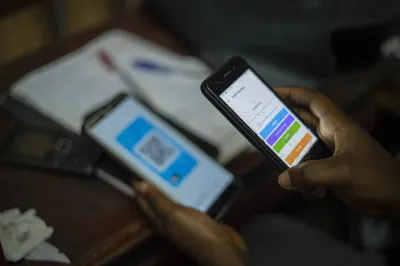

Growth of Digital Finance in Côte d’Ivoire is Not Without Risks

For the first time, thanks to our recent CGAP study, we have an accurate picture of the nature and scale of digital financial services (DFS) consumer risks in Côte d’Ivoire. While DFS are certainly playing a positive role for Ivorian users and driving financial inclusion, we are also seeing the emergence of significant consumer risks, especially related to fraud and transparency, that will require concerted action from all stakeholders in the digital finance ecosystem to counteract. The lack of transparency also calls for improvements from providers to better present terms and conditions to customers.

Digital financial services come with great opportunities but also challenges

Financial inclusion growth in Côte d'Ivoire is driven by DFS, specifically, by access to mobile money accounts. According to Global Findex 2021, only 21% of adults own an account at a financial institution, while 40% of adults hold a mobile money account, up from 34% in 2017 and 24% in 2014. This growth of DFS has driven total account ownership to over 50% of adults for the first time, helping Ivorians meet urgent family needs or grow their businesses while bringing more convenience in usage than traditional financial services.

While building economic resilience, DFS can expose customers to several types of risks, as highlighted by our recent global research. To better address growing digital finance consumer risks in the West African Economic and Monetary Union (WAEMU), CGAP launched a DFS Consumer Protection Lab, which drives research and capacity-building activities in the WAEMU region. The Lab’s first activities started in Côte d’Ivoire where we launched two national phone surveys on the risks faced by DFS users in collaboration with Horus Development Finance, and the Observatoire de la Qualité des Services Financiers. One survey focused on digital finance consumer risks overall, and another on digital credit risks. Below are key results of the first survey.

What did we learn about who uses DFS and for what in Ivory Coast?

Despite significant growth in DFS adoption, gaps remain. The survey showed that DFS users tend to be men (56%), urban (85%) and young (72% ages 18 to 40). Women are more likely to use one or two accounts, while men are more likely to use three or four accounts (46% of men, vs. 37% of women).

Ivorian women face greater challenges in using DFS. Except for airtime purchases, women use DFS less frequently than men. For example, 85% of women reported using money transfer services at least once a month compared with 91% of men. Digital credit is still nascent with 90% of women and 83% of men never having used it. While 75% of users own a smartphone, 82% access DFS through the USSD channel, and only 22% through DFS providers’ apps. In fact, one in five users, a majority of whom are women, express difficulties in navigating the DFS menus or find the syntax complicated. In addition, 16% of respondents need help using DFS, with women reporting they need help at twice the percentage of men. Beyond the fact that this lack of autonomy limits an individual’s overall access to financial services, relying on the help of a third party exposes them to the risk of fraud.

What did we learn about consumers exposure to DFS risks?

88% of DFS users have been exposed to at least one risk in the past year and 40% have lost money in the process, either by reacting to a fraudulent message, paying more than expected, or as a result of a malfunction during the transaction.

Fraud

This risk continues to be prevalent despite providers’ efforts to make their clients aware of scams and to counter them. While women report having received fewer scams or fraudulent offers (25% of women vs. 30% of men), they are slightly more likely to have lost money as a result of a scam (16% of women vs. 12% of men), underscoring women's greater vulnerability to scamming attempts.

Lack of transparency

Transparency of offers and costs remains an area where improvements seem necessary. Only a third of DFS users report being informed of the cost of a service before making their transaction, and a fifth have encountered difficulties in understanding products or services. In addition, 31% have made a transaction or payment without receiving a receipt.

Data misuse

While problems related to data misuse are often not reported by DFS users, 24% of respondents think that their digital transactions are not totally secure, and they could lose money as a result. Further, more than one in five customers feel that their data is not kept safe by providers, revealing a consumer trust issue that could prevent the expansion of digital finance usage.

Inadequate redress mechanisms

While recourse mechanisms are in place and accessible through various channels, clients make little use of them. Only a third of clients who reported a difficulty contacted the provider, with women being less likely to contact customer services (27%) than men (37%). The main reasons were that customers did not know how to reach the provider (14%) or lacked confidence in the provider's ability to resolve the problem (14%).

Network downtime

Network outages or poor network strength are still common in Côte d'Ivoire and 61% of mobile money users reported encountering this problem in the past 12 months, resulting in difficulty in making a transaction.

Agents

Customers face risks with agents due to a lack of liquidity and electronic money to make a withdrawal or a deposit (more than half of the respondents in the last 12 months). More surprisingly, almost half of the respondents – a majority of whom were men – reported that agents do not treat them with respect, and a small proportion of clients expressed a preference for an agent of the same sex (21% of men and only 12% of women). Further research would be needed to better understand these two aspects.

Because they are often the main contact for customers, especially for low-income groups, agents also have a key role to play in both risk prevention and problem-solving support. We found that agents assist customers in many cases.

These results call for actions by key stakeholders.

As Côte d'Ivoire seeks to accelerate its digital transformation, these risks should alert all stakeholders to the need for a concerted approach to building a responsible DFS ecosystem. As part of the WAEMU Lab activities, we are using this data to develop solutions and start conversations with key actors in the digital finance ecosystem. Consultation frameworks between actors for a common understanding of DFS risks and mitigation actions as well as stronger consideration of the consumers' voice have been discussed. The need for capacity building has also been highlighted, including enhancing customers’ digital literacy.

We hope to trigger cross-learning and collaboration among different countries to improve DFS consumer protection, and a similar survey has started in Senegal with another in Burkina Faso starting soon – stay tuned!

This post is also available in French on FinDev Gateway.

Add new comment