Wave Money Myanmar: The Power of Smartphone Design

In less than a decade, mobile money has proven to be an effective means of increasing financial access in frontier markets. In the process, it has brought significant economic benefits to the countries that have fostered its development.

In countries where mobile money has been highly successful, such as Kenya, Bangladesh and Pakistan, customers now have the ability to send and receive payments, store money safely and pay bills. In the process, lives have been changed through better access to finance, something traditional brick-and-mortar banks have struggled to deliver. The remarkable aspect of this phenomenal growth, however, is that it has been achieved almost exclusively through feature phones and analogue channels such as SMS and USSD.

Why is this so remarkable? Compared to smartphones, the user experience of feature phones is generally poor, with multiple technology challenges. Many lack the unicode needed to display local languages correctly, and their limited character availability makes it harder for people to easily complete financial transactions. For mobile money providers, their ability to offer complex financial services products is curtailed, particularly when consumers need educated about product features before purchase.

Smartphone penetration in Myanmar, and the rapid proliferation of data usage, dramatically alters this equation by removing the limitations implicit in widespread feature phone use. Based on current estimates, between 70% and 80% of mobile devices in Myanmar are smartphones, and of these the majority are accessing data regularly. No other frontier market has experienced growth of this kind. Coupled with very low banking penetration, it considerably enhances the opportunities for serving the unbanked – estimated at over 90% of Myanmar’s population.

At Wave Money, we have been exploring the opportunity that digital presents by partnering with CGAP and specialist design firm Small Surfaces. In this partnership we have been leveraging the principles of human-centered design to build a digital finance application for customers. Human-centered design starts with the people we are designing for and ends with solutions that are tailored to their needs. Building digital products through this process requires a deep empathy for the people we are designing for – forcing us to go deep into their communities, workplaces and even homes to understand what they feel, what they think, what they like and what they desire.

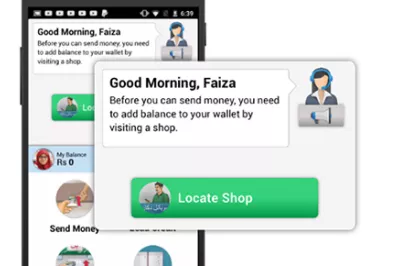

The objective of the research was to understand whether customers could complete important tasks easily and confidently, navigate with ease and understand the content within the app. The methodology that we followed was to identify a number of design concepts that we could initially test with user groups. Paper prototyping was used to simulate the look and feel of the app across several design concepts, and direct feedback from customers allowed us to define the design direction and adapt it to overcome usability hurdles. The fascinating observation in Myanmar was that our prospective customers already had a good understanding of the concept behind apps and screen navigation, given that they had leapfrogged straight to smartphones. This switch to smartphones is happening in many markets, but it has been especially fast in Myanmar given recent changes in telecommunications policies.

Following the initial paper prototyping and selection of a design direction, a more sophisticated electronic prototype was built that tested customer ability to onboard, send and receive money, access help, and most importantly understand the iconology that we built into the design. The research was conducted in both urban and rural settings, with migrant workers and small business holders as the preferred segments. There were many learnings during this process, some of which would likely be globally relevant, and others which are more local in context. For example:

- We identified that every small detail in the design that was unclear or ambiguous led to a negative impact on people’s confidence using the service.

- Small improvements that were made to the electronic prototype during the interviews built confidence and trust.

- Burmese is a verbose language, and it is often not possible to use “hanging” words as in English. For example, “balance” needs to become “money balance” to ensure customers will understand what is being described.

Technical prototyping allowed these concepts and more to be tested, resulting in a design that we feel is very relevant to our customer. This design has been converted into a new app for android phones, and the app is now available widely in Myanmar.

But why is the rapid growth of digital in Myanmar relevant more broadly? By 2020 there will be 5.8 billion smartphones globally, growing from 2.6 billion today. Data usage is expected to grow at an astounding rate of 45% a year between 2015 and 2020. In essence, almost all people globally will have a smartphone by 2020, with the majority using data. The ability of these people to gain access to financial services will be heavily influenced by the thoughtfulness of the interfaces they have access to.

We believe that when it comes to mobile money, Myanmar will provide the template for frontier markets globally. Digital mobile money solutions with the customer at the core will demonstrate how mobile money can move beyond feature phones to give customers an experience never before seen in these markets. Our investments in the smartphone interface are central to this new proposition, and we look forward to the months ahead as Myanmar adopts mobile money more widely.

Add new comment