Stakeholder Landscaping: A Tool for Improved Consumer Engagement

In a recent paper and blog, CGAP took stock of the role that consumer advisory panels can play in regulators’ quest to incorporate the consumer voice more explicitly in their agendas, including those of women and vulnerable customers. The research builds on previous work on elevating the collective consumer voice in financial regulation where advisory panels were identified as a promising mechanism for integrating the consumer perspective, alongside building the capacity of consumer associations and leveraging technology to better communicate with and hear from consumers.

To develop deeper insights into the process of creating a consumer advisory panel, the Financial Sector Conduct Authority (FSCA) launched a pilot to develop such a panel in South Africa with CGAP support. According to Kershia Singh – FSCA’s Head of Department, Policy Support – as a relatively new market conduct regulator in South Africa (established in 2018), the FSCA is required in its founding legislation to facilitate consultation and the exchange of information with financial customers. To give effect to this, the FSCA intends to establish a consumer advisory panel, with members selected on their ability to ensure that customer views and perspectives are better incorporated into the work of the regulator.

As part of this process, FSCA and CGAP worked with Cenfri to conduct a stakeholder landscaping exercise. Mapping the landscape of stakeholders can be a useful tool to assist market conduct authorities in designing various aspects of a consumer advisory panel so they make sound strategic decisions about whom to involve and how best to do so. And even if an advisory panel is not on the horizon, stakeholder landscaping can provide valuable insights to inform other types of engagement in which consumer perspectives would be valuable.

The nuts and bolts

The landscape exercise started with desktop research to map established consumer advocates and associations across several different categories, including women, youth, MSMEs, people with disabilities, elderly, LGBTQ community, informal dwellers, refugees, and migrants, those focusing on consumer education or community outreach, consumer watchdogs, and those representing specific advocacy topics. For each individual or organization, the assessment considered their relevance, interest, and capacity for advisory panel participation across specific indicators defined for each category, including low-income relevance, size of the underlying target market, and likely financial sector touch points. After the first-round assessment, Cenfri conducted interviews with a shortlist of organizations to assess their actual interest and capacity.

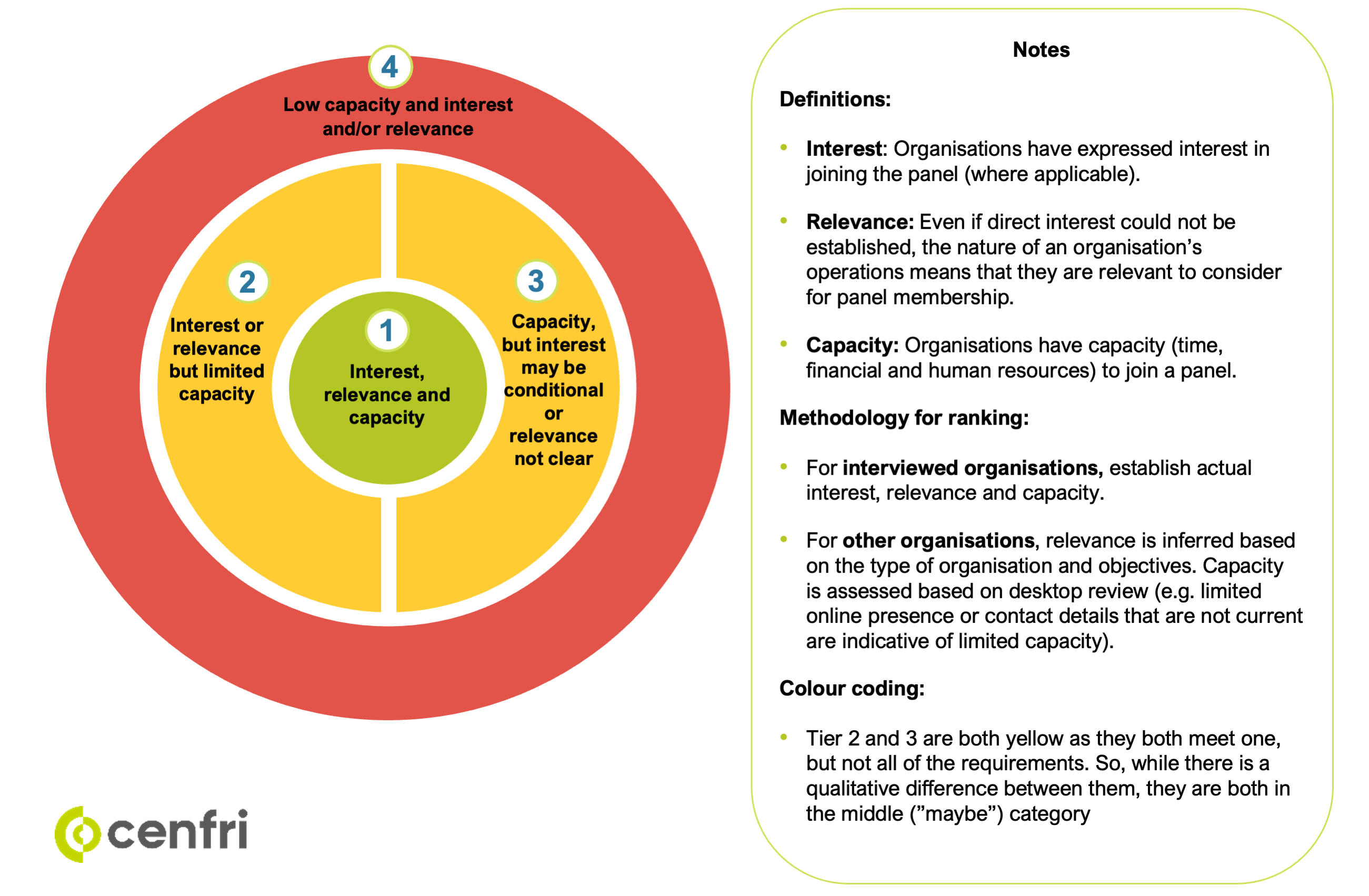

The next step was to set up a master spreadsheet to filter the list of stakeholders in different fields (e.g., by size, target market) to get a bird’s eye view of the types and range of individuals and organizations. The landscape was then segmented into four tiers, from highest (Tier 1) to lowest (Tier 4) potential advisory panel fit, as illustrated in Figure 1. This helped FSCA to visualize both opportunities and constraints related to the capacity, interest, and relevance of potential participants.

Figure 1: Ranking the stakeholder landscape (credit: Cenfri)

Observations and lessons learned

- In addition to identifying general capacity, interest, and relevance, the landscaping exercise highlighted variations between groups and individuals representing specific populations and interest areas, those with a financial service focus, and consumer watchdogs that do not have direct member representation. This made for an interesting debate on what gives an organization or a person sufficient credibility to speak on behalf of low-income financial consumers.

- The stakeholder landscaping also showed that many consumer organizations have a limited understanding of the complexities of the financial system, raising a question on the right mix between participants who are knowledgeable about financial services versus grassroots organizations with a deep understanding of consumer issues. With that, the question arose on how to build capacity for promising candidates to ensure meaningful engagement in complex financial regulatory topics, and how to position the role of the panel at the outset versus how it could evolve over time.

Finally, given the limited capacity and resources of many consumer groups and their primary agendas (which may not include financial services), the landscaping exercise sparked considerations around the level of engagement to be expected of the panel members.

The FSCA found that the stakeholder mapping exercise painted a useful picture of what the consumer advocacy landscape in South Africa currently looks like. While there were issues raised around representativity and the capacity to engage on more complex matters, it also gave a very good sense that it would be possible for the regulator to hear from different voices when developing regulatory approaches. The design of the panel, in terms of its role and function, will be done in recognition of the reality of the existing landscape. It also provides information on stakeholders that the FSCA can consider engaging with in the future, even on a less formal basis than through a panel.

"The stakeholder mapping…gives a very good sense that it would be possible for the regulator to hear from different voices when developing regulatory approaches."

Broader application

Doing a systematic stakeholder landscape exercise is useful beyond informing the creation of an advisory panel. Elevating consumer voices to understand their diverse agendas, relevance to financial sector oversight, and unique capacity constraints can help financial regulators better address customers’ issues even if creating an advisory panel is not feasible right away. Regulators can use stakeholder mapping to drive broader or more targeted engagement in a number of ways, such as:

- Dissemination list to circulate updates regarding financial regulatory matters or topics, or to ask for comments on upcoming regulation.

- Stakeholder list for invitations to webinars, seminars, or forums on pertinent consumer protection topics.

- Geographic map of organizations to target roadshows undertaken by the regulator to engage the public on upcoming regulations, to raise awareness on recourse channels, or to increase visibility and understanding of the regulator’s activities.

- Conduit for financial education initiatives targeted at end-users.

- Contact database to schedule informal check-in conversations on an ad hoc basis with bodies representing different parts of the consumer landscape, so that regulatory decision-makers can take the pulse of the consumers more easily.

In short, drawing on the stakeholder landscape map can be as simple, or as formalized, as the regulator chooses, given its own capacity and the realities of the domestic context.

Springboard to capacity building

A stakeholder landscape exercise can also form the entry point into capacity-building initiatives for consumer associations as discussed in CGAP’s collective consumer voice research. In the South African landscaping exercise, Cenfri found that, though there were a lot of organizations, many did not have contact details publicly available and were not permanently staffed or well-capacitated. The first step to building capacity effectively is knowing which actors are most relevant and what their current capacity is likely to be. This knowledge can be used to target efforts to strengthen consumer associations’ ability to engage productively with regulators.

There are some noteworthy initiatives already working to build consumer association capacity in the financial services and financial consumer protection spheres. For example, Consumers International recently launched the Fair Digital Finance Accelerator to provide training, new insights, and bridges to regulators for a range of community and consumer associations in low- and middle-income countries.

A new tool for the supervisory toolkit

CGAP’s Market Monitoring Toolkit provides extensive resources, case studies, and tools for more customer-centric market monitoring by market conduct supervisors. The toolkit was recently expanded to include a new Consumer Advisory Panel tool that includes guidance and a sample template for conducting a stakeholder landscaping exercise. As the tool is tested and refined, we welcome your perspectives on other ways the tool could be applied and learnings from your own stakeholder landscape experiences.

Add new comment