Tackling Gender Norms in Mozambique's Financial Services

In Mozambique, the financial landscape is evolving, but one stark gap remains: women, especially microentrepreneurs and smallholder farmers (SHF), are significantly less likely to access formal financial services than men. Despite strides in financial inclusion, women are still 12 percentage points behind.

In 2023 Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH, in partnership with the Banking Association of Mozambique (AMB), took a closer look at the inclusion gap in Mozambique to understand what continues to hold women back. This was done as a request from the ENIF- National Financial Inclusion Strategy of the Central Bank (Banco de Moçambique). The answer pointed to deeply rooted gender norms. These norms, dictating everything from who makes financial decisions to what role women should have in the household, are a major barrier to women’s economic empowerment. Yet, until recently, little research has been done to understand how these unwritten rules of behavior impact women’s financial lives.

In response, a collaborative effort—backed by GIZ, GOPA AFC, and CGAP—launched a market-system gender norms diagnostic to delve deeper. The goal was to uncover the specific challenges faced by different segments of women in Mozambique in accessing and utilizing financial services, from rural smallholder farmers to urban micro-entrepreneurs, and figure out how financial systems can evolve to meet their needs. The findings are now paving the way for targeted interventions that could transform Mozambique’s financial system and empower women.

Unveiling the invisible barriers to women’s financial inclusion in Mozambique

The 2023 gender norms diagnostic focused on women micro-entrepreneurs and smallholder farmers. The focus group discussions and individual interviews were carried out in Mozambique's Nampula, Zambezia, and Inhambane provinces with women, men and others in the community that influence women's adherence to gender norms, frontline staff from financial services providers (FSPs), mobile money agents, and agent network managers. Interviews were also conducted in Maputo with headquarters staff from various FSPs and supporting function providers like mobile network operators, agent managers, and the Movable Collateral Registry. Recognizing how gender norms shape the behavior of all actors in the financial system is vital, as these norms often become formalized rules that systemically exclude or disadvantage women.

The diagnostic revealed widespread disapproval of women making independent financial decisions. Two dominant norms emerged:

- "Men should be the main financial provider"

- "Women should not have financial privacy from husbands"

These norms significantly influence all market actors contributing to an inequitable financial market system where women have less access and fewer opportunities compared to men. Traditional ceremonies reinforce gender roles, often with the expectation that women defer decision-making, including household financial decisions, to their husbands. As a result, women face risks of violence or abandonment for disobedience, while men fear losing household power. Mothers-in-law often reinforce these gender-based norms.

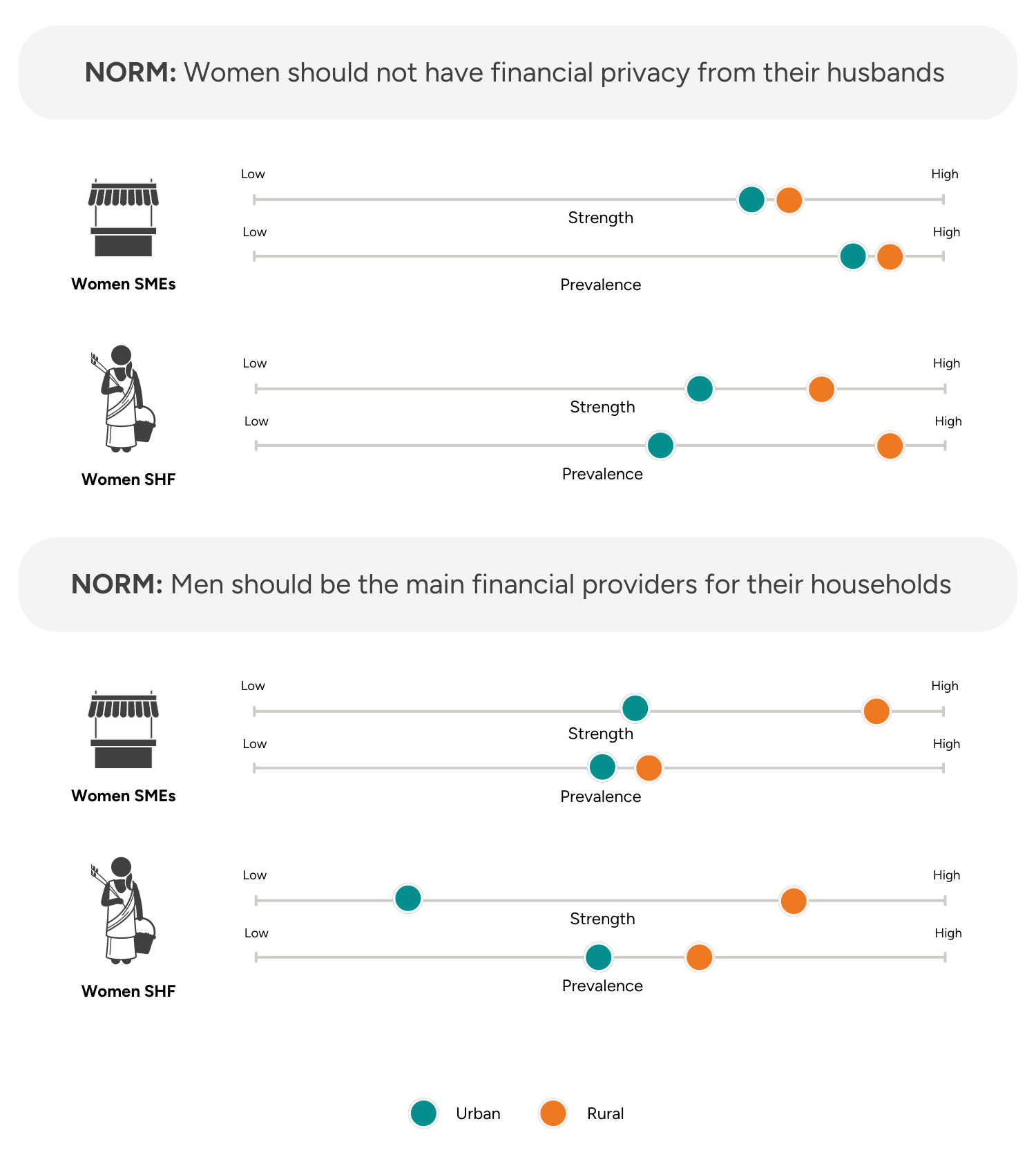

The strength (severity of sanctions for violating norms) and prevalence of these norms vary across different segments of women. The norm "men should be the main financial provider" is equally prevalent among urban and rural women smallholder farmers but stronger for rural micro-entrepreneurs (See Figure 1). The research showed that urban men are more open to joint financial decisions, although women underestimate this willingness, presenting an opportunity for correcting the misperception. The norm “women should not have financial privacy from their husbands” is highly prevalent but is slightly stronger for the two rural segments (rural women SHF and micro-entrepreneurs). Due to the severity of sanctions for violating this norm, such as male abandonment or domestic violence, it's advisable to work around it to avoid triggering serious repercussions.

Figure 1: Understanding how gender norms shape the behaviors of different segments of women in Mozambique

Gender blind spots in the financial system

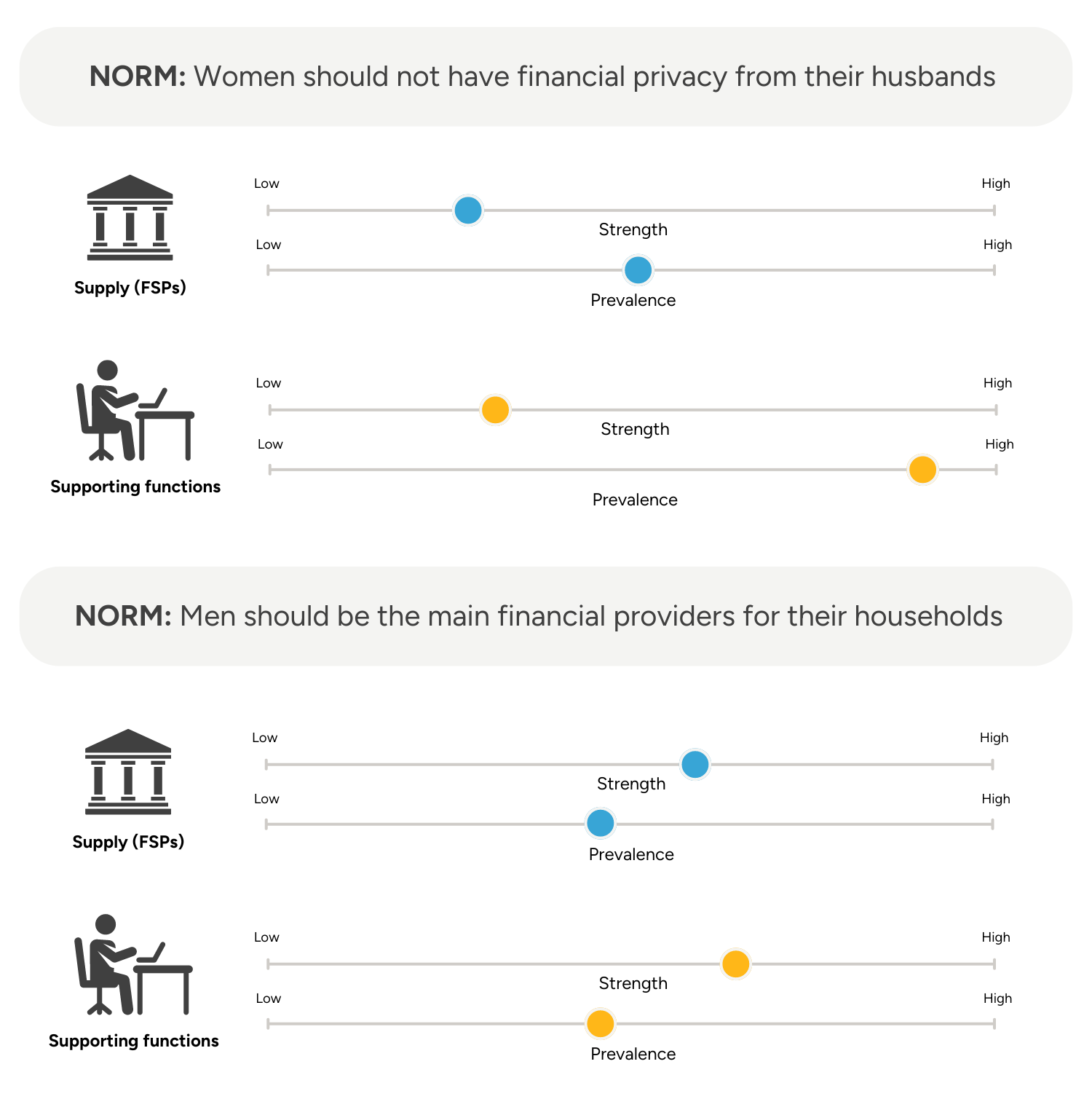

Gender norms affect FSPs and other market actors' perceptions and behavior (See Figure 2). Staff often assume men control household financial decisions, which results in deprioritizing women customers. The research found that FSP staff perceive women micro-entrepreneurs as less skilled, riskier clients, and lacking decision-making power leading to discriminatory practices. Many assume their offerings are gender-neutral, thereby ignoring women's specific needs and constraints. Mobile money agents often see women as financially uninformed, lacking in decision-making power, and thus less profitable. Agents who are men perceive women agents as less dedicated to their enterprise despite the lack of any evidence to support this belief, reinforcing gender disparities in the ecosystem.

Figure 1: Understanding how gender norms shape the behaviors of different segments of women in Mozambique

Some actors are willing to address these blindspots, however. Two fintech startups interviewed during the research shared that they plan to target women in savings groups by digitizing savings and differentiating themselves in the market. As newer actors in the financial system, they are open to collaborating with development organizations to develop products that take into account women’s financial needs, preferences, and capacities.

Taking action to address gender norms

The gender norms diagnostic findings provide valuable insights to design interventions that can help address harmful norms and adapt formal financial service offerings for different segments of women. Here are two examples.

Inclusive finance actors can leverage savings groups to tap into new markets with products that consider women’s needs and capabilities

The diagnostic revealed that women in rural Mozambique have lower financial privacy and autonomy compared to their urban counterparts as well as harsher sanctions for violating gender norms. However, women's use of informal channels such as savings groups is more widely accepted by men, particularly in rural areas. FSP staff and mobile money agents in rural locations believe that women micro-entrepreneurs are less skilled and lack decision-making power, and thus do not prioritize products for this segment. This presents an opportunity for inclusive finance actors to leverage savings groups to develop products that will work better for women and to expand outreach to underserved areas. GIZ, drawing on its past experience in Mozambique, is partnering with M-Pesa Vodacom Mozambique – the largest mobile network operator in the country – to expand the M-Pesa Xitique product (a group savings product to serve women MSEs and SHF in rural areas). Since its launch in 2019, the Xitique product has seen significant uptake, mostly in urban Mozambique. Given the findings from the diagnostic around the acceptability for women in rural areas to save through groups, focusing on this market presents an opportunity for M-Pesa to tap into a new segment while ensuring women have access to a product that meets their financial needs while also avoiding sanctions related to women’s use of formal financial services. Other banks in Mozambique have also demonstrated interest in applying the study’s findings to refine their product offering for women as GIZ continues to share the findings.

Gender norms diagnostic findings shape Mozambique's path to inclusive finance

In April 2024, GIZ presented findings from their gender norms diagnostic to over 90 key stakeholders at the Banco de Moçambique, initiating informed policy discussions. GIZ has since joined a gender working group led by the Central Bank, contributing to Mozambique's upcoming National Financial Inclusion Strategy (NFIS) for 2024-2030. Within this group, GIZ has used the diagnostic findings to raise awareness about how gender norms impede women's financial inclusion and proposes actions to address these constraints in the NFIS. Their goal is to translate diagnostic insights into concrete policy measures.

GIZ has also shared the findings with other financial inclusion donors in Mozambique to influence their programming. The diagnostic reveals the need for a holistic approach to intervention design, focusing not only on women but also on the community, market actors, and influencers who shape women's financial decisions. This approach aims to integrate gender norms into program development, ensuring sustainable change that can transform gender norms.

Conclusion

As Mozambique charts its course towards increasing financial inclusion, the insights from the GIZ and CGAP gender norms diagnostic offer a roadmap for transformative change. The upcoming National Financial Inclusion Strategy presents a unique opportunity to embed gender-responsive policies and practices in national policy. Key priorities include developing tailored financial products for rural women, expanding digital services, and fostering partnerships between financial institutions and mobile operators.

By addressing harmful gender norms and adapting services to meet women's needs, preferences, and capacities, Mozambique can create a more equitable financial ecosystem. The challenge now lies in translating these insights into actionable strategies that will empower women economically and narrow the financial inclusion gender gap.

Add new comment