Insights on Inactivity of Mobile Money Accounts in Côte d’Ivoire

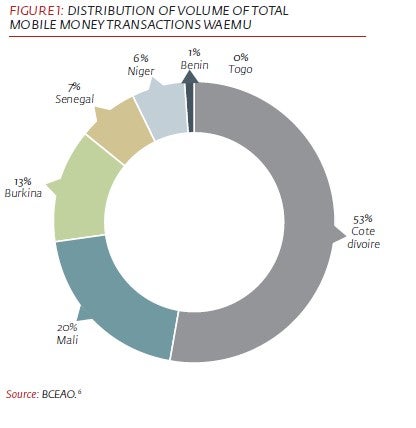

Côte d’Ivoire is one of the most vibrant digital financial services markets in West Africa. The number of registered accounts has tripled in recent years, to over 9 million by the end of 2014. This represents over 50% of the total mobile money flows in the entire West African Economic and Monetary Union (WAEMU) (Figure 1). Today, there are more mobile money accounts in Côte d’Ivoire than bank and microfinance accounts combined, and it is becoming very common for Ivoirians to use mobile money to make payments. For example, as of 2014 all secondary school fees nationwide must be paid using mobile money. The national electric utility expects that by the end of 2015, mobile money will be used to pay over 50% of electric bills in Côte d’Ivoire.

Despite this success, the journey is not as smooth as it may appear. In particular, the recent jump in account registration has not translated into widespread usage of these accounts. Inactivity rates are high, with over 50% of registered clients not having used their accounts within the past 90 days. In order to understand why people open accounts that they then do not use, IFC and The Mastercard Foundation launched a market research effort in 2014 to increase the understanding of inactivity and to provide guidance to the mobile money actors in Côte d’Ivoire. The results of this [study] of 1,000 randomly selected mobile money clients reveal some main reasons for inactivity, leading to suggestions on how these can be addressed:

Income irregularity was cited by over 40% of the study sample as the main reason for inactivity, while 27% reported being inactive because they had no need to use the available services. For many customers, the current range of transactions for which they can use mobile money appears to be of limited relevance. Mobile money providers in Côte d’Ivoire cannot afford to ignore customers with irregular incomes, since the vast majority of Ivoirians do not enjoy a regular paycheck, including the half the population working in the agricultural sector where incomes are seasonal. Diversifying the product offering could make mobile money more relevant for many customers, with savings products looking particularly promising. Income irregularity gives rise to a need to save, since people need to smooth consumption during the troughs between paychecks. Indeed, in our research 47% were already using their mobile money accounts to save, despite the lack of interest and high withdrawal fees. This suggests an untapped demand for mobile based savings products. Providers could consider how to make mobile money relevant to more users by providing interest-bearing savings accounts and credit products, as is already happening in East Africa.

Cost was another common reason given for inactivity, with 16% of respondents citing high usage fees as a reason for not using mobile accounts more. CGAP explored this issue a couple of years back, and found that two Ivoirian mobile money providers are among the most expensive in the world. If mobile money providers are serious about reaching the mass market, prices need to drop. Providers should explore different fee structures that are less off-putting to customers.

Agent inaccessibility was cited as a reason for inactivity by about 10% of surveyed customers, with the problem more acute in rural areas. Rural users were over three times more likely to complain about a lack of agent accessibility. This concern is echoed in macro-level data from the BCEAO, which shows that Côte d’Ivoire has the highest customer-per-agent ratio in the WAEMU (483 customers per agent, compared to a regional average of 220). However, agent quality is also an important factor. In order to assess this, the study included 40 mystery-shopping visits, which found both the internal environment of the agent (security, availability of communication materials) and customer service to be lacking. More work is needed to find the right balance between the proximity and the productivity of agents.

Finally, the research also revealed a seemingly paradoxical result: while 35% of clients needed help to use their mobile money account (and 8% listed “complexity of service” explicitly as a barrier to usage), a full 82% percent still answered positively when asked if the service is easy to use. This suggests a disconnect between perceptions and actual usability, and a need to step up training and marketing efforts to ensure effective uptake of mobile money services.

Côte d’Ivoire is on the verge of becoming an established mobile money market, confirming its leading position in West Africa. To take the next step, some changes are needed to persuade customers to use their accounts more often. This will require a more innovative and less risk-averse approach from industry players. Affordable products and services that better address the customers’ needs as part of a well-developed ecosystem will pave the way to sustainable market growth.

Comments

Thanks fir this. Interesting

Thanks fir this. Interesting that these findings seem to mirror the Kenyan experience in Agent banking- Banks. The availability of Bank Agents in the rural area where 75%of the Kenyan population reside us wanting, yet more and more Agents are being established in the urban area. Is this key strategy for banking the underhanded and rural poor failing? At 27‰non usage due to 'no need to use the service' point at inappropriate customer acquisition strategies? Are banks & MNO s counting the cost of account dormancy? Or is that cost passed on to the consumer, making transaction fees too high?

Account dormancy due to the

Account dormancy due to the fact that a large number of mobile money costumers have no need to use the available services. This issue has been highlighted in this post. Some of the services offered by mobile money operators in Cameroon (paying VIP traveling tickets, paying Insurance fees, paying Canal Sat bills, transferring money from bank account to mobile money account) are more likely to be used by the richest rather than the large majority of mobile money account users. Nevertheless, P2P money transfer trough mobile is suitable for any user as it gives the possibility to send or receive money according to everyone incomes profile. Income irregularity of the large majority of users definitely calls for consumption smoothing services in the one hand, and for financial resilience focus services in the other hand. Using mobile money accounts for savings purpose is not the answer because of the high withdrawal rate due to the lact of constraints. In addition, one most not forget that Africans are more used to savings credit groups. Mobile money has much to offer in this regard. As a graduate of the conglose german centre for microfinance i been thinking on how to "Digitalize Self Help Groups ( SHG) using mobile money". This leads me and two of my friends to implemented two "Family mobile money Bank" (first in Cameroun and recently in DRC). Well these are Online Savings & Credit Associations (OSCAs) built from an innovative combination of mobile money & mobile messenger functionalities. It enables a group of friends and relatives to create an manage their own "Family Bank" no matter where they are using thier smartphones. Friends and relatives living in different areas of a giving country can therefore save together and borrow to each other through mobile money. Our family banks combine both ROSCA and Crowdfunding aspects. This has significantly increased the rate of mobile money accounts usage within the members of the two ongoing projects. It has also help them to reinforce thier financial resilience to unexpected expenses and smooth their consumption over time. We also offer financial education (Savings, Budgeting and Debt management) to our members using mobile mesenger. Every member reads the educative notes according to his time table and needs. At the end of every note, a small quiz is performed in other to help the learner's understanding level. Mobile money is the answer. The question is how to use it for a better future?

Add new comment