No Inclusion Without Customer Empowerment

Low-income customers around the world have greater access to formal financial services than ever before, partly thanks to digital finance, but many customers still use informal services. Why? Our research shows that many of today’s financial services do not address customers’ realities, constraints and preferences. They do not give them the level of confidence or sense of control they need to choose financial services over cash and informal mechanisms. In short, they don’t make customers feel empowered to engage with formal finance.

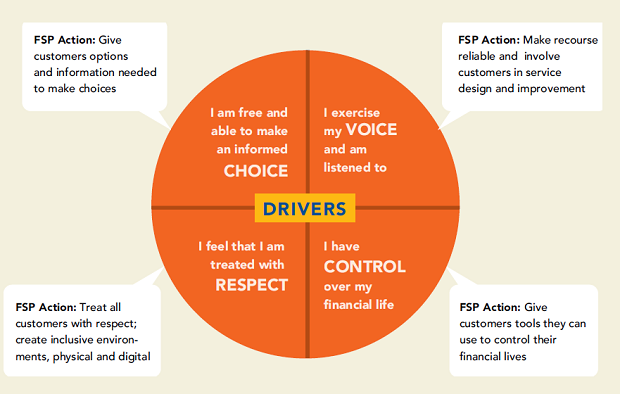

In our customer research and work with financial services providers across Africa and Asia, we found that customers are essentially looking for four things when they engage with finance: choice, respect, voice and control. If providers reflect one or more of these drivers in the design and delivery of their services, it builds trust, prompts higher use and generates business value. The following examples show how businesses are using these drivers to help empower low-income customers and improve their business case.

Choice: Give customers options and the information they need to make good choices

Flexibility is a key reason why low-income people often choose to use informal financial services. Informal services tend to be better suited for managing unpredictable inflows and outflows and allow customers to keep their options open. Digital technologies can become more attractive by giving customers more options and allowing them to tailor services to their cash flow needs. Advans Cote d’Ivoire’s digital savings service for smallholder farmers is a good example of how providers can give farmers greater choice and flexibility. Offered in partnership with a mobile network operator, the service uses a USSD channel that is accessible on all phones and suited for illiterate farmers. Transactions between the Advans savings account and e-wallets are free. When farmers get paid, they can decide how much money they want to receive in cash and how much to put in their personal Advans savings account. This allows them to slice and time their money based on their circumstances and to become more comfortable with the digital service over time.

Respect: Treat all customers with respect and create an inclusive environment

Janalakshmi, an Indian small finance bank, attempts to create a more inclusive environment and to treat people with dignity. It introduced “Jana Basics” in its branches to ensure they meet minimum standards, including drinking water, clean toilets, a private space for breastfeeding and a token waiting system monitored by a host so that no one can cut the line. The changes required were relatively small, costing less than $250 per branch, and were easy to implement and test. Jana Basics was tested in 25 branches across India and showed significant improvement in customer satisfaction (from 51 percent to 88 percent). These results convinced Janalakshmi to roll out the program more broadly. Making people feel respected is essential to encouraging them to use formal finance. Most people drop out at the trial or registration phase, so reducing the burden and costs to the customer (e.g., by simplifying enrollments and onboarding and adapting to people’s capabilities) can be beneficial for the customer and for business acquisition and retention.

Voice: Show customers that you’re listening

Customers want to know that their voices are heard and to feel confident that providers are acting on their grievances. Metlife, a global insurance company, found a way to enhance customer satisfaction and cut costs with a simple change: It eliminated time limits for individual calls to the call center. As a result of this new policy, customers were happier and called less often for unresolved issues. Employees were also more satisfied. The median time operators spent on the phone for one call was 3 minutes 8 seconds, which was close to the original cut-off point. The overall number of calls and time spent per issue by the call center reduced.

Control: Give customers the tools they need to control their financial lives

In Zimbabwe, Econet is testing a solution designed to give customers more control over their experience with financial services. Save4School allows smallholder families to save gradually — and at their own pace — for children’s school fees and extends an optional microcredit line to help them fill gaps. It is intended to help manage unpredictable cash flows and offer a payment solution that gives them more seamless access to education. Giving people more use cases for their mobile money account to meet their basic needs is expected to spur use of their accounts, which in turn is good for business.

Another example of making customers feel more in control is Absa’s Shesha game, which the bank piloted in 2013 and 2014. The game allowed people to try different features of their digital financial service without any risk and with a chance to win a prize. It was a fun way for customers to learn to check their balances on their phones, and it gave them the confidence they needed to conduct actual transactions. By teaching players how to consult their balances, it addressed a key concern many people have with digital money: assurance that their money is in their account. The game reduced traffic to the branches, which lowered costs for both Absa and its customers.

For meaningful financial inclusion, customers and providers need to revamp their relationship and start interacting in a way that achieves greater customer engagement and better business outcomes. These examples show that providers can make strides in this direction by considering the key drivers of choice, respect, voice and control, which can help to build customers’ trust and confidence in their interactions with formal finance.

Comments

I totally agree with this.

I totally agree with this.

Despite the presence of 4

Despite the presence of 4 said drivers particularly in Asia and Africa , exclusion takes place after inclusion in the manifestation of drop outs,inoperative account/dormant,account, group (SHG) mortality /defunct in the case of inclusion through group.What is the extent ofinclusion of bottom poor empowered by these four drivers?Is the inclusion (digitally ) inclusive enough to call success?

Add new comment