When Digital Meets Traditional Banking: A New Concept in Senegal

With only six percent of the adult Senegalese population having an account in a formal financial institution, commercial banks in Senegal have so far shown little interest in contributing to financial inclusion by serving this vast untapped market. Microfinance institutions (MFIs) have been the only financial institutions attempting to reach down-market but this has not reached substantial scale. Banks in Senegal, as in other WAEMU countries, are very cautious. And despite the opportunity, most are reluctant to build the adequate expertise or adapt their policies and procedures required to reach low income people.

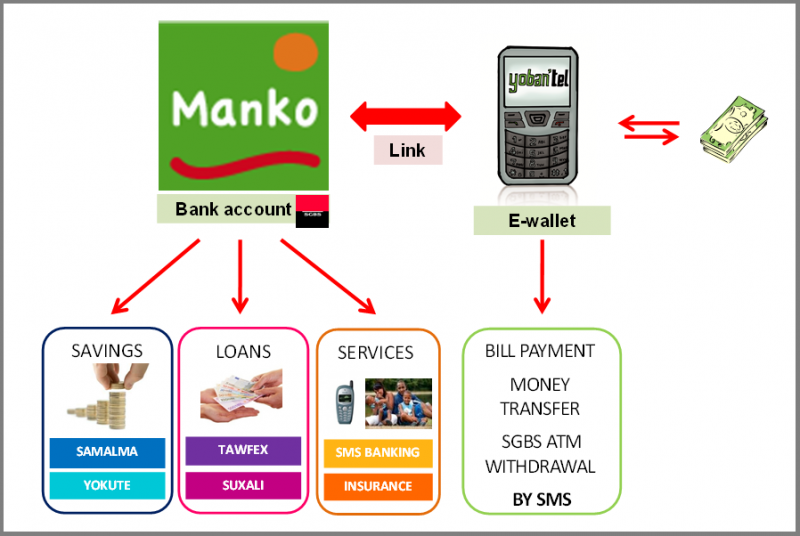

With the launch of its subsidiary Manko in 2013, Société Générale de Banques au Sénégal (SGBS) is one of the few commercial banks challenging the status quo. Equipped with two interesting features, the model could potentially disrupt the market and redefine the role of banks in Senegal and WAEMU more broadly.

Manko’s first feature builds on the legal status of intermediary in banking operations (IBO). An IBO is an enterprise acting as an intermediary on behalf of a bank with a mandate to distribute its products and services through any distribution channels. This status offers a much simpler and less costly alternative than a traditional bank. Manko drives revenues for SGBS by solely distributing SGBS products, while operating as an IBO allows it to offer different products than MFIs. In WAEMU, banking and microfinance activities are separately regulated with distinctive conditions such as a lower interest rate cap for banks (15% compared to 24% for MFIs). Manko is therefore able to distribute loan products specifically designed for low-income people at a much lower and attractive rate.

Manko’s second feature is the use of mobile technology via Yoban’tel, an e-wallet launched in 2011 by SGBS. Coupled with Manko, the e-wallet is automatically linked to a client’s bank account regardless of its mobile network operator. Customers can remotely make deposits, repay loans and withdraw money at any Yoban’tel agents or SBGS branches. This experience offers an interesting contrast with the existing mobile banking experiences in WAEMU. Banks have traditionally played a passive role by only leveraging e-wallet solutions of mobile network operators (MNOs) for their existing customer base; thus, not going down market.

20 months after the launch of the pilot, what lessons can we learn from Manko?

The early experience has been promising. Manko currently serves 4,300 clients, mainly small merchants in the informal sector. Overall, two-thirds were existing clients of MFIs and one-third was previously unbanked and managed to get their first loan through Manko. The company has provided roughly $8.1 million in total loans (about FCFA 4,500 billion) so far, with 85% ranging from $180 to $1,510 (about FCFA 100,000 to 800,000).

The mobile channel has generated interest but a number of improvements are necessary. Building off a network of merchant partners, people are keen on the mobile channel and this has contributed to positively affect Manko’s image. However, three areas of improvement are necessary so that the concept can be fully effective and responsive to the needs and expectations of the target population.

- Improving the mobile banking tool to make it easier to use by illiterate people. Currently, SMSs are used for transactions. However, more than 50 percent of clients either do not manage to use the tool or have to get help from a relative or even an agent. A solution not involving SMS is being planned to make it more user-friendly.

- Enhancing quality of service at agents. These partners sometimes have too little liquidity available to meet the needs of their clients. More effective targeting of agents and attractive remuneration will enable better quality services.

- Improving the loan approval process to grow the volume and respond to a significant demand. An on-site registration solution through touchscreen tablets is under development to shorten the loan decision period.

While some important improvements are required, this new business model offers an interesting approach for banks to complement their traditional business by serving the low income segments while minimizing costs. At a time where mobile money is expanding quickly in all WAEMU countries, this innovative model may have the potential for replication and scale. What would it take for MNOs to adopt the IBO status - nothing in the regulation prohibits it - and deepen their partnership with banks in offering financial services beyond transfer and payments like savings or credit to their current mobile money customers?

Add new comment