The Stories Behind Late Repayment on Digital Credit in Cote D’Ivoire

According to a 2022 national phone survey in Cote d’Ivoire, 78% of digital credit borrowers had repaid a loan late at some point, primarily due to a lack of planning and forgetfulness. This level of non-repayment was higher than what we observed in Kenya (47%) and Tanzania (56%) in 2017, and it merited further research to better understand the challenges that Ivorian borrowers faced with digital credit repayment.

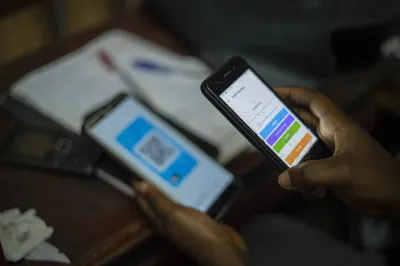

In 2023, as part of the WAEMU Digital Finance Consumer Protection Lab, CGAP, in collaboration with Omedia, conducted qualitative research to better understand customer profiles, loan usage, and drivers of late repayment. This involved 13 focus group discussions and 19 individual in-depth interviews with borrowers, comprising a total of 88 respondents from Bridge Microfinance, MTN’s partner for the digital credit product MoMo Kash. The study targeted borrowers who had defaulted or repaid late in early or subsequent loan cycles. These qualitative results shed more light on the users’ experience and the possible causes of the late repayments.

1) Though it’s often their first experience with formal credit, most respondents value digital credit and a large share of them develop a sense of loyalty

The majority of respondents only use one digital credit provider and closely associate it with their telecom operator. They see it as a value-added service linked to their mobile phone that provides “help” and “support” (or “soutra” in Bambara). Many respondents also associate digital credit with the community values of trust and reciprocity they experienced with community-based lending mechanisms. Digital credit offers them the same reliability as informal mechanisms while preserving confidentiality and reducing the risk of conflicts with relatives. This sense of trust fuels a duty to repay, no matter the clients’ actual ability.

“MoMo Kash is about helping others. When you’re having trouble managing, you can use the service with a view to repaying within a certain timeframe.” (Man, self-employed)

2) The promise of instant money, however, attracts several respondents in financial distress

This happens despite safeguards that digital credit providers have put in place, such as minimum time between enrollment in mobile money and access to a loan, encouragement to save prior to borrowing, and loan amount ceilings. For these distressed respondents, digital credit is not the first option to get money, but rather the last recourse when they have been turned down by – or are too embarrassed to go to – friends and family or other informal lending mechanisms. Juggling several loans to meet basic or emergency needs, many respondents are simply not able to repay.

“On this day I had the rice, but nothing to put in the sauce. I asked around, desperate, again and again, until I was told to try MoMo Kash. That’s how I could go to the market and how we could eat on that day.” (Woman, self-employed)

3) Lack of clear terms and conditions negatively influences consumers’ trust and on-time loan repayments

The difference between the loan amount requested and the amount received after the deduction of disbursement fees created complexity and frustration from the onset of the respondents’ experience. In addition, the consequences of late repayments such as penalties and reporting to the credit bureau (BIC, Bureau d’Information sur le Crédit) are not well understood during the onboarding phase. Most respondents accessed digital credit over USSD interfaces, which limits the amount of information they can get. Digital credit providers do not systematically display their terms and conditions in full during the subscription agreement phase. These must be sought through a non-clickable URL that is hard to copy-paste and requires using airtime data, an extra step that most users won’t take.

“I didn't go to the terms and conditions because you have to be connected to the Internet. And well, do you have time to look at all that in the circumstances under which you apply for a loan?” (Man, self-employed)

4) There is, however, a learning curve for clients to make better-planned and informed decisions

The first time a customer applies for a digital loan is a key teachable moment to understand the product. In Côte d’Ivoire as in other nascent digital credit markets, word-of-mouth is a powerful driver for clients to get a digital loan. Some participants shared how experienced borrowers demonstrate the use of a digital credit product, which usually helps new users feel more comfortable about their future use of the product, more confident to apply for it, and more trusting of the service. Other participants indicated having less opportunity to learn about digital credit products and being exposed to the risk of loans taken without their consent when they relied on friends or relatives to handle their phones and accounts. A few cautious participants shared that they deliberately borrowed less than the maximum amount they were offered and then repaid early to test the product ahead of future credit needs.

“That very day, it was hard, and we were struggling to find a solution. My friend had already taken a loan with Orange but he knew it was also possible with MTN. So he took my phone and typed in to ask for a loan. This is when I got interested and asked him to show me again how it worked.” (Man, self-employed, illiterate)

Aware of these challenges, Bridge Microfinance has taken several steps to improve its offering of digital credit products

With IFC support, Bridge is testing the psychometric credit scoring of customers. This new approach will complement the financial analysis based on customers’ transactional profiles by also assessing their financial planning capacity and willingness to repay. In addition, Bridge has updated its call center scripts to give borrowers more information that can help them better understand the product and to use when following up with delinquent clients. Call center staff now dedicate more time per call to explaining terms and conditions and delivering advice for subsequent loans. Further, Bridge is investing in technical platform upgrades as some arrears are caused by system glitches – which clients often perceive as network issues.

What else can be done to improve digital credit repayments?

Drivers of on-time payments, late repayments, and defaults are complex and may depend on cultural, financial, or educational factors. While it’s up to key national stakeholders to find the best local solution to the issue of late repayments, our global experience has taught us that it is key to take a holistic approach where different actors from the digital finance ecosystem contribute to making the services more responsible to consumers. Below are suggestions for different key actors.

- Financial sector authorities, in collaboration with other authorities, can put in place outcomes-oriented transparency rules that ensure not only that providers make their products’ terms and conditions available, but demonstrate that users understand them well. Presenting loan costs in a more consumer-friendly manner can significantly reduce default rates as illustrated by an experiment conducted in Mexico. Regulators may also adapt credit reporting requirements to balance the benefits of positive and negative credit information with the risks of financial exclusion arising from very small loans that are not repaid on time. Requiring digital credit providers to only report loans above a certain threshold so as to exclude the first-time smallest-value loans would acknowledge the necessary learning curve and improvement in understanding of terms and conditions that take place during the first loan cycle. Further, authorities should continue monitoring the digital credit market and assessing key risk indicators, especially on non-performing loans.

- Digital lenders may adopt stronger and more customer-centric product governance procedures. Lenders need to design products that strike a balance between a seamless customer journey and positive friction that enables better decision-making, putting special attention on first-time borrowers who have the highest risks of not repaying on time. Assessing factors contributing to the bad performance of digital loans, and subsequently reviewing credit screening, scoring, and approving methodologies and processes – especially for first-time loans —would reduce risks for users and adverse selection for providers.

- Consumer representatives and NGOs may sensitize the most vulnerable current and potential digital credit users about the obligations and risks associated with digital credit.

All these key actors in the market need to collaborate to find solutions they can adopt. Leveraging our previous work on digital credit, CGAP is conducting a global landscaping of solutions to address consumer risks in digital credit, which aims to contribute to this discussion so that many more consumers gain access to credit in a way that brings positive outcomes in their lives.

Add new comment