong take-up of these products is encouraging, the NIC is concerned about some of the challenges posed by this mode of distribution. First, there needs to be a balance between transparency and consumer protection on the one hand and cost effectiveness on the other. Insurance offered through the mobile phone is all done through electronic texts on the phone, and no “paperwork” is involved. The consumer must submit personal information on the phone to activate a policy. With no paper documents to reference, it can create problems for consumers attempting to file complaints.

Another challenge is the security of the partnership or collaboration between the telecommunication company and the insurance provider. If the parties decide at any time to discontinue the collaboration, there would be serious repercussions for the policyholders if pragmatic steps are not taken to properly manage the disengagement. The NIC is planning to liaise with the telecommunication industry regulator, the National Communications Authority (NCA), to discuss and formulate measures to mitigate this risk.

Aside from the challenges posed by mobile insurance, the NIC is also very much concerned about consumer awareness since the best way to protect consumers is to educate them. Informed customers are less likely to be victims of mis-selling, fraud or other undesirable practices. A demand side assessment conducted in 2012 showed that lack of knowledge and trust are the major impediments to insurance take-up especially in the low-income segment.

Going forward, the NIC is planning to engage experts to conduct a country study and risk analysis of the mobile insurance market and make recommendations to mitigate any potential risk and to develop effective supervisory strategies. In addition, the NIC also plans to review the regulatory framework to enable mutuals and cooperatives to enter the microinsurance market in the areas (especially non-urban) that have been neglected by the conventional insurance companies.

Add new comment