Regional Trends in International Funding for Financial Inclusion

The 2015 CGAP Funder Survey revealed how international funding for financial inclusion varies across regions. If you’re interested in learning more, please take a look at the brief or explore the dataset.

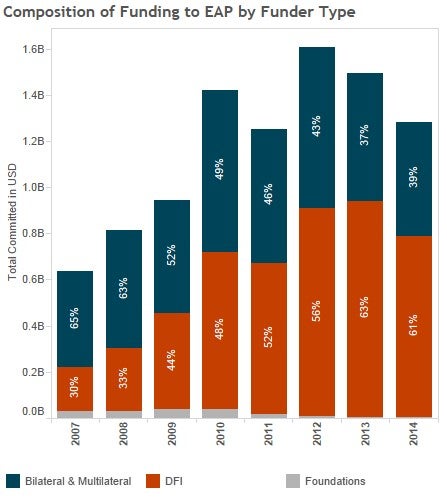

East Asia and the Pacific (EAP)

East Asia and the Pacific received $1.28 billion in international funding for financial inclusion in 2014, down from $1.5 billion in 2013. About 60% of funding comes from development finance institutions (DFIs), and the rest from bilateral and multilateral funders. Compared to other regions, EAP receives a higher proportion of funding in the form of guarantees. Indonesia receives the largest amount of funding and has the highest number of active funders.

Eric Duflos, regional representative for EAP at CGAP, adds: “EAP has traditionally been a region with limited investments from cross-border investors and donors partly because commercial microfinance is not prevalent in the region with the notable exception of Cambodia. The main providers of ‘financial inclusion’ have traditionally been governments and state banks. However, with the emergence of digital finance in large markets like Myanmar, Indonesia and China, donor interest and investments opportunities may step up.”

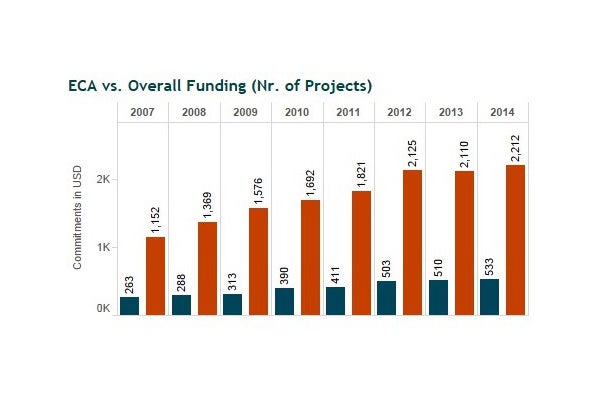

Eastern Europe and Central Asia (ECA)

Eastern Europe and Central Asia continue to receive the largest amounts of funding ($6.28 billion or 31 percent of 2014 commitments), in part due to the relative maturity of these markets. Although funding fell slightly from 2013, the number of projects is still growing, which indicates that funders are supporting a greater number of projects with smaller amounts of funding. Turkey receives the most funding in the region, almost all of which goes to banks.

Olga Tomilova, regional representative for ECA at CGAP, says that she’s seen funders steadily increasing their interest in funding projects that create employment and contribute to economic growth. “Increasingly,” she says, “these are SME rather than microfinance lending projects as there is a growing realization that funding micro businesses alone may not be the best strategy of the financial service providers to whom most of the funding goes.”

Latin America and the Caribbean (LAC)

Funding to Latin America and the Caribbean fell in 2014, partly owing to the closure of several large projects to local intermediaries and exchange rate fluctuations. Funding to the region has steadily decreased since 2010 at an average annual decline of nearly 8%. Over 80% of funding to this region comes from DFIs, and most projects focus on micro and small enterprises. Within the region, Peru receives the largest volume of funding and has the highest number of active funders.

Pablo Garcia Arabehety, regional representative for LAC at CGAP, says, “While funders in the region have generally focused on traditional microfinance, diversification of financial inclusion approaches is burgeoning, and funders are starting to take more innovative approaches.”

Middle East and North Africa (MENA)

Funding to MENA boasts significant growth (up 12% from 2013), and it is the only region that saw an increase in funding in 2014 after accounting for exchange rates. Egypt, Morocco, and Tunisia receive the largest volume of funding, and most projects in the region focus on micro and small enterprises. Compared to other regions, funders in MENA channel a higher proportion of commitments through governments, which is partly due to the region’s history of using apexes to distribute funds to FSPs, particularly in Egypt and Morocco.

Nadine Chehade, CGAP’s regional representative for MENA, recently wrote the following in a blog: “It is of course difficult to write about the Arab world and not mention the massive human and development challenge posed by over sixteen million refugees and internally displaced people. […] Could digital payments facilitate fund transfers and remittances, a major contributor to GDPs across the region, and perhaps contribute to economic resilience of both refugees and their hosts?”

South Asia

As in other regions, many projects in South Asia support micro and small enterprises and rural and agriculture finance. Notably, though, a significant proportion of projects in the region also contain an element focusing exclusively on women. This is an encouraging finding, since the latest Findex data show that South Asia has the largest gap in account access between men and women.

Kabir Kumar, senior financial sector specialist at CGAP based in New Delhi, says, "Both public and commercial funding for financial inclusion in India in particular has picked up in the last couple of years and is likely to increase in the coming years given Prime Minister Modi's emphasis on financial inclusion through the Jan Dhan Yojana and related schemes. With broader digitization of the economy, government emphasis on going cashless and an energized start-up environment, India is also widely seen as a growth market for FINTECH which will attract more funding.”

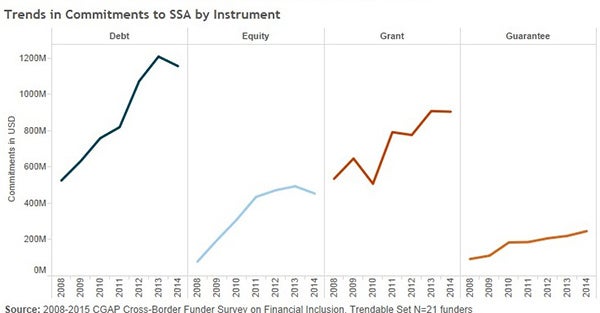

Sub-Saharan Africa

While it doesn’t receive the highest volume of funding, sub-Saharan Africa has the largest number of projects (553 projects). Funding to SSA increased in nominal terms in 2014, but slightly decreased after accounting for exchange rates. Countries in East Africa receive the highest amounts of funding in the region (e.g., Kenya, Tanzania, and Ethiopia). However, funding to countries in the West Africa Economic and Monetary Union (WAEMU) is on the rise, growing 17% on average per year from 2011 to 2014, which is more than double the average growth rate for the entire SSA region over the same time period.

Grants account for a third of the $3 billion in funding to SSA, a much higher proportion than in other regions. Similarly, funding from foundations comprises a higher portion of funding to SSA than in other regions (14% compared to 4% of funding overall).

Corinne Riquet, regional representative for West and Central Africa francophone countries at CGAP says that a majority of funders remain focused on the retail level by supporting growth and capacity building of traditional microfinance institutions, although interest in digital financial services (DFS) is growing.

“Outside of East Africa,” she says, “DFS are also developing fast in West Africa (e.g. Cote d'Ivoire, Mali) and funders can play an important role to support not only providers reaching scale but also the market infrastructure and regulatory framework necessary for DFS to develop."

Multi-Country and Global Projects

Finally, multi-country and global projects grew significantly in 2014. The majority of this funding is channeled through microfinance investment intermediaries (MIIs), although commitments to other types of recipients have also increased. These projects are primarily related to providing digital finance solutions, enhancing essential services, and guidance on client protection.

Add new comment