Why Do CICO Agent Networks Matter and How Do We Promote Them?

CGAP, the Boston Consulting Group (BCG) and the Bill & Melinda Gates Foundation (BMGF), along with our partners, have been working in recent years to understand the role of cash-in/cash-out (CICO) agent networks in building inclusive digital finance ecosystems. Currently, we are supporting our stakeholders — digital financial service (DFS) providers, policy makers and regulators — across the world to build or expand inclusive CICO networks and will continue to share learnings from our joint efforts.

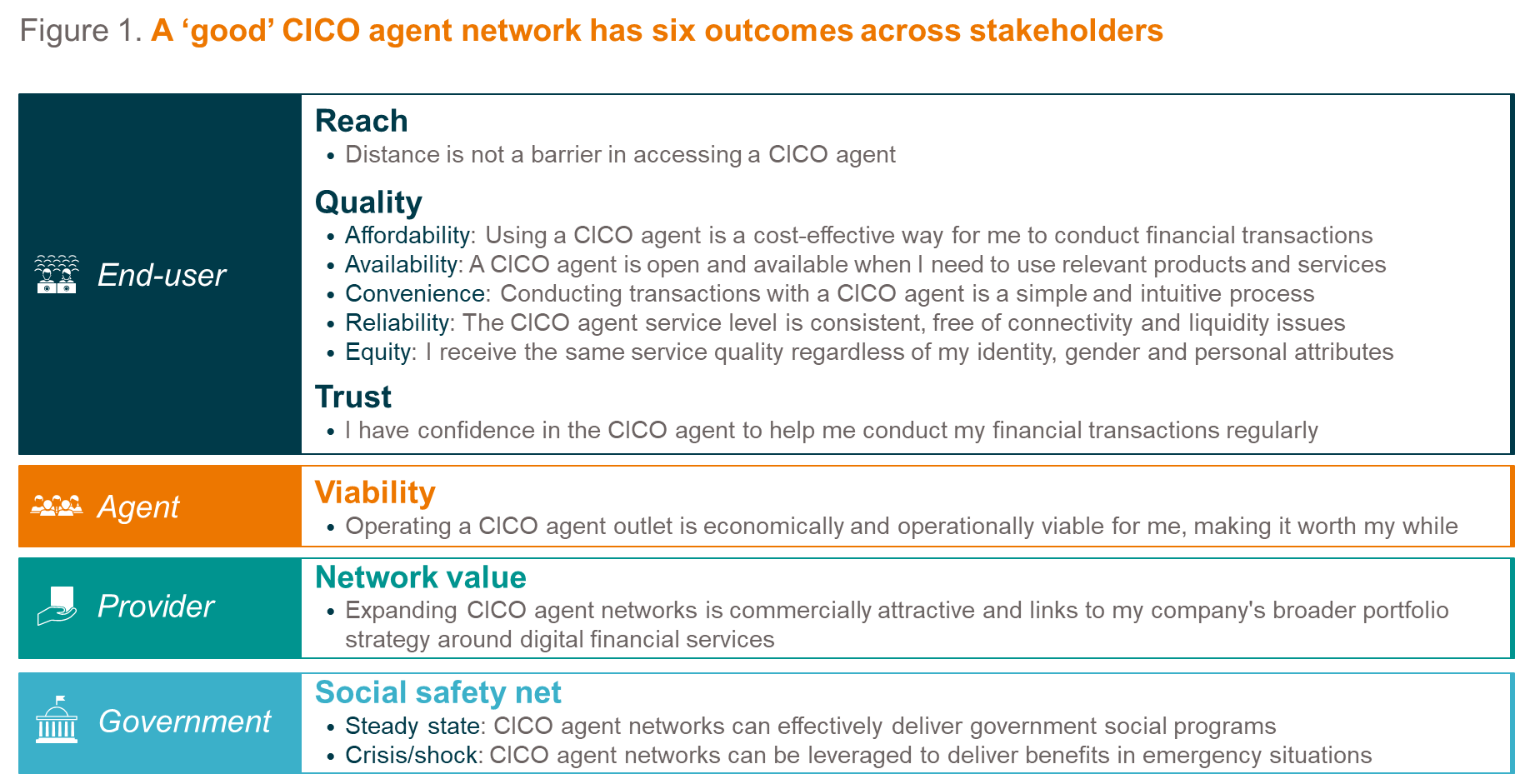

In this blog, we synthesize our collective knowledge to date by offering a framework for the financial inclusion community to be able to speak in common terms about the challenges and imperative of extending CICO networks. Recognizing the diversity of agent business models developed by different DFS providers, we believe that a shared understanding of CICO networks will contribute significantly to our community’s goal of realizing the full potential of DFS to benefit low-income individuals and households.

Let’s start with why CICO agent networks matter. The global evidence is consistent, but in our experience, it can be difficult for stakeholders to articulate the answer consistently. In a nutshell, CICO agent networks are like a net, spread by providers, that determines who gets to have the choice of using DFS.

After more than a decade since the global rise of digital finance, cash remains an important way in which many people use and manage their money around the world — more so in lower-income countries, but also in industrialized ones, and even in countries with more mature DFS markets and high rates of smartphone ownership. It seems counterintuitive, but for most people to use DFS, they first need access to “good” CICO agent networks to convert their cash into e-money and back.

CICO agents can provide more than this conversion function. They can also surface customer needs and help providers to make informed decisions about how to diversify their DFS offering. Furthermore, CICO agents — with adequate provider support — can help establish a foundational layer of customer trust in DFS (see USAID and MSC), driving both financial inclusion and the transition to more digitized economies.

Lastly, CICO agent networks tend to be a more cost-effective channel for expanding financial access, particularly in rural areas, as compared to traditional branch networks.

One outcome of a good CICO agent network is that customers have access to CICO agents close to where they live. For most lower-income, less financially included customers, this means having access to agents in rural areas. For example, in China, which has the largest financially excluded population in the world, 200 out of the 225 million financially excluded people live in rural areas. Global Findex 2017 reports this rural gap holds for the 1.7 billion people who are financially excluded globally.

An approach to improving CICO agent networks

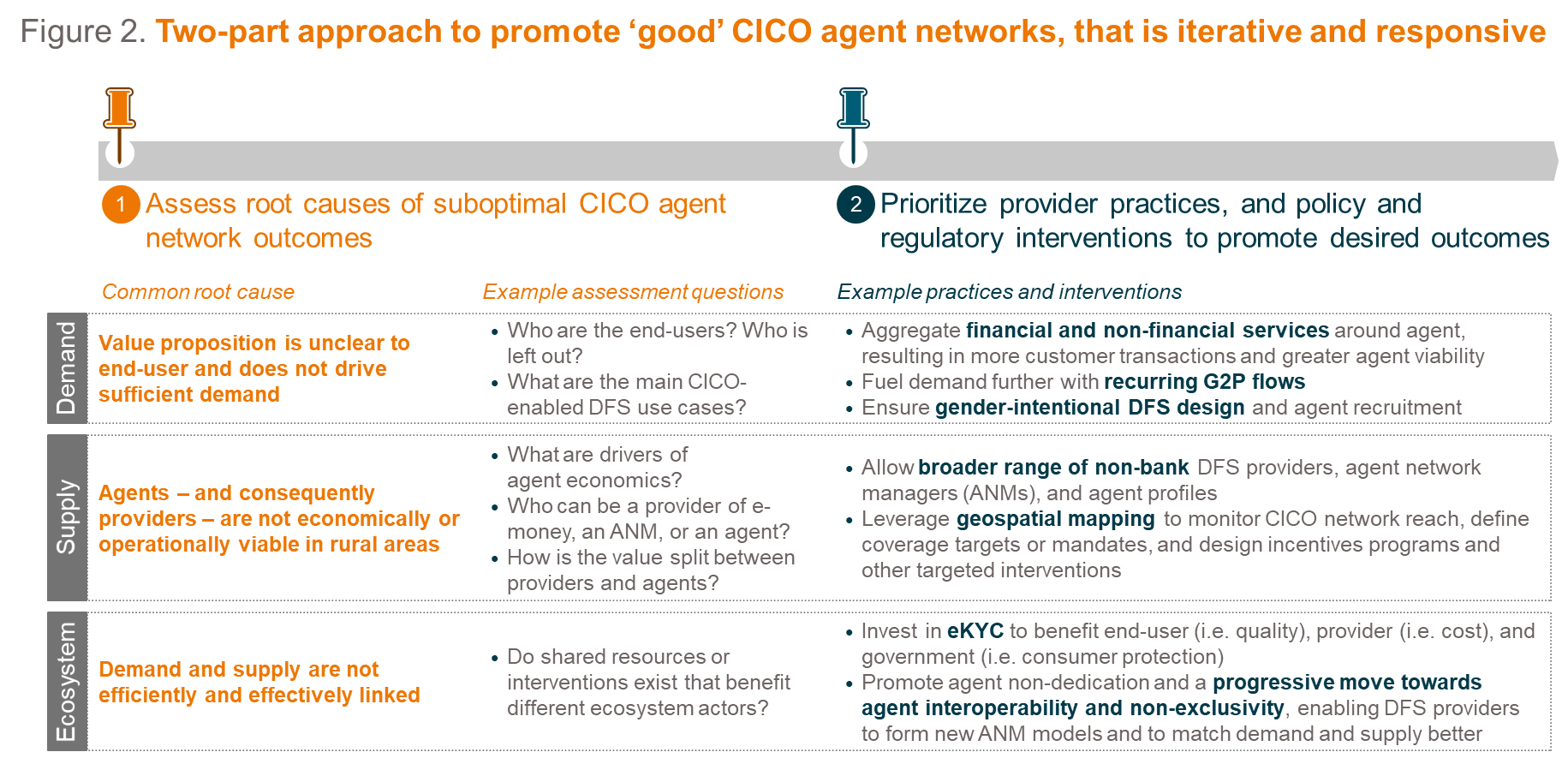

The logical next question — and the focus of our organizations’ in-country stakeholder support — is “How do we viably extend the reach and quality of rural CICO networks?” While the answer is highly context-specific, an iterative two-step approach emerges from the experience of DFS providers, policy makers and regulators across the world in achieving tangible solutions to demand, supply and ecosystem-wide challenges.

Demand-side challenges. One common root cause of sub-optimal CICO network outcomes is that the value propositions of the DFS are not strong enough to drive sufficient customer demand. If the benefit of using DFS via CICO networks is unclear, then there will not be sufficient demand for agents to be economically viable — no matter how operationally excellent the CICO network may be.

Global experience reveals that DFS value propositions for customers can be strengthened when these services allow customers to benefit from non-DFS offerings that are already valued, resulting in more CICO transactions per customer and a viable agent outlet. This aggregation is usually achieved through partnerships that leverage each financial and non-financial service provider’s unique strengths, such as their customer knowledge or trusted rural presence. Governments can further fuel demand for DFS by delivering government-to-person (G2P) payments through diverse types of DFS providers and their CICO networks. In addition, gender-intentional DFS design and agent recruitment models have resulted in more women customers and boosted overall demand.

Supply-side challenges. Another common root cause of suboptimal CICO network outcomes is that agents — and consequently providers — tend to be economically or operationally inviable in rural areas. Economic viability refers to agents being able to recover their costs and earn a reliable income compared to alternatives. Operational viability refers to agents being capable of operating reliable technology and infrastructure to offer CICO. Understanding the economics of different types of DFS agents and providers, as well as those of potential partners outside financial markets (e.g., fast-moving consumer goods providers, agribusiness, or e-commerce players that operate rural service points), is critical to achieving agent viability.

This precise understanding of agent and provider economics can inform policy and regulatory interventions that enable rural agent viability. Global experience demonstrates that agent viability is enhanced when regulators allow a broader set of non-bank DFS providers, agent network managers and agent profiles to participate in financial markets, as this can result in the new provider partnerships mentioned above. Moreover, policy makers that leverage geospatial mapping to monitor CICO network reach have been able to identify with sufficient granularity where customers lack access to CICO networks and where new CICO agents may be viable. Geospatial mapping can be used as an evidence-based policy tool to define adequate coverage targets or mandates. It can also be used to design incentives programs that extend CICO networks for the least served geographies and users.

Ecosystem-wide challenges. One final common root cause of suboptimal CICO network outcomes is that demand and supply are not efficiently and effectively linked. Here, it is useful to consider what shared resources or interventions have the potential to unlock value for different ecosystem actors. As an example, global experience suggests that regulatory support for e-KYC has enabled greater convenience for customers, cost reductions for providers and agents, and greater customer protection. All of these factors contribute to the formation of DFS ecosystems in rural areas. Furthermore, regulators that have built support among industry players for agent non-dedication and a progressive move toward agent interoperability and non-exclusivity have enabled DFS providers to form new agent network manager models that increase the sharing of partner resources and better match demand and supply. Agent business models in East Asia have been a great example of this, whereas most agent models in Sub-Saharan Africa have found it harder to apply such features.

Looking forward

In this blog, we have distilled a set of recommendations to achieve optimal CICO network outcomes that are generally applicable based on our body of evidence and country experiences to date. We acknowledge that these recommendations are interdependent, and the most effective implementation approach varies widely by context. Over the next few years, CGAP and its partners will be supporting the adaptation of these more generalizable recommendations to different country contexts, including in Colombia, Cote d’Ivoire, India, Indonesia, Pakistan and Morocco. We will synthesize and share the most up-to-date lessons and recommendations on how stakeholders in other countries can extend rural CICO network reach and quality, driving DFS uptake and broader financial inclusion on CGAP's knowledge hub Channel. Visit the page and sign-up to receive periodic updates on this work.

Emilio Hernandez is a senior financial sector specialist at CGAP. Shalini Unnikrishnan is a Managing Director & Partner at the Boston Consulting Group. Sisi Pan is a Principal at the Boston Consulting Group. Dave Kim is a program officer on the Financial Services for the Poor team at the Bill & Melinda Gates Foundation.

Add new comment