Empowering Small Giants: Inclusive Embedded Finance for Micro-retailers

Highlights

- Financial inclusion for many excluded and underserved micro-retailers is now more possible as newly established B2B e-commerce companies are digitizing the last mile of the fast-moving consumer goods (FMCG) supply chain.

- This Focus Note details several different business models that integrate the last-mile retailer onto digital ordering platforms, providing them with convenience, transparency, and product diversity. Most importantly, these platforms allow micro-retailers to access tailored inventory financing, mainly as buy-now-pay-later products, on reasonable terms.

- The success of B2B e-commerce models in providing inclusive financial services to underserved communities depends on their ability to scale while addressing challenges such as digital literacy, infrastructure, and gender biases. Collaborative efforts are needed to overcome funding constraints and ensure equitable access.

- This Focus Note reviews the fundamentals of the B2B e-commerce business models, with a particular focus on their financial conclusion potential. It draws on research conducted by CGAP over the course of 2022-2024 through in-depth interviews with B2B e-commerce companies, fintech providers and impact investors throughout Africa, Asia and Latin America, as well as from CGAP pilot partnerships with fintechs and related field visits.

Executive Summary

Known by many different names around the world, including duka, kirana, warung and sari-sari, neighborhood convenience stores or micro retail shops are central to the economic fabric in emerging markets and developing economies (EMDEs). By providing incomes to millions of low-income families, and essential goods and services in neighborhoods across the globe, these shops are crucial for the communities they serve. Despite the proliferation of supermarkets in EMDEs (Monzon 2022), the relevance of these smaller retail stores has only grown. Across nearly all emerging markets, they remain the primary channel for fast-moving consumers good (FMCG) sales (Iver et al. 2022). A consumer survey by Flourish Ventures in Brazil, Egypt, India and Indonesia found that 30 percent of customers plan to buy more at their local corner store going forward, and 64 percent plan to continue to buy as much as they do today (Flourish 2022). Unfortunately, despite their importance, these micro-retailers face a variety of economic challenges, with one of the most acute being limited access to finance, especially working capital.

Digitization of the supply chain and B2B e-commerce models have the potential to improve the resilience of micro-retailers.

For decades, the financial inclusion community has grappled with the challenges that traditional financial services have faced in reaching the smallest shop owner, particularly in hard-to-reach geographies. In recent times, the digitization of FMCG supply chains coupled with B2B e-commerce companies provides great promise to potentially transform traditional business paradigms offering a new era of efficiency and connectivity throughout the FMCG supply chain. Importantly, the technology-driven business models being used by these companies can generate transactional data and seamlessly provide embedded financial services to various actors in the supply chain, including the last mile micro-retailers, who have traditionally remained financially underserved or excluded. This publication focuses on the various technology-enabled business models that target micro-retailers and will detail embedded finance, specifically within digitized FMCG supply chains, emphasizing in-house and partnership-based models.

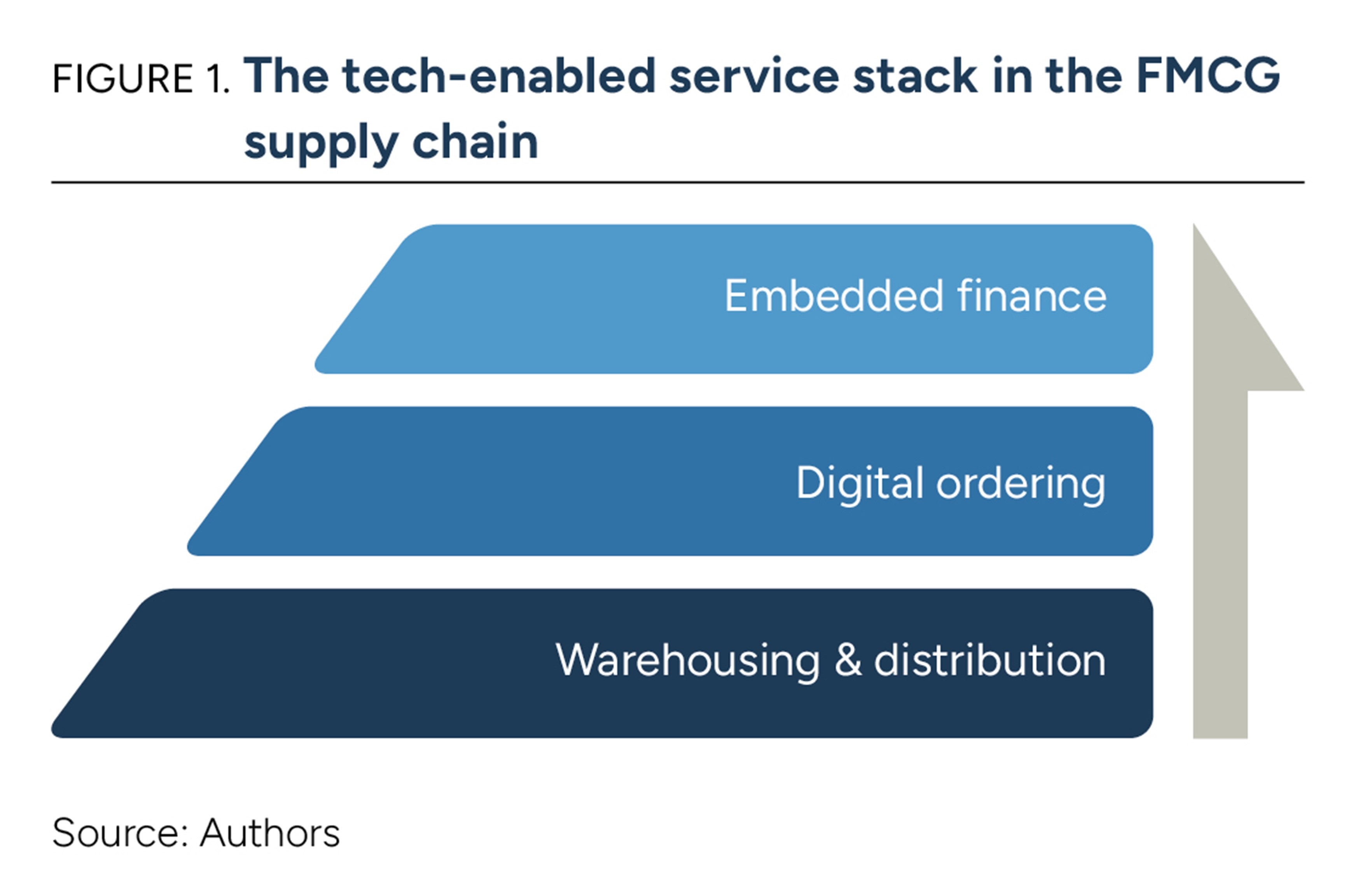

A technology-enabled service stack is at the core of these business models.

The emerging tech-enabled business models can be characterized as offering a stack of services comprising of warehousing and distribution, digital ordering, and embedded finance. Figure 1 shows that each layer in this stack builds on the foundations of the layer below. Individual companies may provide one, two, or all three layers, depending on their selected model. Hence, technology companies can only digitize ordering where product delivery services are already being provided by them or other third parties. Similarly, digital ordering and the data it generates is a pre-requisite for embedding finance – usually buy now pay later (BNPL). The range of services provided by a technology company are therefore partly dependent on pre-existing market conditions.

There is a large variety of ways in which these business models operate. Broadly speaking, the main two categories of models are asset-light and asset-heavy models, with asset-light companies demonstrating a potentially quicker path to profitability.

As it relates to financial inclusion of the micro-retailers, the most significant innovation is the top layer, where financial services are embedded into these models. Financial services can be provided directly by the platform or could be outsourced to a third-party fintech or finance provider. In the latter instance, the platform shares the transactional data for credit scoring and the fintech or finance provider offers credit to the micro-retailers or wholesalers via the platform. While some companies digitize product ordering with the primary intent of embedding finance, others embed finance as a secondary priority as a ‘value-added’ service that improves the loyalty of micro-retailers and helps increase order volumes. Financial services are usually provided in the form of BNPL products that target the short-term needs of micro-retailers, complementing traditional finance mechanisms.

While the potential benefits for micro-retailers are significant, sustainability of these models remains challenging.

Being part of a digital supply chain and having access to B2B e-commerce provides several benefits for micro-retailers. Primary among these is digital ordering and the ability to stock up their shops from the comfort of their home or business, without needing to take time away from income-generating activities. Another crucial benefit is delivered through embedded financial services to meet their working capital needs, allowing them to stock-up and gradually increase their inventory, and hence build a more resilient and stable business.

Embedded financial services are, by their nature, more inclusive than traditional finance which has eluded smaller micro-retailers for decades. Technology-enabled business models have the potential to not only reach underserved and financially excluded micro-retailers, but also do so at a considerably lower cost (see annex 1). The cost of acquiring and servicing a borrowing customer is reduced dramatically, as the customers have already been onboarded into the e-commerce platform. The use of transactional data removes some of the barriers that have prevented traditional providers from extending credit to this market segment. As the financial product is aligned with a micro-retailer’s ordering pattern, delivery is instant, and repayment is aligned with the micro-retailer’s cashflow. The small size and brief tenor also reduce the risk of default, and the risk is further mitigated by an incentive to remain connected to the digital supply chain and all its related benefits.

Although these models show great promise to improve financial inclusion, there is a significant concern around their ability to scale and hence their sustainability. Particularly, against the backdrop of declining valuations and a significantly smaller pool of early-stage investor funds in emerging markets, B2B e-commerce platforms with an uncertain path to profitability are being negatively affected and their survival is under threat.

Challenges to scalability include asset-heavy structures and cost pressures due to high-tech, high-touch models. These pressures make it more difficult to achieve profitability while also maintaining inclusivity, particularly in the short-term.

At the time of publication, CGAP has witnessed several B2B e-commerce startups struggling to keep their operations afloat, leading to lay-offs, country retreats, mergers, and closures. Some of the companies that closed or that are currently in administration have received over US$100 million in previous funding rounds. One is also reported to have reached break-even. The changing funding environment has unveiled several weaknesses and the sustainability of building large, scalable businesses in this sector is now being scrutinized more carefully.

An ecosystem approach is needed to support these models to scale and achieve financial sustainability.

For these models to deliver on their inclusion promise, there is a need for more patient capital in lieu of the more aggressive venture capital; continued support to document the development impact for micro-retailers and research lessons learned; and deeper engagement from the private sector, who stand to benefit from the digitization of the last-mile micro-retailers. As such, CGAP would encourage deeper and coordinated involvement and collaboration among investors, donors, and the private sector to address common obstacles.