Using a Gamified Solution to Incentivize Mobile Money Agents

For a digital financial services (DFS) provider, few things are more key to success than having an agent network that provides a good customer experience. Research has shown that customers benefit from more consistent service quality, reliable service delivery and apt responses to their questions, needs and problems. Yet as most DFS providers can attest, empowering and incentivizing agents to provide exceptional customer experience can be challenging. In Indonesia, Bank Tabungan Pensiunan Nasional (BTPN) has developed an innovative solution that uses gamification to empower agents of its mobile savings account.

BTPN launched its low-cost mobile savings account, BTPN Wow!, in 2015 to target the unbanked. BTPN employed a human-centered design process to develop the product, involving low-income customers and agents every step of the way from initial design to prototyping. This process resulted in several design decisions that have made BTPN Wow! a popular product. For example, the transaction interface for BTPN Wow! runs entirely over USSD, which enables Indonesians to access it on any device. And the product’s simplified customer due diligence (know-your-customer) procedure allows customers to open an account and start banking in a matter of minutes. BTPN Wow!’s simplicity and ease of access — even in low-resource, poor-connectivity regions — has helped BTPN expand its customer base very quickly. At the end of 2016, BTPN Wow! had over 2.9 million registered accounts and more than 170,000 mobile money agents.

To keep the customer growth momentum and further increase customer activity of BTPN Wow! accounts, BTPN analyzed customer transactions. At the end of 2016, one in three accounts was active. Research showed that the key to increasing customer engagement after product adoption was to increase agents’ product knowledge and motivation to serve customers effectively by providing cash-in/cash-out services, answering their questions and informing them about relevant BTPN products. It revealed that an agent’s motivation has a direct impact on the customer experience and the extent to which customers use and operate their bank accounts.

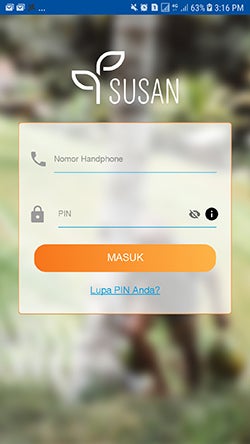

BTPN’s response was “Susan,” an agent empowerment smartphone application (and supporting web interface) that works seamlessly with other applications and technology systems within the bank to keep agents informed on their performance, targets and how to achieve them.

Susan uses principles of gamification and a strong narrative-based design to engage agents. There were three guiding principles for the design of Susan: (1) provide transparency and real-time information to agents on their performance and incentives they have earned; (2) foster a feeling of community among agents and their customers, allowing them to share ideas with each other; and (3) build agents’ capacity around financial services to better serve their customers (e.g., through short tutorials and quizzes). Of these three key themes, transparency is the one most fully developed in the current version of Susan. Transparency features were built first because the BTPN Wow! ecosystem already had an elaborate set of indicators to monitor agents’ motivation and performance. Those indicators lent themselves to a gamified, goal-based reward system that motivates agents.

Susan’s points-based sales promotion program is a good example of a simple game mechanism that can motivate agents to acquire and service their customers. Agents earn points by serving customers. Based on how many points they have, agents can move through successive levels: Bronze, Silver, Gold and Star. Each level rewards agents with the ability to multiply their incentives. Another game mechanism is a leader board that allows agents to see where they stand on performance in relation to other agents in their area, region or even at a national level.

Thanks to features like the sales promotion program, more than 40,000 agents have already downloaded the app on their phones since Susan was launched at the beginning of 2018. A recent survey showed that close to 80,000 agents are aware of the app and that two-thirds of those that access the app do so more than twice a month. The most used features of Susan are the checking and redeeming of points and the incentive report. The agents reported the following categories to be of most benefit: point information, customer information, Business in Box and liquidity monitoring. It’s still too early to conclude what effect this is having on customers’ experiences and activities, but expectations are that this will positively influence uptake and use of services.

For most BTPN agents, the promise of being the frontline representative of a modern banking solution, the community goodwill it affords and the growth prospects it offers have been some of the biggest motivating factors in coming onboard. However, for agents to remain invested in this platform, BTPN must demonstrate how it can help them grow their revenues. One of the bets the bank is making in this regard is to allow third-party services like ecommerce, ticketing and other financial services to be sold through the BTPN Wow! platform, enabled on the backend by an open marketplace architecture into which anyone can integrate. They call this part of the platform Business-in-a-Box. The success of this approach will depend on the same simplicity and seamless user experience that has come to define BTPN Wow! thus far.

BTPN Wow! demonstrates how technology solutions can be used to provide access to financial services and improve the customer experience if the capabilities and motivations of customers and agents are kept in mind.

To learn more about BTPN’s efforts to empower its agents, read the related case study in the Employee and Agent Empowerment Ideabook (page 17). For guidance on how you can empower your agents or employees using resources, see the Employee and Agent Empowerment Toolkit.

Add new comment