Supply-Side Gender Disaggregated Data for Advancing Financial Inclusion: Insights and Areas for Further Research

Highlights:

- Financial Supply-Side Gender Disaggregated Data (S-GDD) holds tremendous potential to support strategies to improve women’s financial inclusion and agency.

- Yet S-GDD collection and use remain suboptimal across the board. Many stakeholders remain unaware of this potential and/or do not know how to harness it cost-effectively and safely.

- To date, no ideal or standard set of best practices has emerged for collecting and using S-GDD in the financial sector.

- To unlock the potential of S-GDD, a systematic and collaborative effort is needed to put S-GDD frameworks in place that effectively align the incentives of the different market actors. To lead this effort, authorities need clear guidance.

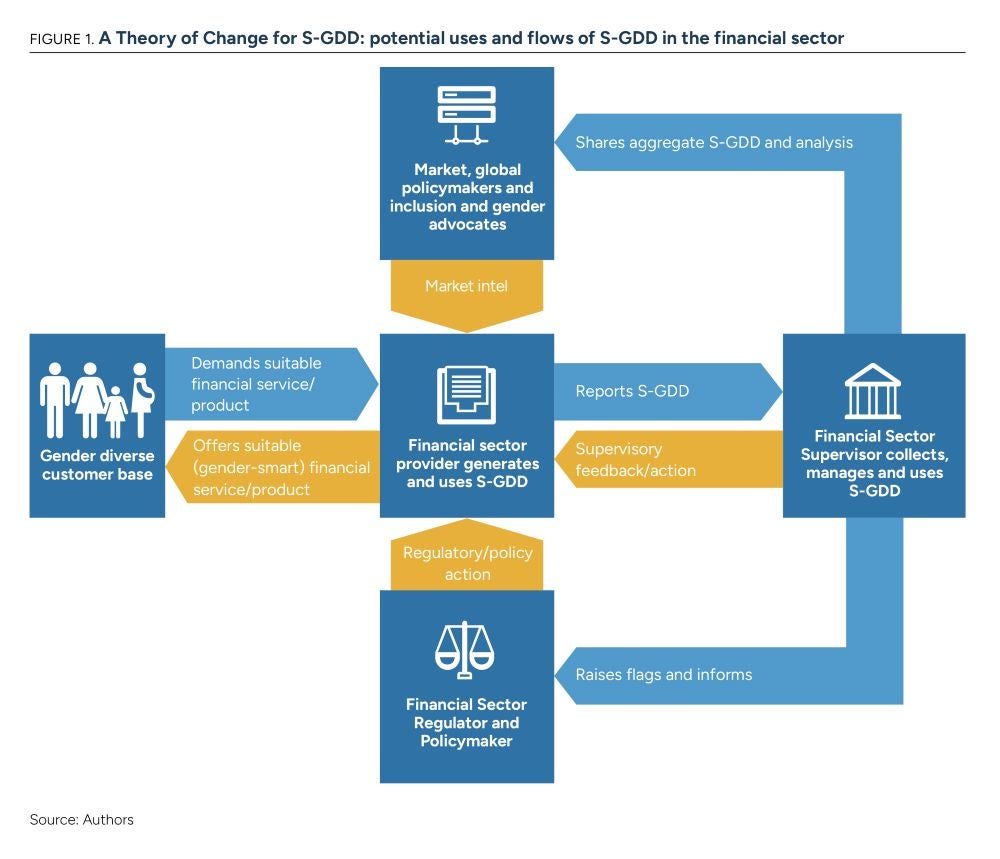

- Using the guidance (or parts of it), authorities would be able to start a virtuous circle whereby the financial supervisor collects the right S-GDD, that is then used and shared with key public and private stakeholders (FSP, supervisor, regulator, policymaker, funders, and investors) to support better strategic decision making and market intelligence.

Executive Summary

The gender gap in financial inclusion continues to be unacceptably high in most developing countries, highlighting the need to prioritize policies that promote gender equity in the financial sector more effectively. Policies must be informed by high-quality gender-disaggregated data (GDD) generated from both the demand side and supply side of the market. Gender data is also essential for financial service providers to understand the market opportunity for serving women and to build strong business cases for designing products and services tailored to women’s needs.

The financial inclusion community has supported the gender data agenda since the early 2010s through several global initiatives and country-level efforts. These efforts range from raising awareness about the need for and potential benefits of gender-disaggregated data in the financial sector, documenting countries' experiences in collecting and using such data, developing gender data toolkits for regulators, sharing lessons, and advocating for the collection and use of gender data to promote women’s financial inclusion. While these initiatives have contributed to a notable increase in the availability and use of gender-disaggregated data in the financial sector, especially on the demand side, significant gaps continue to exist in the generation and, especially, in the use of administrative (supply-side) data.

This paper examines these efforts, focusing on supply-side gender-disaggregated data (S-GDD) initiatives. It explores how S-GDD has been collected and used, mainly by financial sector authorities but also by providers, and the challenges and opportunities associated with this work. It highlights lessons to date, identifies existing gaps, and proposes next steps for future work to unlock S-GDD’s potential to support women’s financial inclusion and economic empowerment.

The first key lesson is that there is no ideal or standard set of best practices guiding countries toward collecting and using S-GDD in the financial sector.

The research has revealed significant differences across countries regarding the departure point, the motivations and goals, and the approaches used to collect and use the data.

- The motivations for each country to start collecting and using S-GDD vary greatly. Several countries were encouraged to capture S-GDD by global initiatives targeting financial authorities (such as the International Monetary Fund’s Financial Access Survey (FAS) and the Alliance for Financial Inclusion’s Denarau Action Plan). In other cases, a strong culture of data-driven, evidence-based policy making, as well as strong-willed and committed gender data champions with influential roles in the financial sector, was critical to launching S-GDD collection efforts (for example, Rwanda and Zambia). [EF1] [DD2] In some countries, S-GDD efforts were prompted by the desire of policy makers and regulators to address financial gender gaps revealed by data from demand-side studies (for example, Nigeria and Rwanda). The development of national strategies with explicit targets to reduce gender gaps in the financial sector has also strongly incentivized authorities to start collecting S-GDD (for example, Pakistan). In a few countries, broader national-level gender equality objectives trickled down to the financial inclusion agendas and prompted the collection of S-GDD in several sectors, including the financial sector (for example, Chile and Mexico).

- The gender variable is usually (but not always) generated by providers at the onboarding (Know Your Customer (KYC)) stage, using an ID or similar identification document when these exist, and reported to the supervisor along with all relevant administrative data. In many countries, S-GDD is collected by including a gender variable in the mandatory regulatory reports, whether granular, aggregate, or both. In a few cases, authorities have sought to engage providers to share S-GDD on an ad hoc or voluntary basis (for example, Honduras and Kenya). Where available, a national identification system contributes significantly to the authorities’ ability to disaggregate data by gender without having to update financial reporting templates (for example, Brazil, Chile, Costa Rica, Egypt, Malaysia, and Rwanda). Some authorities collect granular data from the supervisees (customer microdata), whereas others request aggregate series (for example, number of deposit accounts by gender). When published, S-GDD is presented in aggregate form (system level, by product, by financial service provider (FSP)). Data collection for business accounts is mostly done for sole proprietorships who run the business in their own names, rather than including women-owned micro, small, and medium enterprises (MSMEs).

- Authorities tend to collect S-GDD for retail accounts, typically credit variables, given its significant role in financial development and supervision. S-GDD on credit may include the number of borrowers and accounts, the volume of outstanding balances, and conditions (such as price or collateral required). S-GDD on savings is often limited to aggregate indicators of deposit volume and number of accounts, mainly because of concerns regarding compliance with banking secrecy laws that forbid providers to share individual data for deposits other than at the account level. At the global level, the International Monetary Fund’s FAS has gathered S-GDD indicators from 83 countries, with ongoing efforts to expand country and series coverage further.

- Authorities typically use S-GDD to assess the financial gender gap, inform gender inclusion or diversity strategies and policies, and monitor progress. In countries with more experience gathering S-GDD (such as Bangladesh, Chile, Ecuador, India, México, Rwanda, and Zambia), insights from data have been used to develop gender-informed policies, guidance, and products (with different degrees of traction) and to understand gender gaps in financial inclusion further. Several countries have used S-GDD to set financial inclusion objectives or gender diversity targets as part of their national financial inclusion strategies or specific gender strategies. Some regulators have used the data to produce publicly available data and mainly reports to raise awareness, build capacity, and promote collaboration and consultations among key stakeholders (for example, Bangladesh, Chile, Ecuador, Ghana, Honduras, Mexico, and Morocco).

The second key lesson is that, despite considerable progress in S-GDD availability, the collection and use of S-GDD is suboptimal.

This is due to low data quality and suitability, lack of awareness, mandate or capacity, and data privacy concerns. The lack of relevant public data generates a lack of awareness by both authorities and providers about S-GDD’s potential. On the other hand, the lack of awareness about the value of S-GDD and guidance to collect and use it effectively minimizes the incentives or ability to do so in the first place.

- Inconsistencies, errors, and missing information. There is consensus about the attributes that data, including S-GDD, should have to be useful and impactful (such as robustness, reliability, quality, comparability, cost-effectiveness, and relevance) (World Bank 2021c). In many cases, these conditions fail to prevail in existing schemes. Issues mainly arise when:

- Different supervisory authorities require S-GDD using different KYC and standards (for example, definitions for gender categories and types of transactions), formats, or timelines.

- The gender field had not been traditionally requested, and there is no identification system to help update it.

- Data are gathered and processed manually (either by reporting entities or financial authorities).

- Data are generated with errors by providers’ staff due to issues such as lack of data skills and siloed internal databases.

- There is a lack of understanding of the data standards imposed by financial authorities, due to issues such as a lack of detailed reporting guidance.

- Data are submitted late or are incomplete.

- The gaps regarding the scope of available S-GDD also pose serious limitations to providers’ and authorities' use. For example, gender-disaggregated indicators for account dormancy, loan delinquency rates, or credit conditions are generally not requested by regulators. Still, such information, when reported on a timely basis and with standardized frequency, can help both regulators and providers to better understand how well products are used, identify risks and opportunities, and assess whether products are providing value to customers. Also, the lack of publicly available industry or market-level S-GDD, both at the individual and women-owned small and medium enterprises (WSME) level, means that providers cannot see the full scope of women’s activity in the financial system, which hampers their ability to both identify pockets of risk and new business opportunities in serving women. Finally, the use of S-GDD by financial supervisors to monitor and address market (mis)conduct putting at risk both consumers and the system's stability is almost nonexistent despite the high vulnerability of women and their key role in preserving financial resiliency at the household level.

The final, and definitive, key lesson is that to unlock the S-GDD potential to contribute to women’s financial inclusion and women’s economic empowerment (WEE), a more systematic approach toward effective ways to collect and use S-GDD is needed, in the form of guidance.

When powered by adequate incentives, capacity, and collaboration, S-GDD frameworks can deliver the high-quality data required to assess the risks and opportunities of targeting women and design a strategic response to the findings, be it at the funder, policy, supervisory, or business levels. While there is no agreed definition of an “ideal” S-GDD framework, some features stand out from the literature. These include having champions, producing data with sufficient quality, embracing a customer-centric approach to design and analyze data indicators, promoting data sharing and collaboration across stakeholders, and seeking proportionality in the data requirements. Other qualities that merit attention include sustainability and efficiency (the incentives of the different stakeholders are well aligned, and the system’s resources are used optimally), flexibility (the framework is tailored to the country’s needs and capabilities), safety (data is protected and used in safe ways), and effectiveness (data is used in impactful ways). Several useful tools are already available to guide stakeholders at different steps along the S-GDD process (see Appendix), but holistic guidance is needed to help authorities design and implement S-GDD frameworks that can generate, analyze, and use relevant S-GDD in effective, safe, and impactful ways.

The new guidance should be flexible and scalable across countries and must rest on a robust conceptual framework that can align incentives by leveraging strong use cases, adequate S-GDD indicators, and effective collaboration mechanisms. A clear theory of change should articulate how adequate S-GDD can catalyze a positive market reaction toward serving women in effective, safe, and impactful ways (Figure 1). For the guidance to be flexible and scalable across countries with different objectives, settings, and capabilities, it should be outcomes-oriented and focused on ensuring that the S-GDD framework delivers results aligned with the intended objectives, rather than prescribing specific methods, formats, or tools. These good results include delivering adequate data and using them to achieve the intended objectives, including informing decisions and monitoring progress. Whether authorities mandate or incentivize providers to cooperate, it is likely that S-GDD collection and application will be more sustainable in a collaborative ecosystem that supports the goals and objectives of all players. This should also include agreements on data sharing among various government agencies and supervisors. Finding common ground to align the incentives of all stakeholders from the outset of an S-GDD initiative will, therefore, be essential.

Another key area where the new guidance could bring value is developing gender-sensitive financial indicators to measure financial inclusion or to help regulators and supervisors fulfill their mandates for all individuals, including the most vulnerable ones. The S-GDD needs to transcend the traditional focus on data about access and basic usage of accounts (for example, outstanding amounts, dormant accounts) and adopt a more customer-centric approach that measures the immediate outcomes of responsible financial inclusion for women (for example, percentage of loan rejections by gender, average credit conditions by product category and gender) and therefore for providers (for example, default rates or number of complaints), as well as measures of financial health and, ideally, longer-term development outcomes of financial inclusion. Using advanced (outcomes-based) S-GDD indicators, providers might decide that reviewing the eligibility criteria for certain products, such as a basic account, is warranted to facilitate women’s uptake and participation. They might also want to review some decision processes for credit allocation or the protocols for complaints handling to ensure that women are not discriminated against by men. With the same indicators, supervisors might decide whether to take corrective action if it is found that women are being discriminated against by a particular provider or across the board. And might even decide to adopt (or recommend adoption of) new or revised measures to prevent discrimination practices, including by setting inclusion targets, generating public awareness about the situation through public data or reports, providing financial education to women, or incentivizing providers or women to participate in the market by adopting risk-sharing schemes.