Microfinance and COVID-19: Principles for Regulatory Response: ANNEX

Back to Briefing >> |

A SUMMARY OF RELEVANT GUIDANCE FOR REGULATORY RESPONSE (NOT SPECIFIC TO MICROFINANCE)

This Annex summarizes relevant guidance issued by international standard-setting bodies, the World Bank, the International Monetary Fund, and the European Banking Authority. The guidance focuses on the regulatory treatment of debt relief measures, such as moratoria granted by banks to borrowers, and regulatory response measures such as the release of capital buffers. It mainly focuses on the stability of the banking sector and the economic recovery of countries. While the guidance is not designed to cater to microfinance and does not adopt a customer perspective, it is a useful reference. The underpinning principles, including the need to uphold prudential definitions for protecting safety and soundness, are largely applicable to crisis responses in microfinance.

The summary is an amalgam of excerpts from the original documents referenced below. Our intent is to capture and highlight the spirit of the guidance texts rather than to create a comprehensive overview. Any discrepancies with the original documents are the sole responsibility of the authors of this Briefing.

Basel Committee on Banking Supervision and Bank of International Settlements

The Basel Committee on Banking Supervision (2020) has issued guidance on how to consider payment deferrals in assessing credit risk under applicable accounting frameworks to avoid a procyclical approach by banks, for instance, tightening lending policies, which would further exacerbate the COVID-19 crisis.

a. The risk-reducing effect of measures should be recognized in risk-based capital requirements:

- Sovereign risk weight should be used for loans subject to government guarantee.

- Payment moratorium periods can be excluded from counting days past due for classification as a nonperforming asset (NPA).

- Assessment of whether the borrower is unlikely to repay should refer to rescheduled payments (amounts due after the moratorium period ends).

- A borrower’s acceptance of a moratorium or access to relief such as public guarantees should not automatically lead to the loan being categorized as forborne.

b. Extraordinary support measures should be taken into account when banks calculate expected credit losses (ECL):

- Relief measures by public authorities or by banks on a voluntary basis should not automatically result in exposures moving from a 12-month ECL to a lifetime ECL measurement.

- ECL should reflect the mitigating effects of the economic support and payment relief measures put in place.

- Banks should not mechanistically apply the standard and should use the flexibility inherent in IFRS 9.

- Regulatory capital treatment of ECL should follow the amendments to the transitional arrangements.

The Bank of Institutional Settlements (2020) additionally has stated that on one hand, prudential policy needs to support bank lending during the crisis. On the other hand, it needs to preserve the ability of the financial system to contribute to a swift economic rebound. This depends on the availability of usable prudential buffers. Release of buffers can complement and enhance the effect of fiscal and monetary policies if banks are willing and able to expand their balance sheets—a trade-off affected by the extent of risk-sharing with the public sector.

Financial Stability Institute

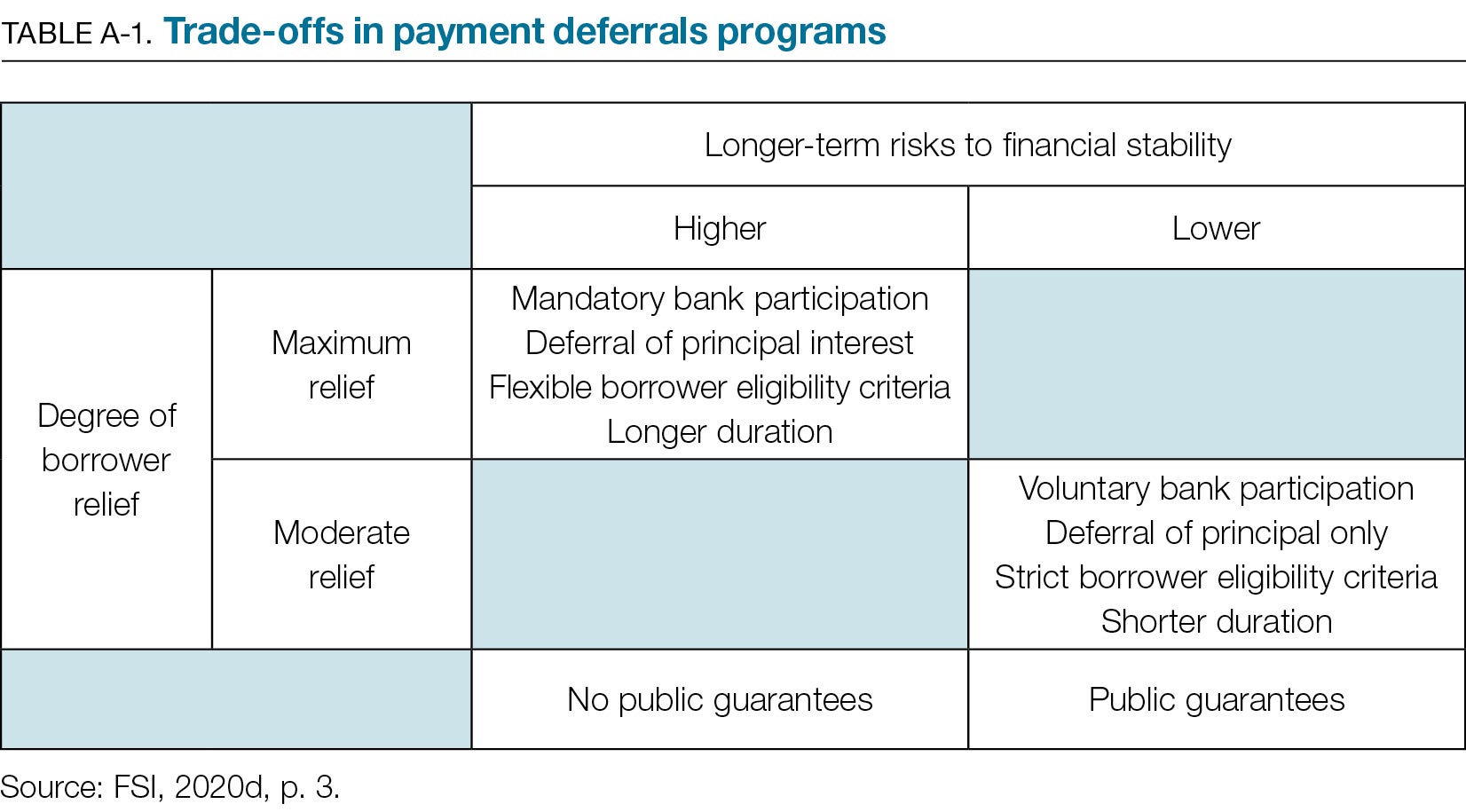

a. General principles for regulatory response (FSI 2020a). See Table A-1.

- Principle 1. Adjustments should be effective in supporting economic activity, at least for the crisis period but ideally beyond, by establishing the basis for a solid recovery. Regulatory policy response should seek to support economic activity while preserving soundness of the financial system and ensuring transparency.

- Principle 2. Adjustments should preserve the health of the banking (financial) system. Banks should remain sufficiently well capitalized, liquid, and profitable to underpin sustainable growth.

- Principle 3. Adjustments should not undermine the long-term credibility of financial policies. From this perspective, adjustments should be (and be seen as) temporary. Transparency is key in meeting this principle.

b. Discretionary payments

- Recommendations that banks make full use of capital and liquidity buffers should go hand-in-hand with restrictions on dividends and bonuses, and clarity concerning the process for rebuilding buffers (FSI 2020a). Supervisory initiatives that provide capital relief should be augmented by severe constraints on the payment of dividends, bonuses, and share buybacks (FSI 2020b).

c. Government guarantees (FSI 2020a)

- Releasing buffers for banks is not enough as they disincentivize banks from lending.

- One disincentive may be a lack of clarity on the supervisor’s expectations, including realistic deadlines for banks to rebuild the buffers used during the crisis.

- Another disincentive is related to distribution restrictions. Adjustments can include a blanket distribution restriction across the banking sector that is unrelated to the size of the buffer.

- Issuing supervisory guidance avoids excessive conservatism concerning assessment of banks’ asset quality, allowing flexible interpretation for reclassification of restructured loans.

- Forms of government credit guarantee—carefully designed to limit moral hazard— are a crucial complement to measures that bolster bank capital.

- Government guarantees are essential, but their design needs to strike a balance between promptly responding to the pandemic and maintaining a sufficient level of prudence. Key features include target beneficiaries, coverage of the guarantee, loan and pricing terms, and program length. Guarantees are subject to operational challenges and fiscal capabilities (FSI 2020c).

d. Guidance for payment deferral programs

- Payment deferral programs must balance near-term economic relief benefits with longer-term financial stability considerations (FSI 2020d).

- Government guarantees reduce the risks of payment deferral programs (FSI 2020d).

- Banks should assess where each borrower falls in the spectrum: solvent and unaffected, solvent but affected (illiquid), or insolvent (FSI 2020d).

- Flexibility in loan classification criteria for prudential and accounting purposes should complement sufficient disclosure on the criteria banks use to assess creditworthiness. A balance between the impact on procyclicality and a transparent recognition of bank asset valuations is needed (FSI 2020a).

- National suspensions of IFRS 9 should be uniform so they do not impair comparability (FSI 2020a).

- Publication of detailed guidance on the application of expected loss provisioning rules, combined with sensible transitional arrangements, may constitute a balanced approach to mitigating the unintended procyclical effects (including on regulatory capital) or the credibility of new accounting standards (IFRS 9) (FSI 2020a).

Joint recommendations by IMF and World Bank staff on responses to COVID-19

a. Use the flexibility in the regulatory and supervisory framework while upholding minimum prudential standards and preserving consistency with international standards.

b. Facilitate well-designed public and private support interventions that target affected borrowers and sectors through timely prudential guidance.

c. Ensure that policy responses minimize opportunities for moral hazard and maintain adherence to sound credit risk management practices while facilitating the effective allocation of new credit.

d. Provide guidance on asset classification and provisioning, building on guidance from standard-setting bodies. Refrain from relaxing the regulatory definition of nonperforming exposure.

e. Maintain transparency and provide, where necessary, additional guidance on risk disclosure.

f. Suspend the automaticity of corrective supervisory action triggers.

g. Review supervisory priorities and maintain close dialogue with industry stakeholders.

h. Actively coordinate with other supervisors, domestically and internationally, and other authorities.

i. Ensure the smooth functioning of critical market infrastructure (IMF-World Bank 2020).

World Bank principles for borrower relief measures (Dijkman and Salomão Garcia 2020)

a. Targeting. Target borrowers whose repayment capacity has been negatively affected by COVID-19 to mitigate moral hazard related to willful defaulters, to avoid extending the life of zombie borrowers and to limit the financial impact on banks. Banks should be given discretion to elect borrowers.

b. Exit strategies. Communicate measures as temporary—to be unwound as soon as circumstances allow and define what this involves. Upfront sunset clauses to revert to prepandemic norms.

c. Supervisory reporting and transparency. Banks should produce reliable, frequent, up-to-date, and comparable information on affected loans, including impact on profitand- loss accounts. Supervisory agencies may pay special attention to the monitoring of such loans.

d. Uphold loan loss classification, provisioning, and accounting requirements. Easing regulatory definitions, even on a temporary basis (e.g., NPLs, forborne exposures, classification, and provisioning) should be avoided as it obfuscates a bank’s true asset quality challenges, undermines market discipline and comparability, distorts the veracity of financial information, and blurs the distinction between borrowers temporarily affected by COVID-19 and zombie borrowers.

European Banking Authority guidance on the treatment of moratoria

The European Banking Authority provided detailed guidance on the application of the definition of default and classification of forbearance in the context of the general payment moratoria applied before September 30, 2020—a timeline which may further be extended (EBA 2020a, 2020b). The guidance defines “general moratoria,” which do not automatically meet the definition of forbearance (for purposes of classification).

a. Definition of forbearance in the current regulatory framework. Financial institutions grant a concession such as a temporary postponement of capital and/ or interest payments of a loan when a borrower is identified as experiencing or likely to experience financial difficulty. Concessions are specific to the borrower’s financial circumstances and the loan. In accordance with applicable requirements, institutions continue to categorize exposures as performing or nonperforming. Extension of forbearance should be considered distressed restructuring, which in turn, is an indication of unlikeliness to pay if it leads to diminished financial obligation.

b. General legislative and nonlegislative moratoria. These moratoria are preventative in nature, not borrower-specific, as they aim to address systemic risk. They should not be considered forbearance as defined above, nor distressed restructuring. Consideration of diminished financial obligation does not apply. Hence, reclassification as forborne exposure is not automatic unless the exposure was subject to forbearance (i.e., classified as forborne or defaulted) prior to the application of general moratoria. In such cases the prior classification is maintained. Treatment of nonlegislative moratoria should be consistent with treatment of legislative moratoria.

c. Specific criteria/conditions that permit general moratoria not to be considered forbearance:

- Moratorium was launched in response to the COVID-19 pandemic and is limited in scope (only applies to specific measures taken in response to the economic situation) and time (announced and applied before September 30, 2020).

- Moratorium is based on national law or on an industry- or sector-wide private initiative agreed on and coordinated within the industry or a material part of it.

- Moratorium is broadly applied by the industry. An initiative of a single institution without industry-wide coordination is not sufficiently broad to benefit from special prudential treatment.

- Moratorium applies to a broad range of obligors:

- A payment schedule is not changed to address specific difficulties of specific borrowers and does not depend on their creditworthiness.

- Moratorium applies to a large, predefined group of borrowers.

- Selection criteria are sufficiently broad, such as specific exposure classes or subexposure classes, a product range, or borrowers from specific regions or industry sectors.

- Moratorium can be limited to performing borrowers who did not experience payment difficulty before the COVID-19 crisis began.Moratoria must not be obligatory for borrowers, but rather based on borrower application. Application assessment must not involve assessment of payment capacity or creditworthiness, and conditions of the moratorium are standardized and available to all borrowers within its scope. Decisions on applications must be made prior to September 30, 2020

- The same moratorium offers the same conditions, although it is possible that different moratoria criteria apply to different exposure segments.

- Moratorium changes only the schedule of payments by suspending, postponing, or reducing principal, interest, or both within a limited time period. This may lead to increased payments after the moratorium or to an extended loan duration. Moratoria should not affect other conditions, such as interest rates, in order to neutralize the impact on present value. Application of public guarantees is not considered a change to terms and conditions. Moratorium does not apply to new loans granted after its launch. Existing credit lines or revolving loans are not considered new loans.

d. Tailor-made measures. When institutions use individual measures or renegotiations that take into account a borrower’s specific situation rather than general moratoria, they need to assess whether the individual measures meet the definition of forbearance. Reclassification is on a case-by-case basis, not automatic. If measures are classified as forbearance and lead to a diminished financial obligation, the borrower should be classified as defaulted.

e. Definition of default. Institutions should count days past due based on a revised payment schedule resulting from the application of general moratoria.

f. Continued assessment of unlikeliness to pay. Institutions are obliged to assess the credit quality of exposure even with moratoria not classified as forbearance. This helps identify situations where borrowers may face longer-term financial difficulties and classifies them according to standard rules, including the definition of default. The existence of risk mitigation should not exempt an institution from performing assessments as these evaluations do not affect a borrower’s payment capability. Institutions should use their normal policies to regularly review indications of unlikeliness to pay in a risk-based manner. When verification is manual rather than automatic, institutions should prioritize borrowers most likely to experience difficulty. The following cases should be given priority at the end of a moratorium:

- Borrowers experiencing payment delays shortly after the moratorium ends •

- Forbearance measures that apply shortly after the moratorium ends

g. Reporting and public disclosure. In June 2020, EBA issued reporting and disclosure requirements for exposures that were subject to measures applied in response to the COVID-19 crisis (EBA 2020c). Since these payment holidays did not change the preexisting classification of exposures they are not captured in the supervisory reporting framework. Such frameworks ask for additional reporting requirements for supervisory purposes and call for specific guidance on public disclosure for purposes of market discipline and transparency. The requirements noted below are expected to be in force for 18 months beginning June 2020, with semi-annual reporting. The guidelines comprise a set of templates subject to the principles of proportionality and supervisory flexibility when applied by the European national authorities. The templates are divided into:

- Reporting requirements that monitor the use of payment moratoria and the evolution of the credit quality of exposures

- Disclosure requirements for exposures subject to payment moratoria

- Reporting requirements for new loans subject to specific public guarantees set up to mitigate the effects of the crisis

- Disclosure requirements for new loans subject to specific public guarantees set up to mitigate the effects of the crisis

- Reporting requirements on other forbearance measures applied in response to the crisis

To view full list of references, please see PDF.

Back to Briefing >> |