Decoding Financial Inclusion Gaps Between Young Men and Women

Despite an overall positive trend, the gender gap in financial inclusion remains stubbornly persistent in some parts of the world. To understand what gives rise to this gender gap and how it evolves over time, CGAP and The Bill & Melinda Gates Foundation have been independently analyzing Global Findex data to identify drivers, patterns, and trends. This blog series will present the results of those analyses – first, with an overview of factors associated with financial inclusion for young women and men across low-income economies, and then with a deep-dive into three East African countries. Together, these analyses show that the period between 15 and 24 years of age is a pivotal time for financial services adoption – potentially presenting a high-impact opportunity to close the gender gap.

The gender gap in financial inclusion emerges in young adulthood

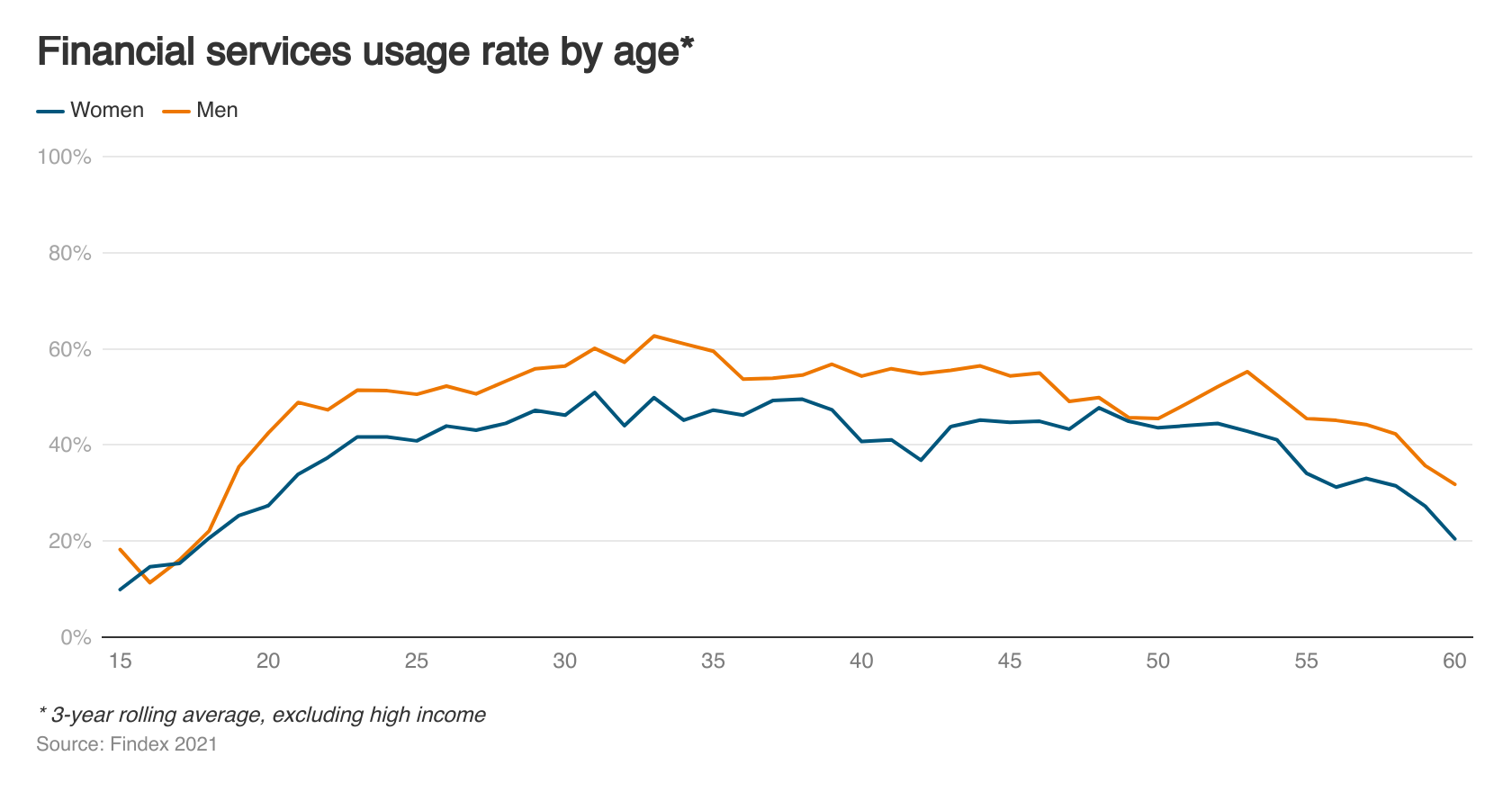

Back in October, we documented a remarkable pattern in adoption of formal financial services by young women and men in low-income countries. After rising sharply and roughly equally in the late teen years, rates of access to financial services diverge markedly around the age of majority – giving rise to a gender gap in access to financial services that persists across the age spectrum. This trend is mirrored in Findex statistics on usage, as seen in the graph below.

What might be driving these gender gaps? CGAP dug further into Findex 2021 data to better understand the factors that might be triggering and perpetuating these disparities.

What drives the uptake of financial services by young people?

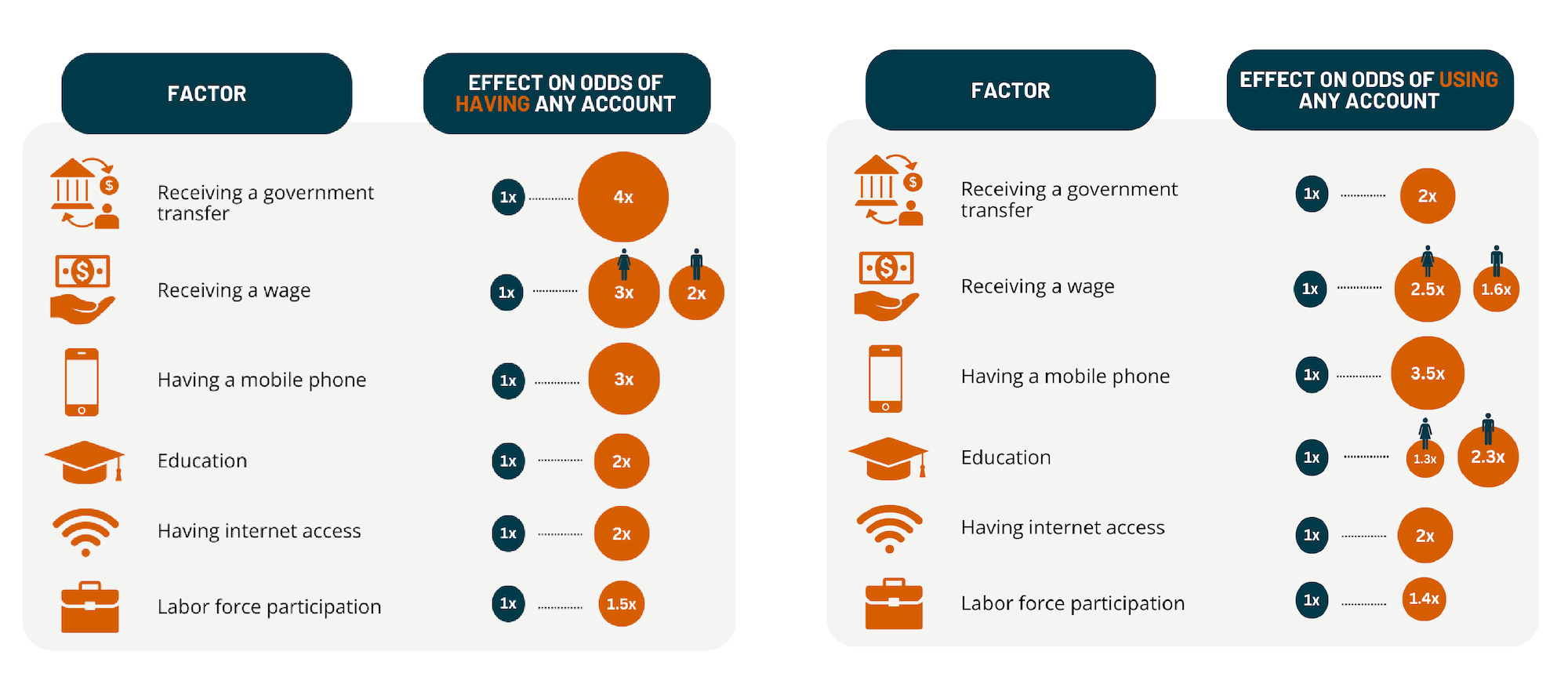

Analysis of Findex data for people ages 15-24 revealed that a handful of key factors might be driving the pattern of uptake in adolescence and young adulthood. These include receiving a government transfer, labor force participation, wage income, education, mobile phone ownership, and internet access.

Some factors prove more influential than others. For instance, young people receiving government transfers are four times more likely to have accounts, while those with mobile phones are three times more likely (see the table for details). Access to an internet connection doubles this likelihood, and entering the labor market increases the odds of account ownership by 1.5 times.

Interestingly, while most of the factors have similar impacts for both young women and men, two seem to have a differential gender effect: receiving a wage (an indicator of participation in the formal economy, as distinct from labor force participation in general), and educational attainment. The enhanced impact of wages on account ownership and usage is more pronounced for women than for men. This implies that jobs have a more positive effect on financial inclusion for women. Conversely, education has a bigger impact on improving financial usage for young men, implying that an additional year of education contributes more to their financial usage than for young women.

So, what explains the gender gap?

If most of these factors have no significant differential gender effects, what is the underlying cause of the gender gap that emerges in adolescence and persists across the age spectrum?

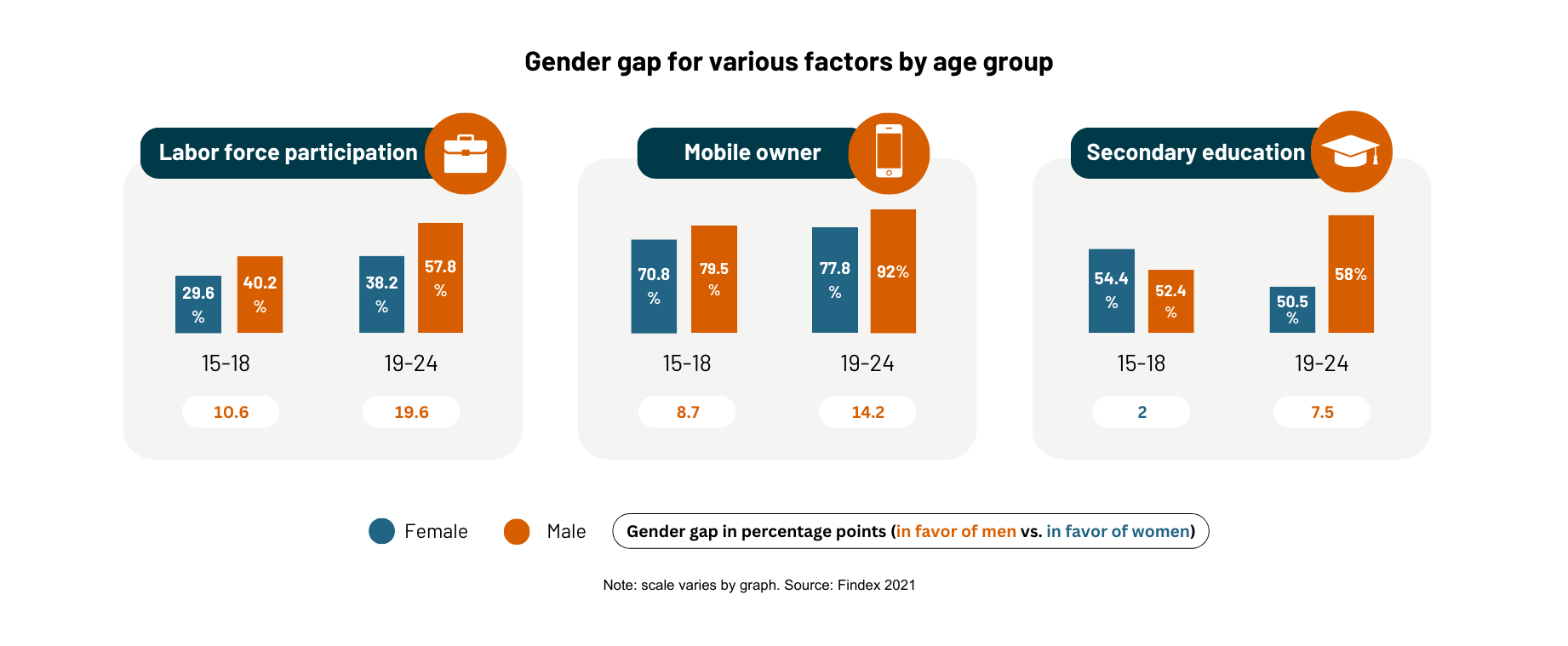

To address this question, we looked deeper, examining the gender disparities in access to the driving factors without a differential gender impact – government transfers, labor force participation, cellphones, and education – both before and after the gender gap in financial inclusion becomes apparent. For three of these factors, we saw a gender gap that widens significantly at age 18, coinciding with the emergence of the gender gap in financial inclusion. So, while a cell phone or another year of education might have the same impact on a young man or woman’s likelihood of financial inclusion, the levels of these endowments they start out with also matter.

These figures paint a picture of the types of people the formal financial system is de facto designed to serve: those with a regular income stream from a formal source, with secondary education, and with access to digital connectivity. Since women begin their financial inclusion journey with lower levels of education, connectivity, and labor force participation, these disparities place them at a disadvantage in terms of lifelong financial inclusion. And while remedying these gaps is critical not just for financial inclusion but for a host of other reasons, it is an enormous, long-term effort.

But initiatives to close the financial inclusion gender gap need not wait for success in these other areas (i.e., education, connectivity and labor force participation). CGAP’s work on financial inclusion and young women is exploring how formal financial offerings can be (re)designed to serve those who are currently excluded. In 2024, we’ll be commissioning mixed-methods research to understand the dynamics behind these trends in specific contexts, exploring use cases, barriers, and enablers, and reasons behind any positive outliers. Partnering with others interested in finding solutions that can work at scale, we will develop recommendations for those designing financial inclusion programs for young women, particularly around products and delivery channels, but also addressing gender norms change, building self-reliance, and other complementary interventions as appropriate.

Other stakeholders are pursuing complementary efforts. In the next blog in this series, we'll explore the Bill & Melinda Gates Foundation’s analysis of how financial inclusion trends for young women have moved across the years in three East African countries – and what happens when young women are included at an earlier age.

Add new comment