Addressing Competition Bottlenecks in Digital Financial Services

Despite some early success, the mobile money industry’s future remains unclear as many markets remain slow to ignite. In fact, starting mobile money operations, whether for a Mobile Network Operator (MNO) or a bank, is expensive, complex, and relatively high risk. As a result, mobile financial systems in developing countries tend to be dominated by a few large players, mostly mobile operators. This dynamic often reduces incentives for the dominant firm to lower prices or innovate. And in the end, these market dynamics are an obstacle to financial inclusion as customers tend to use mobile money systems infrequently, for a limited range of applications, and in the end continue to rely mainly on cash.

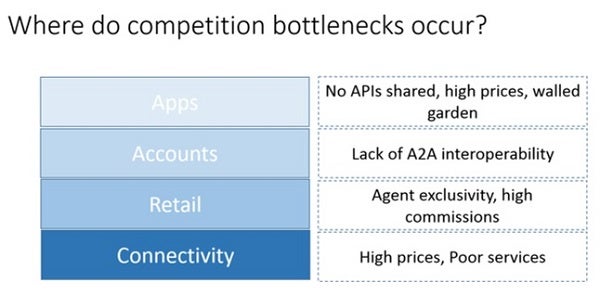

In a recent paper, David Evans and Alexis Pirchio, two economists from the University of Chicago and Global Economics Group, identified four layers in mobile payments platforms where competition bottlenecks can occur:

- Connectivity: For example, in Zimbabwe, EcoCash was investigated because they created a separate USSD for banks to offer their transfer services at a much higher price than what Econet was charging those connected to EcoCash.

- Agent network: Recently, in Kenya Airtel filed a complaint with the Competition Authority of Kenya to force Safaricom to remove the exclusive arrangements with its agents. The CAK ordered Safaricom to open up its network to other players and prohibited Safaricom from charging extra charges on others.

- Accounts: In Kenya, currently, an M-Pesa customer can send money to a non-Safaricom phone but recipients do not receive that into their wallets. Instead, they have to withdraw cash from a Safaricom agent.

- Applications: the mobile money provider can be a bottleneck for value-added services as it can usually decide whether or not to allow the service to access its communications, accounts, and agent network platforms, as it is also the case in Kenya with M-Pesa right now. Moreover, the data exhaust created by the use of digital financial services by the poor can also be used by firms to propose better services and deals, improved credit access, etc. This question of data ownership cuts across these four layers and constitutes a fifth level of competition analysis.

So what can countries do to navigate complex competition issues? In this recent paper, I try to propose ideas to start answering these questions.

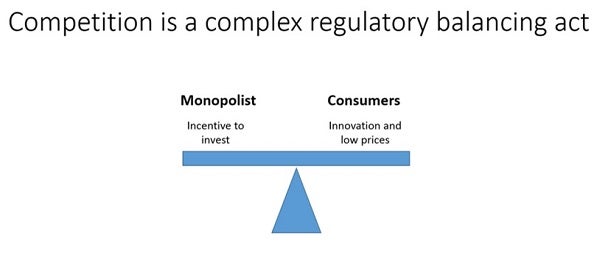

The lack of competition is hard to address as regulators are wrestling with complex market incentives. On the one hand a monopoly incentivizes the dominant player to invest and this is something the regulator will want to preserve; on the other hand, a monopoly prevents market players to enter the market, reduce prices or innovate for customers, and this what the regulator will want to address.

Some of the questions in-country regulators are wrestling with are:

- When is the right time to intervene?

- Which intervention will foster competition and accompany the market, without stalling its growth?

- Which regulatory agency will have jurisdictions over the claim or dispute? Should it be the Telco, banking regulator or Competition Authority? This lack of mandate clarity usually favors the status quo thus the dominant player.

Governments, regulators and investors could work together to foster in-country competition by setting in motion the following activities:

1. Strengthening mobile money expertise of competition authorities

2. Promoting regulatory coordination between all three regulators and clarity of roles

3. Boosting in-country and global mobile money competition ecosystem

4. Spurring disruptive innovation that will challenge the current mobile money landscape and the dominant player.

How do you think competition issues are affecting the mobile money landscape? What interventions would allow to foster competition without stalling market growth? What is the role of the donor community in this space? These questions will generate much debate over the years to come. We are only scratching the surface here and invite you to contribute your thoughts below.

Add new comment