A Tale of Two Markets

Imagine Johannesburg, with its highways, traffic signals, shopping malls, chain restaurants and supermarkets. Now picture Nakuru, a small Kenyan town, filled with old, narrow roads clogged with tuktuks and street vendors, pushing themselves shoeless into the traffic and hauling heavy hand-drawn carts stacked with goods that will fill the small, owner-operated shops and kiosks, 10 on every block. If you were getting by on $5 per day, where would you rather live?

When I interviewed urban “cuspers” in both countries — that large population in sub-Saharan Africa getting by on $2-$5/day, on the cusp of poverty but not yet secured in Africa’s middle class — I was told that it was Nakuru that was in “the spring of hope,” while Johannesburg’s cuspers weathered the “winter of despair.” For all of its efficiencies, South Africa’s formal retail market crowds out much of the small informal trading that thrives in Kenya. Formal low-skilled employment options are limited and uncertain. Large numbers of family members depend on those few workers, unable to earn a successful living in small, informal enterprise.

In a government housing settlement on the outskirts of Soweto, Sabelo tells us, “I know that I’m rotten everywhere.” He’s talking about his problems with debt. He and his wife were so hopeful when he landed a formal job as a security guard, and they were finally awarded a government house and able to leave their shack behind. At the time, Sabelo earned $450-550 per month depending on overtime, while his wife, a cleaner with a company on a contract from City Parks, earned about $300 per month. In order to wire their new home with electricity, plaster the walls, tile the kitchen floor and buy furnishings for the home, they decided to leverage Sabelo’s formal salary to get loans. Very little was left from his paycheck every month, but, he says, “It was alright because she could buy food and do other things, and I would pay the debts.”

That all changed when the company where Sabelo’s wife worked lost its City Parks contract, and she lost her job. Suddenly, Sabelo was swallowed by debt. Loans could not be repaid and grew and grew. His wife has been looking for a new job for three years with no success. Trying to start a business selling biscuits or bananas would be a waste of time. Her neighbors shop at Shoprite, where the prices are cheaper, and where they already go to cash out their monthly government cash transfers.

Sabelo feels stuck:

“Now I get phone calls left and right. I can’t even answer a private number because I know it’s them… I blame myself I can’t blame the banks, because I needed cash...Why did I take so many credits that now it is difficult for me to pay back? It was easy the time my wife was working. Others were phoning me and selling their products. If I’m interested I should come with my particulars. When they say ‘approved’ I’ll say ‘yes, good I want it.’ That ‘approved’ killed me; now it’s only ‘declined’ everywhere.”

Esther in Nakuru also faced hard times. She was running her stall selling second hand clothes while her husband drove a motorbike taxi. They had just used most of their savings on a new motorbike, when he became suddenly and tragically ill with meningitis, dying two weeks later. She then herself became sick, spending three months at home, using up the rest of her savings. Down to her last $30 and looking ahead to the next term of school fees for her son, Esther got very nervous. On the advice of a friend, she turned to a lender called “Supa Wiki,” which gave her an $85 loan, payable over one month. It was enough to help her buy quick-turnover stock and get back on her feet again. Though she had saved for years with local banks, she had never borrowed before—and doesn’t plan on it the future: “I never wanted debts that would stress me up.”

Esther, like so many cuspers in Kenya, could rebound from economic devastation in a matter of months, by simply buying stock and trading. In an environment of thriving informal businesses—and consumers willing to buy from them—small traders thrive. Unencumbered by high levels of debt to service and in a more conservative lending environment, it is easier to rebound after a shock, without the extra stress of debt payments. None of the Kenyan cuspers we interviewed experienced falls so hard and so persistent as those in South Africa. Because anyone can enter into a profitable business with very little money, it is much easier to get back in the game.

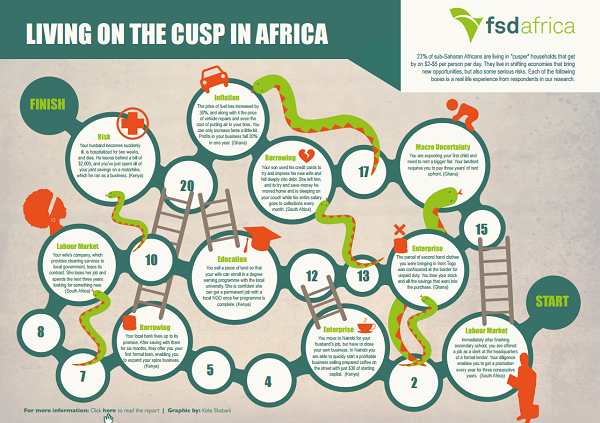

While we so often associate the forward march of progress and “development” with increasing levels of formality, we ought to take note of what’s left behind—especially for those on the cusp, climbing up a slippery slope of upward mobility. A vibrant informal economy seems to offer fewer snakes and many more ladders.

Comments

Greater economic resilience

Greater economic resilience as an outcome of a vibrant informal economy. Looking forward to the study report

Add new comment