Five Ways Providers Can Do Digital Finance Better

Digital finance is on the rise. But that doesn’t mean that it’s working as well as it could to expand meaningful access to affordable financial services to the poor. With the release of its latest Focus Note, "Doing Digital Finance Right: The Case for Stronger Mitigation of Customer Risks," CGAP has launched a blog series to highlight the research findings and their implications. In the opening post, Michelle Kaffenberger summarizes new evidence that strongly suggests that certain aspects of digital financial service models impose risks- seven to be exact - that affect, through experiences or perceptions of loss or harm, customer enthusiasm for more extensive or deeper use of the services. The Focus Note looks hard at the current evidence and issues a clear warning to digital financial service providers: if customers don’t trust it and/or they won’t use it, then wave goodbye to a large part of that alluring fortune at the bottom of the pyramid.

In other words, profitability and scalability of digital financial services squarely depend upon minimizing the experience and perception of risks among millions of new and underserved customers.

But how?

In our Focus Note we recommend five core priorities for digital financial service providers to address right now to improve the safety, reliability, and performance of their products, channels, and systems, reducing the barriers the customers face in taking up and transacting more intensively. For each priority area, we explore not only specific solutions, but, wherever possible, provide current examples in action from providers around the globe. Indeed, it is important to underscore: many providers are already working creatively to address these issues, and it seems that creative and cost effective solutions are possible.

Here are the five priorities, with a glimpse of some highlighted solutions you’ll find in the focus note.

1. Improve service reliability and robustness. As the number one complaint among customers, reducing network downtime should be a top priority. This can include such activities as regular network system testing and monitoring, like Airtel Uganda’s system of incremental and full backups with a system-uptime monitoring tool that provides alerts and reports. Or, ensuring a reliable platform that can integrate smoothly with other ecosystem players. MTN Uganda has been working to heavily invest in infrastructure, upgrading its platform, and adding 117 new 2G sites and 130 new 3G sites in 2014.

2. Make the customer interface more user friendly. Complex and confusing interfaces introduce opportunities for customer loss and suppress activity levels. Providers can make user-interface improvements that increase value to both customers and providers by offering menus in local languages. For example, M-PESA in India is available in Hindi, Bengali, Marathi, Gujarati, and English, and more regional languages are planned. Mobile money providers can also work to reduce USSD time outs as well as keystroke errors. Tigo Kilimo in Tanzania modified its menu, replacing open-ended questions with multiple-choice questions that were easier and quicker to answers; DBBL in Bangladesh adds a “check digit” to the end of the mobile number when it creates a customer’s account as a safeguard against sending money to the wrong account.

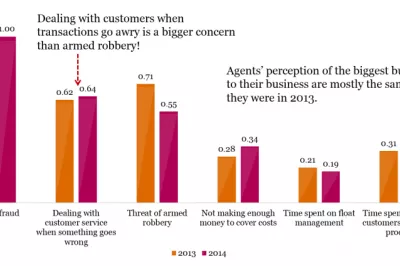

3. Strengthen agent quality, management, and liquidity. Improved agent management, reinforced with incentives for good agent behavior, can help improve transparency and compliance with rules and procedures; reduce agent fraud; improve data handling; and improve customer choice, empowerment, and recourse when things go wrong. Providers can work to strengthen liquidity management. Vodacom Tanzania’s master agents, for example, offer toll-free numbers to their agents to easily communicate liquidity needs. Or, focus on effective induction and continual training, like Orange in Côte d’Ivoire, which combines a half-day training in regional hubs with later field visits. Telenor Pakistan’s Easypaisa ensured fee structures incentivized ethical agent behavior by combining a tiered commission model with a minimum deposit amount, which reduced split transactions.

4. Combat customer-affecting fraud. Greater attention to fraud that affects users is important for consumer confidence, revenue assurance, and the reputation of digital financial services overall and provider brands more specifically. Providers can improve customer awareness of fraud schemes. Banco WWB in Colombia mandates that agents and sales officers provide product security tips to customers upon opening an account or registering for mobile money. Safaricom’s M-PESA uses SMS alerts, radio announcements in local dialects, newspaper ads, and other efforts to improve customer awareness. Or, introduce measures to reduce unauthorized SIM swaps. ABSA in South Africa places a temporary hold on a customer account if it becomes aware of a SIM swap. The customer has 36 hours to authenticate and advise ABSA if the SIM swap was legitimate. Providers may also improve data handling to reduce the risk of fraud. F-Road in China, for example, uses a SIM overlay card specifically tied to financial activity (phone activity is tied to the regular SIM), in which data are encrypted and only the financial service provider has access to the data.

5. Improve handling of complaints, queries, and redress. Recourse is important to customers and affects all the other risk areas, so providers need to carefully examine appropriate recourse options for their digital financial service business line. Providers should better equip agents to help address problems. In Colombia, Bancolombia created a dedicated agent hotline. Or ensure designated and specialized call center staff, like Digicel in Haiti that trained and allocated call center staff specifically for their Tcho Tcho Mobile money service, through which government social cash transfers are paid. During payment periods, Digicel doubles the TTM-dedicated call center staff. If you don’t have a call center at all, create one: When World Food Programme in Kenya realized recipients of its Cash for Assets payments had no clear or effective avenue for recourse, it launched a new hotline managed by multi-lingual staff and an internal queries/complaints tracking system.

To be sure, providers will need to assess their priorities and employ - or create - cost-effective solutions in light of their business model and objectives. The solutions highlighted here and in the Focus Note, do not come without a cost, and some (e.g., enhanced agent oversight or network/platform capability) are more complicated and expensive to address than others (e.g., better signage, customer communication, or call center procedures).

If the evidence revealed in "Doing Digital Finance Right" is any indicator, then the tangible benefits of addressing these priorities - such as cost savings, revenue assurance, revenue gains from increased activity levels and cross-sale, and indirect benefits like reduced churn or savings on airtime distribution - will justify the investments.

Comments

Jamie, good article with nice

Jamie, good article with nice tips. Many of these are similar to the issues and tips raised by central bankers and other financial regulators that comprise the digital financial services working group of AFI. Please see the note prepared on consumer protection for MFS http://www.afi-global.org/library/publications/mobile-financial-service…

Thanks John! We are always

Thanks John! We are always glad to see AFI on the forefront of these issues and were indeed inspired by the excellent concept note you all published last year. I hope you will find it well cited in the focus note!

Jamie, great points you

Jamie, great points you mentioned. I have some initiatives around Financial Inclusion in Ghana that i will like to share with you. How can i contact you?

Lovely Article... Thanks for

Lovely Article... Thanks for sharing.

Add new comment