COVID-19 BRIEFING: Insights for Inclusive Finance

|

Throughout the COVID-19 pandemic, CGAP has sought ways to respond to the impact on microfinance providers and the communities they serve. This Briefing looks specifically at how to address the solvency risks facing medium and small microfinance providers, which often reach into communities and geographic areas that are not served by larger lenders. |

I. Introduction >>

II. What is at Stake? >>

III. How Big is the Looming Funding Problem for Microfinance Providers? >>

IV. Who Might Help? >>

V. Making it Work: Proposals and Principles >>

VI. Recommendations and Conclusions >>

I. Introduction

Even before the COVID-19 pandemic emerged in early 2020, medium and small microfinance providers—often described as Tier 2 and Tier 3 providers—struggled to achieve consistently positive financial returns on assets (MicroRate and Luminis 2013). Since the start of the pandemic, CGAP has convened discussions with development finance institutions (DFIs), microfinance investment vehicles (MIVs), policy makers and regulators, and microfinance providers to address the ramifications of the pandemic on microfinance providers.

We tracked the initial impact through the Pulse Surveys conducted in 2020 and supplemented this with specific regional studies as a combined exercise between Symbiotics and CGAP.1 More recently, as a follow-up to the CGAP Pulse Surveys and with the analytical support of MicroFinanza Rating (MFR), we looked at the extent to which solvency risks might be lying beneath the surface for microfinance providers.

Our key findings include:

- The full impact of the crisis on the microfinance sector is yet to be felt. While fears of a liquidity crisis in the microfinance sector have not yet materialized, the pandemic has placed significant pressure on many microfinance providers and their customers, and it is ongoing. Continued stress on microfinance customers and opacity around the credit quality of microcredit portfolios indicate that a solvency crisis may be looming. The sector should take steps now to prepare for that eventuality.

- Tier 2 and Tier 3 microfinance providers require greater support. Our analyses indicate that the biggest risks lie with the Tier 2 and Tier 3 microfinance providers that serve poorer populations who have been severely affected by the pandemic. There is likely to be consolidation across these providers as some may not be sufficiently capitalized to weather the effects of the pandemic.

- Responding to the crisis effectively will require a coordinated and regional approach. While it is not easy to determine which institutions should be supported during a consolidation of the microfinance sector, a coordinated approach by funders and regulators would help ensure that any disruption to financial services is limited. Coordination is needed among key stakeholders, including donors, governments, DFIs, and private investors to put the interests of low-income customers at the center of decision-making. We believe that regional approaches, with a particular focus on Sub-Saharan Africa, are most appropriate, given regional variations in the impact of the pandemic, regulatory responses, and more general market differences.

- Quasi-equity instruments and blended finance solutions are well-suited to address the challenges brought on by the pandemic. Funders should look beyond traditional debt and liquidity-based measures. They should focus more attention on supporting investments in the microfinance sector that respond to solvency concerns, and on creating facilities that provide such capital. We stress the importance of integrated solutions with a strong supportive role from donors through flexible, blended finance approaches that can help deliver the necessary solvency-enhancing measures.

II. What is at Stake?

The COVID-19 pandemic has thrown into sharp relief the longstanding inequities in societies, including the precarious access that the poorest people have to financial services. At stake are more than 140 million borrowers around the world who look to microfinance providers to deliver these services. 2

Although much of the microfinance sector has been resilient and has withstood the challenges of the pandemic so far, the ability of some providers to rebound and continue to serve their customers in the months and possibly years ahead remains in question. A perfect storm appears to be heading toward an important segment of the microfinance sector: Tier 2 and Tier 3 microfinance providers, particularly those operating in fragile and conflict-affected states.

The pandemic has also revealed significant differences among microfinance providers. To some extent this is due to disparities across regions in the depth, breadth and duration of the pandemic’s reach and the response by local governments; but it is also linked to the underlying financial and operational strength of the institutions themselves.

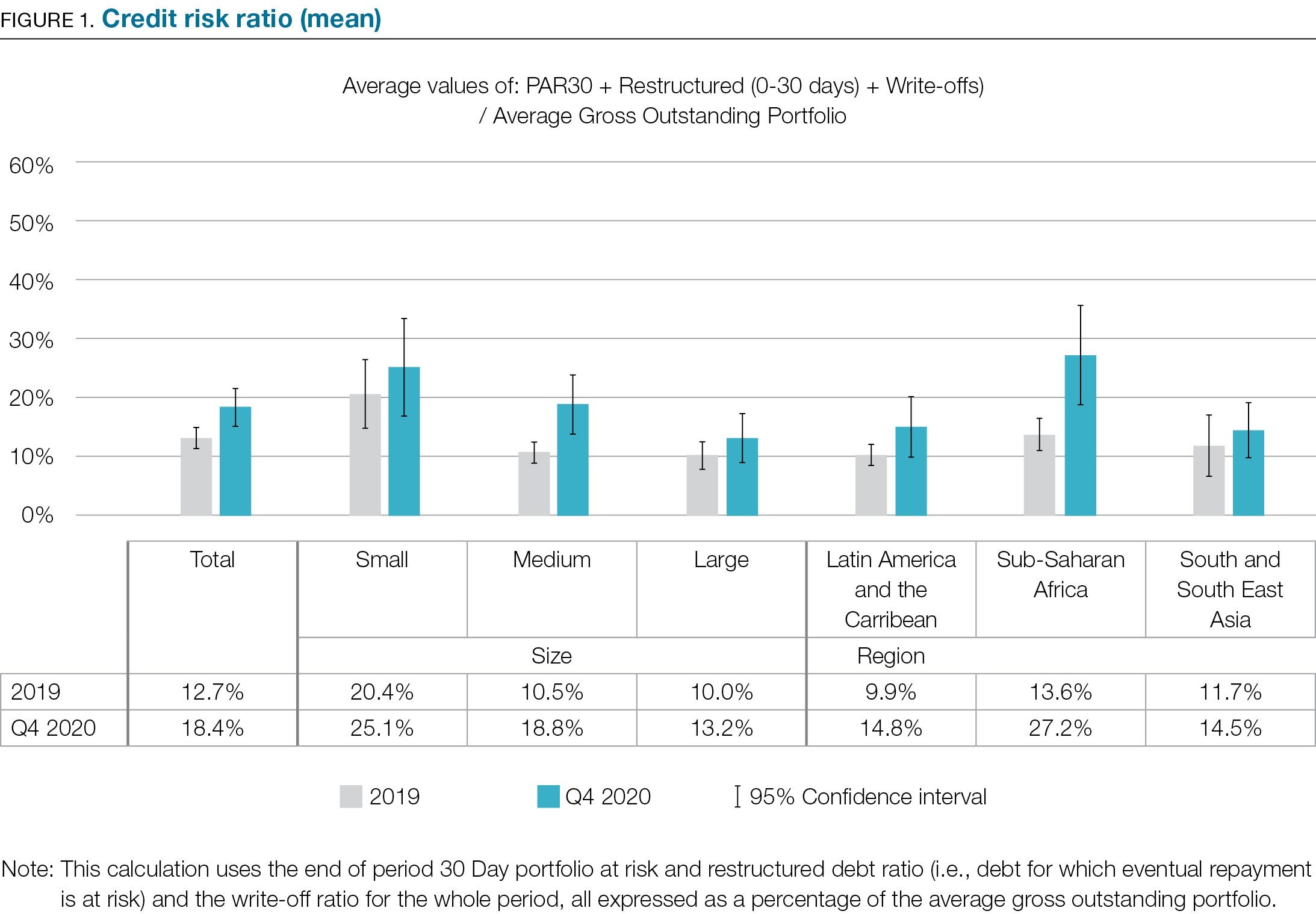

Figure 1, prepared by MFR for CGAP, illustrates some of the regional and institution size variations with regard to underlying credit risk over time (for 2019 and Q4 2020). The risk profiles deteriorated in all the categories examined, particularly among small and medium sized microfinance providers and especially in Sub-Saharan Africa.

Disparities in the performance by microfinance providers at this point in the pandemic reflect the relative strengths and weaknesses of the providers before the pandemic. On average, Tier 2 and Tier 3 microfinance providers that entered the pandemic with limited track records in demonstrating positive financial returns—and consequently with fewer potentially supportive investors—now face considerable challenges even as the havoc wreaked by the pandemic begins to abate in some parts of the world.

A combination of thin capital reserves and debt forbearance measures put in place by regulators for the customers of microfinance providers—but often not for the microfinance providers themselves—placed a serious strain on the finances of many providers of all tiers. This was a result of factors largely beyond the control of the microfinance providers and has affected all aspects of their operations. Liquidity remains a key concern but maintaining the solvency of vulnerable Tier 2 and Tier 3 providers may become an even more pressing problem for the microfinance sector in the months to come.

Why should we care about the growth and survival of Tier 2 and Tier 3 microfinance providers? One obvious reason is that these smaller and often less robustly funded microfinance providers sometimes punch above their weight in terms of the benefits they provide to the poor people they serve. Sustained stagnation in growth or, worse still, the widespread failure of a significant number of Tier 2 and Tier 3 microfinance providers could have a profound and lasting impact on their customers and their communities, particularly if no other microfinance provider steps in. Stagnation and possible widespread failures are clear risks because these microfinance providers may not offer financial returns to investors that are commensurate with the positive social impact returns that they deliver.

In some cases, there may be an inverse return–some of the more financially rewarding investments in the microfinance sector may deliver less positive social impact in absolute or relative terms. Tier 2 and Tier 3 microfinance providers often have a deeper reach into their communities —particularly in rural areas—than larger, better capitalized lenders do. Many of these microfinance providers are highly vulnerable yet deliver high impact. Their failure would erode many of the financial inclusion gains that have been made over the last decade.

This is not a call for a rescue plan to shore up unsustainable microfinance providers by throwing good money after bad. Rather, we identify possible responses and actions that could be taken in coming months by microfinance sector funders—private investors, DFIs, and donors (public and private)—to ensure that even if some regions see a critical mass of microfinance providers stop growing or even fail, their customers will still have access to the financial services they need to recover their economic livelihoods. Regulatory support could also be crucial in helping to ensure that this happens.

The experiences of microfinance providers in weathering prior storms suggest that severe crises-like the COVID-19 pandemic-cast very long shadows. According to a recent analysis of prior crises, which was sponsored by the Center of Financial Inclusion (CFI) at Accion and the European Microfinance Platform (e-MFP), it often took at least five years for crisis-stricken microfinance providers to fully recover (Rozas 2021, 34).

III. How Big is the Looming Funding Problem for Microfinance Providers

At the start of the pandemic, many warned of an impending liquidity crisis in the microfinance sector. The concern was that the economic fallout could dry up the finance available to microfinance providers for on-lending to their customers. At least three important and traditional sources of liquidity for the microfinance sector were at risk:

- Retail deposits (for those microfinance providers permitted by regulators to take deposits from the public).

- Repayments of loans by existing microfinance customers.

- New infusions of investment by funders.

As predicted, many microfinance providers found their financing diminished by the pandemic. However, this does not appear to have resulted in a widespread liquidity crisis for microfinance providers thus far. Indeed, by limiting cash expenditures, typically through a significant contraction in lending activity (partly driven by lack of customer demand, partly by regulatory pressures which limited lending operations at the height of the pandemic, and partly through a reluctance to take on more risk), some microfinance providers have actually realized increased, not decreased, liquidity, at least in the short term.3

But we should not be fooled. The current absence of a significant liquidity crisis among providers of microfinance does not necessarily mean that all is well in the microfinance sector. In fact, in certain regions portfolios have contracted and have not recovered, minimum capital requirements are under pressure, microfinance providers are wary of heightened portfolio risks, and payment moratoria may not continue to be extended by lenders, especially by those more commercially oriented or those that face pressure from their own funders.

Market surveys indicate that lending volumes are starting to recover but this is from a low base. In addition, there are major concerns about emerging new variants and low vaccination rates in some countries.4 Even though the liquidity crisis is not yet widely evident, the risks for weaker microfinance providers remain real. This paper argues that microfinance providers, their funders, and regulators need to be prepared for the possibility of a genuine threat to solvency.

Some microfinance providers will face profound challenges that have yet to surface with respect to their governance, management, data analysis, and quality of microcredit portfolios. Nowhere is this more likely than among the less mature, often unregulated, insufficiently capitalized Tier 2 and Tier 3 microfinance providers that have limited access to additional shareholder support and weaker track records of generating consistently positive financial returns.

As a result, insolvency is likely to be the most significant threat to the viability of these microfinance providers as they emerge from the pandemic, with associated risks for depositors. With deteriorating microfinance portfolios, particularly in countries with a larger proportion of these types of institutions, this could trigger a structural challenge to the microfinance sector as a whole. In some countries, there is a risk of contagion even into wider local banking and financial sectors if multiple microfinance providers stumble and fall.

The microfinance providers that entered the pandemic with strong equity positions will need to continue to provision adequately and even take necessary write-offs of those portions of their microcredit portfolios that have severely deteriorated in quality as a result of the pandemic. However, even the continued solvency of better-capitalized microfinance providers should be monitored as elevated levels of restructured portfolios persist.

Furthermore, as regulatory-imposed repayment “holidays” are lifted, previously undetected portfolio quality issues in those microfinance providers may surface. Also, it can be difficult to distinguish microfinance providers that have inherently weak business models but strong capital support of shareholders from those that have fundamentally sound business models but lack such capital support.

Larger (Tier 1) microfinance providers are likely to have a distinct, but not necessarily decisive, advantage in managing and tracking portfolio quality issues over Tier 2 and Tier 3 providers, particularly over those with limited or weak management information systems.5 Inadequate data management will not only impair sound and timely decision-making, it also is likely to diminish these microfinance providers’ credibility among funders at the very time when funding will be most needed to shore up their weakening equity cushions.

The challenge in the microfinance sector now is whether, with collective support from regulators and funders, Tier 2 and Tier 3 microfinance providers can be helped to find sustainable paths forward that put their customers’ interests at the center. Options to be explored will depend on assessments of the risk and return dynamics, both developmental and financial, for the investments.

For those microfinance providers that may have a path to profitability if they could just make their way through the crisis, this could mean finding creative means of shoring up their equity or finding new sources of equity or support to enable them to attract other forms of financing. For others, this may mean deliberate consolidation with other microfinance providers through mergers or acquisitions. For still others, it may mean asset transfers, such as sales of all or part of existing microcredit portfolios although discounts may be high to reflect uncertainty and concerns over the credit quality of such portfolios. Finally, the fate of some microfinance providers may be determined by their customers, who may be able to choose which microfinance provider will get their business.

Many microfinance providers entered the pandemic with a strong financial position, and thus have been able to provision adequately and even take necessary write-offs when microcredit portfolios deteriorated as a result of the pandemic. These stronger providers could play a crucial role in ensuring that a consolidation of the microfinance sector—which could lead to the culling of weak and unsustainable microfinance providers—does not lead to widespread adverse consequences for the populations that those providers now serve. Finally, providers that have a pathway to profitability could attract returns-focused investors.

IV. Who Might Help?

The funding community for microfinance is diverse, including local and foreign investors drawn from the public and private sectors as well as the donor community. Yet the type of funding most commonly available to microfinance providers is debt, not equity. In addition, much of the debt provided by international lenders to microfinance providers is denominated in foreign, not local, currency, which, if not hedged, transfers foreign exchange risks from lenders to the microfinance providers and sometimes to their customers. The challenge of growing the microfinance sector on the back of foreign currency-denominated debt has long plagued the sector.6

If anything, the pandemic has highlighted the limitations of looking to debt, particularly foreign currency-denominated debt, to build robust microfinance providers. Hedging such debt is possible in some scenarios. But for smaller microfinance providers, the relatively high cost of hedges per transaction size and the limited accessibility of suitable hedging instruments can make traditional hedging problematic, especially against the currencies of more fragile economies.

What is needed in many cases is additional equity. This is particularly the case for microfinance providers that were insufficiently capitalized before the pandemic and whose microcredit portfolios are deteriorating, and for microfinance providers that now face increased regulatory pressure to meet higher capital adequacy ratios (CAR).

However, new sources of equity are in short supply and existing equity providers, some of whom are also under financial stresses, may not be able to or want to provide the additional equity necessary to keep these microfinance providers afloat and help them to grow post-pandemic. Unless this issue is proactively addressed, it is likely that microfinance providers will not have the equity they need to speed and support their recovery post-pandemic. This has been borne out in previous crises where equity was made available too late to do much good (Rozas 2021).

While equity investments, generally denominated in local currency, can avoid the risk of currency mismatches, there is likely to be a limited investment appetite for local currency denominated instruments among those external investors who seek positive hard currency returns. Quasi-equity instruments, such as redeemable or convertible, medium-term, subordinated-debt, could help to resolve part of this disconnect by inserting a fixed repayment schedule into the investment. These and other tools will be addressed in more detail later in this Briefing.

Creative solutions could and, we argue here, should be put in place. But this will take concerted and collaborative action by a variety of players—namely policy makers and regulators, private sector funders, DFIs, and donors.

THE ROLE FOR POLICY MAKERS AND REGULATORS

Policy makers and regulators will be important in shaping the form and tenor of new capital flows into the microfinance sector, particularly to regulated microfinance providers. Just as some local financial regulators used their regulatory toolboxes to give both microfinance providers and their customers breathing room at the onset of the pandemic, these local regulators now have an opportunity to encourage the transparency and good governance among microfinance providers that funders prize and then reward with additional funding.

Financial regulators that make the rules of the game clear to all and require accurate reporting by regulated microfinance providers of their portfolio quality can strengthen the microfinance sector in their jurisdictions by helping to instill market confidence in the microfinance providers under their supervision.7 In addition, it would be useful to have renewed and improved clarity about the forms of regulatory capital that satisfy the CAR requirements imposed on regulated microfinance providers, particularly where those requirements are being increased.

Where supervisory interventions are necessary, the approach taken by regulators when intervening in a failing microfinance provider often signals to other market participants how future interventions are likely to take place. These signals, in turn, will shape how funders and other microfinance providers operating in those markets are likely to act going forward.

Regulators can also help to encourage an orderly consolidation in the industry, should that prove necessary. For example, when regulatory approvals are necessary, they could condition such approvals on there being provisions to guarantee continuity of services to the existing customer base (e.g., maintaining branches, agents, or other channels).

THE ROLE OF PRIVATE SECTOR FUNDERS

At the outset of the pandemic, we saw many of the larger MIVs proactively engage with each other to develop agreed principles specified in a memorandum of understanding (MOU) that would guide their behavior in managing particular debt investments made in weakening microfinance providers.8 In addition, other MIVs that focused on making investments into Tier 2 and Tier 3 microfinance providers launched a common pledge to guide their response to the crisis in a responsible and concerted manner.9

There are useful lessons here. The principles specified in the MOU and the Pledge articulated generally agreed expectations about creditor and microfinance provider behaviors and represented positive collective action in the industry. This was particularly helpful during the early days of the pandemic when parties were still determining the severity of its impact on microfinance operations and whether a more formal debt restructuring might be necessary. The MOU also served as a framework that creditors could follow to align adjustments in the financial ratios being imposed on microfinance providers, agree to payment deferrals, ensure timely communication between and among MIVs and their borrowers, and prompt troubled microfinance providers to treat similarly situated creditors fairly and equitably.

As moratoria and payment holidays imposed by regulators are lifted, the focus turns to finding more permanent solutions. Creditor conversations are shifting. Early discussions among MIVs helped provide collective short-term relief to microfinance providers impacted adversely by the pandemic. Now these are turning to more difficult discussions about burden-sharing as deep-seated and persistent financial weaknesses are showing up among microfinance providers. As discussed above, conversations about preserving the liquidity of microfinance providers are turning to discussions about solvency concerns. Much of the attention of these MIVs has understandably focused, and continues to focus, primarily on investments already in their portfolios. While some new microfinance providers are being brought into the MIVs’ investment portfolios, this is a challenging time for smaller, unregulated microfinance providers to find new funding sources.

There is an even greater need now for the type of flexible responses that the MIVs and, indeed, the DFIs demonstrated in the early stages of the pandemic, together with an understanding of the much greater positive impact for the sector that could be generated by an approach that coordinates across both groups and integrates the donor community as well.

THE ROLE FOR DEVELOPMENT FINANCE INSTITUTIONS

Most DFIs active in the microfinance sector understand the high impact value in engaging with microfinance providers as channels for promoting financial inclusion. Early engagements tended to be direct investment in individual microfinance providers with a combination of loans and technical assistance (such as EIB’s links with Ademi and ADOPEM in the Dominican Republic).10 IFC’s investment in a range of greenfield microfinance institutions in Africa through investments with groups such as Advans and Access Holdings (groups also supported by EIB and KfW as early shareholders) represented a further stage. IFC, KfW and FMO also invested equity in microfinance networks like ProCredit and FINCA. But increasingly DFIs have invested more indirectly in the microfinance sector through MIVs, through other financial intermediaries, or through blended finance facilities funded in part with development risk capital (e.g., FMO’s MASSIF Fund).11

Much of the rationale for this more indirect investment approach follows sound financial logic and is related to considerations of size and cost efficiency. This shift by DFIs from direct investments in microfinance providers and reliance instead on funding through intermediaries that often focus on investing in the larger Tier 1 microfinance providers has resulted in a funding gap of DFI support for Tier 2 and Tier 3 microfinance providers. Many DFIs recognize that these smaller providers of microfinance are an important channel of funding for poor and vulnerable communities and some DFIs have remained engaged with them, a trend that has been reinforced in areas badly affected by the pandemic (EIB News 2021a).

And more broadly, DFIs have taken steps to offer relief to the microfinance sector where they can, either through deferring payments owed to them by the financial intermediaries in which they have invested or through the establishment of new liquidity facilities aimed at mitigating the impact of the pandemic on their operations. Examples include the recent local currency facilities signed by EIB with Ademi (EIB News 2020), ADOPEM under the EIB’s ACP Microfinance facility (EIB News 2021b) and the BlueOrchard COVID-19 Emerging and Frontier Markets MSME Support Fund (Blue Orchards News 2021). The DFI- and EU-supported European Fund for Southeast Europe (EFSE) also has an impressive local currency lending focus.12 And DFIs have been instrumental in supporting both TCX and to a lesser extent, the microfinance-focused MFX, both of which provide foreign currency hedging products, albeit at market-related prices.13

Microfinance providers need increased support in the form of equity and quasi-equity instruments alongside local currency facilities that can help protect local balance sheets from forex risks and support the scaling up and improvement of their operations and technology. A number of DFIs have access to the types of tools that could make a real difference to emerging solvency issues, but the challenge is to find an overarching structure to which they can contribute. For example, IFC, EIB, and FMO’s MASSIF Fund have local currency and equity financing options available to them, and they all have investment footprints that cover countries where solvency issues are likely to arise. The European Bank for Reconstruction and Development (EBRD) has a very active MFI engagement and the U.S. International Development Finance Corporation (DFC) and Germany’s KfW Development have both access to finance and an interest in addressing the challenges posed to the industry by the pandemic. All of these DFIs also have strong connections to donors that could provide backup funding to help mitigate risks (such as through the establishment of guarantees for local currency-denominated loan portfolios) and could even cover the costs of putting in place a solvency-related facility targeted at Tier 2 and Tier 3 microfinance providers.

THE ROLE FOR DONORS

In addition to a strong link between DFIs and donors, there is a common understanding of the needs of Tier 2 and Tier 3 microfinance providers and the types of financial support that might be needed across and within regions. There is also a willingness to consider structured ways in which to address the impact of the pandemic. CGAP’s discussions with donors and microfinance providers indicate that engagements with a regional focus make the most sense, rather than attempting to respond at the global level. Significantly, they are interested in supporting Tier 2 and Tier 3 microfinance providers with blended financing approaches that could be undertaken in partnership with DFIs. Engagements that are also able to support digital financial services and the green finance agenda would be of particular interest to this segment of the donor community and could increase potential take up. In addition, there is a growing understanding in the donor community that solvency support measures are likely to be needed and that subordinated debt instruments and local currency-denominated facilities are important tools that could be supported with some amount of donor funding.

What appears to be missing at the overarching level, however, is the development of specific proposals that could be presented to interested donors and around which the various parties could gather and engage. CGAP’s role is not to try to structure a facility itself but to catalyze discussions with a wide range of parties directly affected by the pandemic, including public and private sector investors, investees, financial analysis companies, interest groups and donors. This has convinced us that a solvency support mechanism especially targeted at Tier 2 and Tier 3 microfinance providers will be necessary and there are a number of proposals and principles that could help to drive this agenda forward.

V. Making it Work: Proposals and Principles

As the longer-term consequences of the pandemic surface, new and important questions are being raised about the quality of microcredit portfolios and the availability of new capital to the microfinance sector. Many of these questions address what should now be expected of funders—private and public, local and foreign—as well as donors to the sector. As noted above, while regulators often set the scene for shaping the behavior of funders and donors toward regulated microfinance providers, their influence on the behavior of funders and donors toward unregulated microfinance providers is likely to be limited. However, this is where the greatest solvency challenges are likely to be seen. We address below three key areas where we believe active funder engagement should be sought.

1. PUT THE INTERESTS OF MICROFINANCE CUSTOMERS AT THE HEART OF JOINT APPROACHES

One way to coordinate funder behavior is to establish a common view on what funders are trying to accomplish for the current customers of Tier 2 and Tier 3 microfinance providers. Ideally a common view can be articulated in such a way that funders can align themselves with it despite varied individual interests and constraints. Decisions to proceed with such transactions could then be made more transparently and measures to mitigate or improve the risk profile of investments could be put in place.

The interests of the microfinance customers should be at the heart of that common view. Customer-centric considerations are particularly important when reaching decisions about what to do in distressed circumstances and whether or how to let unsustainable microfinance providers fail. Prolonging the life of a microfinance provider should take a back seat to ensuring that needed financial services continue to be accessible to the poor and underserved—perhaps by other microfinance providers. Funders, including donors and investors, also should agree to act in ways that make it more likely that private sector resources—local and foreign—are available now and in the future. Accordingly, funders should aim to avoid creating capital structures that serve existing funders well but are likely to dampen the enthusiasm of new funders to invest in the future.

However, it is unlikely that insolvency challenges will be adequately met by a single class of funders, so approaches that combine private sector, DFI, and donor funders will be required. Research undertaken by MFR underlines the difficulties in drawing generic conclusions about types of microfinance providers—the data standard deviation has increased significantly during the pandemic—and shows how important it is to undertake individual microfinance provider analyses when designing solutions. It also makes clear the need for improvements to the microfinance providers’ data capture and management systems. It is not a simple task to coordinate diverse investors around a common set of behavioral expectations, such as was done when major MIVs became signatories to the MOU. Yet, setting expectations for funder behavior can certainly prevent funders from working at cross-purposes.

2. CREATE FUNDING VEHICLES TO CATALYZE APPROPRIATE CAPITAL FOR SELECT TIER 2 AND TIER 3 PROVIDERS

Important efficiencies can be achieved by establishing funding vehicles capable of shoring up the solvency of multiple Tier 2 and Tier 3 microfinance providers, rather than by tackling solvency considerations with one-off investments, microfinance provider by microfinance provider. This is not easy to do with multiple partners, as it requires aligning diverse investors with varying investment horizons, policy/operating constraints, return expectations (financial and impact performance), and investment tools. Care should be taken to ensure that the financial and transactional costs of creating funding vehicles do not overwhelm the amounts of funding to be raised. There are significant efficiencies that can come from repurposing existing funding vehicles or borrowing structures from already proven funding vehicles. The key here is creating catalytic funding vehicles that can speedily deliver necessary capital infusions, as well as other support, such as technical assistance, as necessary.

The Microfinance Enhancement Facility (MEF) is a good example of what can be achieved when interested and affected parties join forces. Set up in 2009 after the last global financial crisis, the MEF provides short and medium-term financing to microfinance providers unable to find suitable finance. It was established by KfW and IFC, alongside OeEB of Austria and has been co-advised by four leading private sector advisors:Blue Orchard, Symbiotics, Incofin, and responsAbility. Although it has provided over US$2bn in finance to more than 250 institutions engaged in microfinance in around 55 countries, it is essentially a liquidity facility. A lot of emerging evidence from the current crisis shows that liquidity has held up reasonably well, although this is partially a result of reduced low-income economic activity caused by the pandemic. However, evidence shows that what is needed is a resource for solvency support. But the principle of linking development finance parties together in such a fashion to address a systemic problem is the lesson we should be drawing.

3. EXPAND THE RANGE OF POSSIBLE INVESTMENT INSTRUMENTS AND APPROACHES

Hybrid Investment Instruments

As previously noted, traditional common equity is in short supply. But there are a number of hybrid instruments that together or on their own could be used to similar effect—such as preferred stock, grant capital, long-term subordinated debt, and convertible debt (convertible to common or to preferred equity). The advantage of this type of quasi-equity instrument, especially if it contains built-in redemption terms, is that it can be self-liquidating and at least partially hedgeable to limit foreign exchange risk. Similarly, for some microfinance providers struggling to meet outstanding debt obligations, some or all of their existing debt may need to be converted into equity or quasi-equity instruments. If satisfying CAR requirements is a priority, the terms (e.g., currency, tenor, redeemability) should be tailored to meet local regulatory standards. Also, funding instruments may need to be adjusted to provide for exits that prioritize mission considerations that are customer-focused. Instruments such as performance-aligned stock (and other instruments that provide for structured exits) can be used to allow funders to exit while microfinance providers maintain control over their social missions.14

Consolidation Considerations

If, as expected, consolidation in the microfinance sector increases, difficult decisions will need to be made about which microfinance providers should continue and which should not receive additional life support in the form of equity infusions. This is where a common view among funders and regulators, to the extent applicable, about what they are trying to accomplish takes on increased importance. If the impact on microfinance customers is front and center, that view will inform not only which microfinance providers survive but the form that survival will take. Will weakened microfinance providers be merged with other microfinance providers? Or will they be encouraged to sell some or all of their assets, namely microcredit loan portfolios, to others? Or should they wind down and send their customers to other more sustainable microfinance providers? This is perhaps where a solvency facility that is accessible also to Tier 1 microfinance providers might have a potential role, particularly if the funding made available to Tier 1 institutions is intended to help them acquire the microcredit portfolios of weaker microfinance providers that are at risk of failing. A solvency facility designed to provide needed equity to Tier 1, Tier 2 and Tier 3 microfinance providers not only could support the consolidation of the microfinance sector and reduce the overall costs and risks of doing so, but crucially, also ensure that access to finance continues to reach customers currently served by those Tier 2 and Tier 3 providers.

Donor Support

A key to the success of any solution will be attracting the level of donor support required to catalyze funding from DFIs and private sector investors. And although subsidizing the microfinance sector is not as popular among donors as it once might have been, we argue that the types of Tier 2 and Tier 3 microfinance providers we are focusing on here—thosethat reach deep into communities where larger and more commercially-oriented microfinance providers often hesitate to tread—are critical to the livelihoods of vulnerable populations. Moreover, there is evidence to support the view that such interventions are efficient uses of donor funding, in terms of maximizing the social impact per dollar of donor funds (Cull, Demirgüç-Kunt, and Morduch 2016).

a. The International Finance Facility for Immunization (IFFIm) was launched in 2006 and uses donor pledges for future finance to support a program of upfront bond finance to support GAVI, the Global Alliance for Vaccines.

Given the importance of Tier 2 and Tier 3 microfinance providers in serving low-income customers, and based on consultations held with the donors, we believe that the donor community would be willing to provide support to a well-structured solution with a clear impact narrative. This is particularly the case if it can be organized on a regional basis, such as a focus on Sub-Saharan Africa, and if the donor support is used to attract other forms of capital. Straight donor contribution funding would be the simplest to incorporate into a structure. Options could include cover for potential forex losses on the quasi-equity instruments as alluded to above, covering the cost of putting the facility in place and risk mitigation provisions via guarantees or other credit enhancements.

There is no one right answer to these questions. Yet, there are steps that funders and regulators can take to smooth this consolidation to promote efficiency while also protecting customers’ interests and ensuring continued access to financial services. For example, funders can show flexibility in allowing transfers of shares or assets, and local government authorities and regulators can remove roadblocks and provide incentives to prospective consolidations.

VI. Recommendations and Conclusions

This Briefing advocates for a more coordinated response to the COVID-19 pandemic. There are several specific features related to the nature of the crisis as it affects the microfinance sector.

- A regional approach makes most sense at the current stage of the pandemic. There are significant differences in how the crisis is unfolding in different parts of the world. We recommend that investors and donors initially focus on microfinance providers in Sub-Saharan Africa.

- Evidence emerging from microfinance surveys undertaken since the start of the pandemic supports a shift in focus away from traditional debt- and liquidity-based responses and toward a focus on creating firmer support for the capital bases of microfinance providers that helps to reinforce their solvency.

- Strong encouragement should be given to DFIs to engage with more direct capital support measures for microfinance providers. While there are issues related to deal ticket size and the need for mitigants against the risk of local currency weakness that should be taken into consideration, we believe that more direct equity engagements should be facilitated.

- The importance of donor engagement in helping to address some of the risk-related issues wrapped up in the equity proposal cannot be overstated.

This combination of features, leveraging off a number of specific instruments highlighted in this Briefing, could make a significant contribution to safeguarding the gains in access to finance that have been achieved in recent decades. Low-income populations need their financial service providers. A coordinated approach should help move microfinance providers safely to a position of post-pandemic financial stability. But attention must then be given, through the same set of participants, to building the sector back stronger and more resilient to the next set of financial challenges that will inevitably arrive.

Improving access to sources of equity and quasi-equity is only a first, albeit crucial, step. However, more can and should be done to help these equity investors act in ways that put customers at the center of the challenging strategic and operational decisions that are likely to come as the microfinance sector navigates its emergence into a post-pandemic world. Just as MIVs joined together in the early days of the pandemic to espouse principles for improved creditor coordination, shareholders of microfinance providers too should move collectively to rally around the advancement of equity support mechanisms that put mission considerations front and center. These will require shareholders and management to consider the impact of their decisions on the customers being served.

1 The CGAP pulse survey had participation in at least one of the periodic questionnaires from almost 400 microfinance institutions; the CGAP/Symbiotics analyses covered the performance of more than 300 institutions in the Symbiotics global portfolio. See https://www.cgap.org/pulse and https://www.cgap.org/ research/data/snapshots-mfis-during-covid-19-crisis.

2 See: https://internationalbanker.com/finance/how-covid-19-is-affecting-microfinance/.

3 Rules and regulations imposed by local government authorities to contain the pandemic’s reach through shelter-in-place requirements and other restrictions on the conduct of nonessential business combined with a slowing of lending activities in the microfinance sector as regulators mandated repayment holidays to relieve the debt burden shouldered by already struggling populations.

4 See “Snapshots: MFIs During the COVID-19 Crisis,” CGAP, July 2021, https://www.cgap.org/research/ data/snapshots-mfis-during-covid-19-crisis.

5 MFR field analysis (2021) identified several important advantages of Tier 1 institutions, including (i) MIS: risk management (systems, controls, management quality); (ii) geographic diversity in the country (e.g., ability to continue operations in regions not subject to lock-downs; and presence of less affected sectors in the portfolio); (iii) operational capacity (organization’s capacity to implement changes in credit risk management strategies); and (iv) support from international holdings (liquidity, strategy, lobbying).

6 See Featherston, Littlefield, and Mwangi (2006) and Apgar and Reille (2010).

7 For more on how regulators can help the microfinance sector through the pandemic, see CGAP (2020).

8 See “Coordination among MIVs in Response to Covid 19,” MOU, 23 April 2020, https://7eab7e50-e834- 461b-8539-7e8435e86338.filesusr.com/ugd/361833_8dcc8ce984984ee2bcc2c4fccc66d0d5.pdf.

9 See “Key Principles to Protect Microfinance Institutions and Their Clients in the COVID-19 Crisis,” Pledge, 29 May 2020, https://www.gca-foundation.org/wp-content/uploads/2020/06/2020-06_Principlesto- protect-MFIs-and-clients-in-COVID-19-crisis.pdf.

10 See: https://www.eib.org/en/press/all/2021-084-the-european-investment-bank-and-adopem-increasemicrofinance- support-for-covid-19-impacted-companies-in-the-dominican-republic.

11 For more information on the MASSIF fund, see: https://www.fmo.nl/partner-with-us/massif.

12 For examples, see EFSE (2021a), EFSE (2021b), and EFSE (2021c).

13 For further information, see https://www.tcxfund.com/about-the-fund and https://mfxsolutions.com/.

14 Performance aligned stock (PAS) is designed to encourage early stage investment by providing investors with exit mechanisms linked to the company’s revenue performance - allowing the original shareholders to maintain appropriate levels of control on their impact aims.

To view full list of references, please see PDF.

|

This Briefing was prepared by Deborah Burand, David Crush, Henry Gonzalez, and Alexander Sotiriou under the guidance of Xavier Faz. Throughout 2020 and 2021, the team convened several workshops and hosted discussions with members of the DFI Alignment Group (representatives from EBRD, EIB, FMO, IADB, IFC, KFW, Proparco, and U.S. International Development Finance Corporation (DFC)) to assess and consider responses to the impact of the COVID-19 pandemic on the microfinance sector. The views expressed in the Brief are those of the CGAP authors, but we acknowledge with immense gratitude the contributions of all the DFI members of the Alignment Group, as well as Mary Rose Brusewitz, Deborah Drake, Lucia Spaggiari, Mayada El-Zoghbi, Peter Zetterli, and Estelle Lahaye. We thank Andrew Johnson for his editorial support. |