COVID-19 and Microfinance: What the Data Says About Risk in the Sector

When COVID-19 erupted across the world early last year, it sparked immediate concerns about whether the microfinance sector would survive — and, if so, in what form. To shed light on these questions, CGAP and the ratings agency MFR partnered to conduct a pulse survey of nearly 400 MFIs from June through December 2020. In 2021, we combined the survey data with data from MFR’s ATLAS platform to further analyze the pandemic’s impact on 225 MFIs of different sizes and regions. Here are our key findings on COVID-19’s impact to date and likely scenarios for the future.

Looking back: a review of COVID-19’s impact to date

1. The massive liquidity crunch many feared did not materialize. Instead, some liquidity increase was observed due to moratoria granted by investors and lower disbursements to end-borrowers.

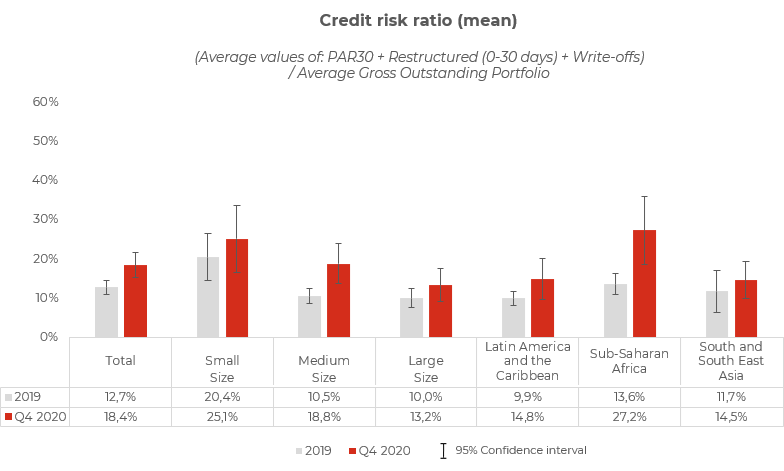

2. The real cause for concern was increased credit risk. From 2019 to 2020, MFIs’ credit risk ratio — which assesses the risk in an MFI’s underlying loan portfolios by combining portfolio at risk after 30 days (PAR30), the write-off ratio and the restructured ratio (including loans under moratoria) — grew on average by around 45% (from 12.7% to 18.4%). Small-scale MFIs and those in Sub-Saharan Africa reported some of the highest credit risk levels in 2020. The standard deviation in the distribution of data also increased, indicating a wider variety of risk levels compared with before. It is also interesting to note that initial data from 2021 shows a decrease in the restructured portfolio ratio and an increase in PAR 30 and the write-off ratio, reflecting in part the end of moratoria to end-borrowers.

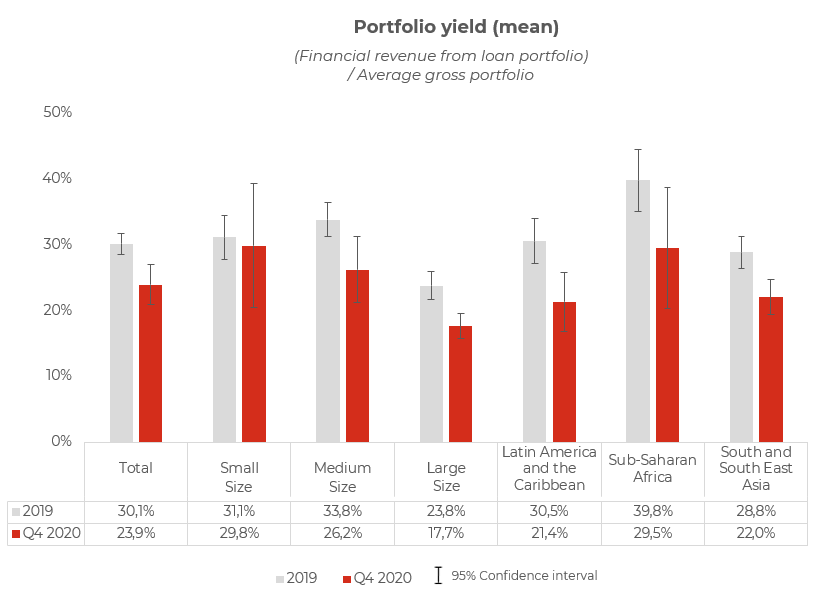

3. Less performing portfolios pose a greater risk through reduced loan portfolio yield — the most important source of revenue for MFIs. The missing revenue from lower portfolio yield was six times larger on average than the cost of provisioning for loan losses, which are an indication of likely losses from bad debt. Missing revenue was most substantial in high interest rate environments.

4. MFIs may still not have recognized the true value of their 2020 losses. The provision expense ratio indicates the level of protection provided by a financial institution’s provisions against future losses. The increase in 2020 was proportionally lower than that of the credit risk ratio, as regulators introduced more relaxed provisioning requirements to preserve financial institutions’ notional solvency. The fact that provisioning did not increase at the same rate as credit risk may indicate that MFI loan portfolios have not yet fully accounted for potential losses of their 2020 loans. In fact, the increase in the provision expense ratio in 2020 was half the increase observed in PAR 30, suggesting possible under-provisioning strategies. Moreover, the provision expense ratio in 2021 displays similar levels to 2020, despite the increase in PAR 30 observed over the same period. This suggests that MFIs may have already paid one part of the cost of the crisis; however, another installment may be due in the future when the postponed cost of the credit risk will need to be absorbed.

The trends described above contributed to an overall stable equity-to-assets ratio, which displayed on average just a marginal decrease in 2020. Emerging data suggest a stable trend in 2021. This also reflects the relatively good solvency positions with which many MFIs entered the crisis. While this is a positive sign of the sector’s resilience during the crisis, it may be prudent to consider some underlying nuances. The lagging nature of some of the credit risk cost means that today’s equity-to-asset ratio may not always be an accurate proxy of future solvency. Indeed, future capital adequacy will also depend on the room available to absorb loan losses that originated in the past and were not fully paid yet, the possibility to recover pre-crisis portfolio yields, and on the capacity to manage future portfolio quality.

Looking forward: solvency stress test scenarios

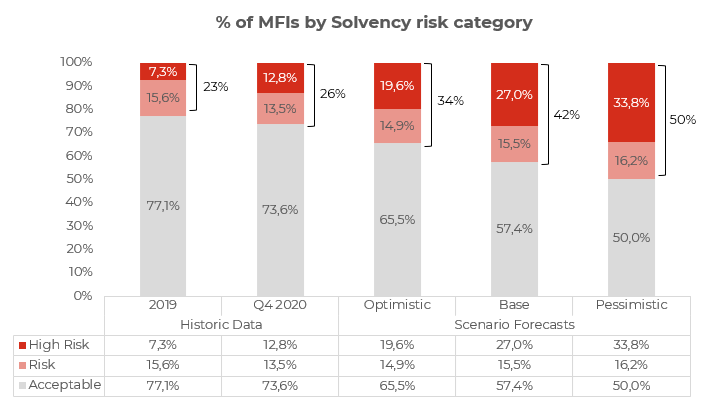

Putting all this together, MFIs today continue to face extreme uncertainty regarding the performance of their loan portfolios and therefore of their medium-term solvency. Given uncertainty around how this will unfold, MFR, in coordination with CGAP, developed a simplified model to project the equity-to-assets ratio — an indicator of financial solvency, with a higher number suggesting a greater ability to absorb a financial shock — from 2020 to the end of 2021. We then outlined three scenarios — an optimistic case, a base case, and a pessimistic case — based on how much of the restructured portfolio (8%, 12%, 16%) and current portfolio (-20%, 0%, 20%) is assumed to deteriorate into portfolio at risk (PAR30).

We classified MFIs into three solvency risk categories (acceptable, risk, high risk) depending on their equity-to-assets ratio and size. For example, we assumed that a medium-sized MFI with an equity-to-assets ratio of greater than 15% would have an acceptable solvency risk, but one with less than 10% would be at high risk.

We then applied the scenarios and examined the results in terms of the above solvency risk thresholds. The findings of these stress tests were enlightening. For example, if the financial costs of the crisis had to be fully paid in 2021, the number of MFIs in solvency risk territory would increase from 26% in 2020 to 42% in 2021 under the base scenario (or 34% under the optimistic scenario and 50% under the pessimistic scenario). Moreover, the high-risk category would increase under all scenarios.

This is a sobering assessment of the risks to come, and it underpins the need for coordinated approaches among stakeholders to be developed sooner rather than later.

Of course, the way COVID-19 plays out in reality will vary by country and depend on risk management strategies taken by MFIs and factors other than COVID. In all scenarios, the evidence we have found of an increase in the data standard deviations does indicate the singularity of the financial and risk profile of each MFI. This makes it harder to draw general conclusions and underlines the need for detailed individual analysis of MFIs. The new CGAP COVID Briefing explores ways in which different industry stakeholders may be part of a future response, and the evidence we have seen, together with the analyses we have undertaken, convinces us that coordinated action will be vital.

Lucia Spaggiari is the innovation director at MFR. For further information, a more complete summary of the analysis can be found here. This is the first post in a new blog series, "Microfinance Solvency and COVID-19," which looks at key issues related to microfinance providers' solvency amid COVID-19 and explores ways forward for the sector.

Add new comment