What Gets Measured, Gets Managed: Findex 2021 Insights for the Future

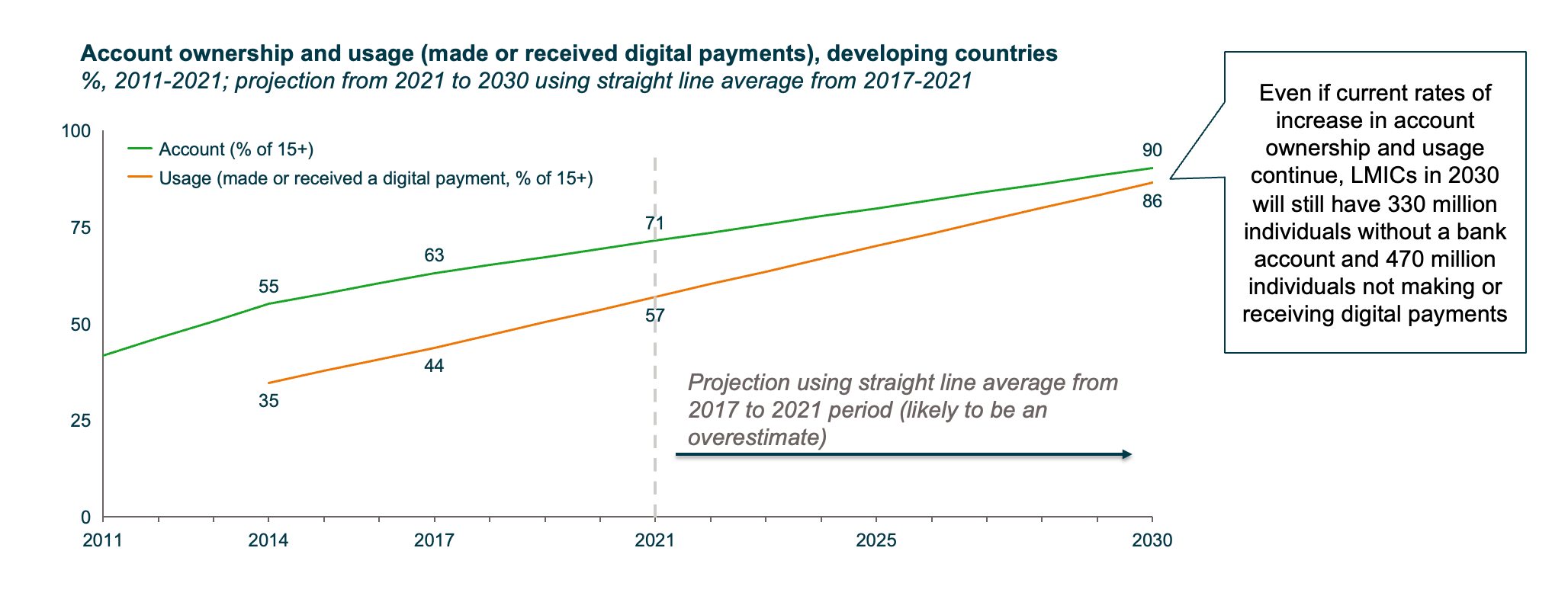

Do we have the right indicators to measure success? The 2021 Global Findex data provides a promising trajectory for financial inclusion. A decade ago, about half the world did not have access to financial services, with that figure even smaller for lower- and middle-income countries (LMICs) where only 42% of people had access. Today, 76% of people globally and 71% in LMICs have an account. A similarly positive trend has occurred for digital payments. Between 2014 and 2021, the main usage indicator – making or receiving a digital payment – has increased from 35% to 57% in LMICs.

By 2030, if we project the same positive trends for financial access and digital payments that we’ve witnessed over the last three years, 90% of people living in LMICs will have access to an account, and 86% will have made or received a digital payment within the last 12 months. Of course, such linear positive trends cannot be guaranteed given the undeniable uncertainties around economic, political, environmental, health and other developments. If this scenario did come to pass, however, some would no doubt call it a major success, but others might point to the 330 million individuals still left without a bank account – likely the most vulnerable populations.

While reach is one of the defining success measures in the financial inclusion community, it is not the only one. Other metrics are key to determining success and where we need to focus and strengthen our efforts.

In the early days of microcredit, most if not all actors were fully aware that its purpose was to help lift people out of poverty. The question of “finance for what?” has continued to feature in the conversations of the financial inclusion community as the field evolves, but is not always front of mind when we consider and measure success.

Throughout the last decade, there has been wide recognition that (i) financial access through account ownership is the first step towards broader financial inclusion, where individuals and firms are able to safely use a range of appropriate financial services, including savings, payments, credit, and insurance, and (ii) that digital payments can help significantly expand access and reduce the cost of financial services. For those reasons, the community has focused efforts on building these foundations. Consequently, access and usage outcomes have come to dominate the agenda as proxy indicators of financial inclusion success, and the industry seems to have lost its measurement focus on “finance for what?” and a holistic and outcome-driven approach to the financial services people need to lead prosperous and resilient lives.

The Global Findex 2021 includes worrying data which shows that 55% of people living in LMICs would not be able to come up with emergency funds in 30 days or would find it very difficult to do so, and 7% of adults with a mobile money account cannot use those accounts without help. These figures paint a much more nuanced – and less positive – picture of the industry’s progress than the one on accounts alone. This data suggests that many people lack at least one key dimension of resilience (availability of emergency funds) and are not necessarily capable of using digital financial services. Such customer outcomes need to be looked at when we consider progress and success. Customer outcomes, related to financial resilience (e.g., over-indebtedness), capabilities, and worries are ever more important considering today’s macro conditions such as increasing extreme poverty, escalating inflation and the real threat of a global food crisis. Paired with both the risks and benefits of new digital services being provided to poor people – including fintechs offering buy now, pay later solutions – vulnerability remains a key concern for the financial inclusion community.

Thus, while it will continue to be important to measure progress on access and usage, these cannot be considered success metrics on their own. As articulated in CGAP’s earlier work presenting a new narrative for financial inclusion: “[…] there is a need to better align the impact evidence with the metrics used to measure progress in our field. The financial inclusion community should not be prioritizing indicators that have no correlation to impact.”

“Finance for what?” implies that we need to measure customer outcomes related to the real economy: the extent to which users of financial services are capturing economic opportunities and building resilience, and how those services are enabling and supporting them. The right indicators help set priorities and incentives, whether it be for development agencies who need to report on the use of taxpayers’ money, providers who need to ensure sustained business performance or regulators and supervisors who need to – amongst other objectives – make sure that customers are protected. As the proverb goes, “What gets measured gets managed.” Perhaps it’s time for the industry to have a fresh look at how we collectively think about and measure success?

Add new comment