|

Vodacom Tanzania was quicker than most mobile money providers to realize the significance of the merchant payments space for the future of its business. As early as 2014, the East African mobile network operator had already been experimenting with merchant payments for some time and went to market with its product Lipa Kwa M-PESA (Pay by M-PESA). Vodacom was convinced of the importance of this initiative, even as it recognized the many challenges to getting it to take off.

The concerns proved well-founded. By mid-2015, 40,000 merchants had been signed up for the new service, but only 1 percent of these were active and seeing transactions. The rest had tried it for a few transactions, often on a single day, but then gone dormant. The merchants who did remain active seemed to find the service useful: many transacted daily, even if at small amounts, while others transacted weekly, but at larger values. But clearly, it was not going to be possible to build a sustainable business on such a small scale—particularly in the field of merchant payments, which is all about presence, network effects, and critical mass. The Vodacom needed to understand what was working, what wasn’t, and what changes to the offering could set it on a path to growth and success.

To do that, Vodacom partnered with CGAP on two consecutive action research initiatives combining quantitative analytics with ethnographic research and human-centered design. By applying a strong customer-centric lens, researchers approached merchants and their clients as two distinct sets of consumers of the product, with different needs, preferences, and issues. A research team from the business management consultancy Dalberg spent a few weeks in the field, hanging out in markets, stalls, and tiny shops, observing and talking to traders, hairdressers, pharmacists, and vendors of everything from plumbing supplies and welding equipment to groceries and used mobile phones.

Their insights were revealing. Both merchants and their customers thought the product was fine in principle—it just didn’t really solve any problems for them. While they could see a few advantages in using Lipa, these weren’t all that significant and were outweighed by the unfamiliarity, clunkiness, unreliability, and above all cost of using the service. Using cash as they had always done was simply easier—and less expensive. So why should they switch?

Moreover, because Tanzania has one of the most intensely contested mobile money markets in the world, just signing up with the dominant provider meant that a merchant could expect to transact only with every third mobile money user. Again, this significantly undercut the value of the offering: why go through the trouble and expense of implementing a new system if merchants could only ever hope to use it with one-third of their customers? And on the flip side, why should customers want a product they can use in only two out of three shops? (On top of this, only a small number merchants accept digital payments.)

In response to these insights, Vodacom made several fundamental changes to the business model—staking out a new strategic direction on merchant payments. The new approach places greater emphasis on creating a compelling value proposition, rather than simply assuming that users will adopt digital payments because it is somehow inherently better than cash. More importantly, it takes a medium-term view of profitability, recognizing that the real objective is a significant shift away from cash toward a fully digital payments ecosystem—and that a short-term focus on transaction fees may directly prevent that from happening.

The first change was to remove transaction fees for both merchants and their customers. This recognized how difficult it is to compete with cash, which is perceived as free to use. Charging a fee for digital transactions had effectively created an obstacle to the very behavior that they were trying to encourage. Vodacom decided that its merchant payments strategy was about scale, ecosystem synergies, and the long-term game. From that perspective, Vodacom realized that it may be necessary to leave money on the table today to build a market that creates far larger opportunities tomorrow.

The change paid off. In the three months after fees were removed, average transaction volumes rose by 136 percent and values rose by 120 percent compared to the three months before. For more on why transaction fees are problematic in merchant payments, see “Don't Charge Transactions Fees, Particularly on Customers.”

The second change was to make payments interoperable with other mobile money providers. After realizing the challenges of building sufficient critical mass of both merchants and end users, Vodacom again decided in favor of a longer-term approach. By allowing its merchants to accept payments from other networks, Vodacom could double or triple the user base of its new business and bolster digital transaction volumes for its merchants. More importantly, by recognizing the mutual self-interest in pulling together to generate a critical mass of users, it could partner with competitors around a win-win strategy to grow the entire market rather than compulsively defend its own small and stagnant share.

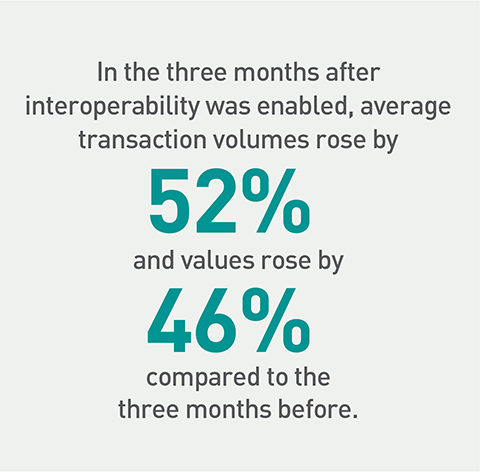

This shift was also rewarded. In the three months after interoperability was enabled, average transaction volumes rose by 52 percent and values rose by 46 percent compared to the three months before. For more on the importance of interoperability in merchant payments, see “Interoperability Should Be Part of the Approach from the Outset.”

The third change was to introduce loyalty rewards for merchants and customers. While removing transaction fees helps to make digital payments no worse than using cash, that alone does not make them better than using cash. One area where digital payments can shine and cash struggles to compete is loyalty rewards. Vodacom deployed loyalty rewards in different ways to promote use of digital payments at particular merchants, including offering 10 percent cash back to customers at certain stores and giving free popcorn to moviegoers who pay with Lipa. The rewards scheme proved effective. Vodacom saw 36 percent higher total value transacted at merchants during the cash back offer. For more on how to deploy loyalty models in retail payments, see "Loyalty models can create value for consumers".

The fourth change was to deliberately integrate with merchant distribution chains. The research clearly showed that winning over merchants requires a stronger value proposition than “fixing cash,” because cash in retail isn’t broken—it works just fine for all involved. But interviews with merchants had revealed several pain points that they experienced in the day-to-day running of their business.

Vodacom chose to address some of those points to build a more compelling value proposition. A prime target was restocking inventory because merchants spend a lot of their time and revenue on this. By digitizing payments to suppliers, Vodacom could not only ease that process, but it could also create an immediate and powerful use case for the digital money merchants collect from Lipa customers. This approach resonated with merchants.

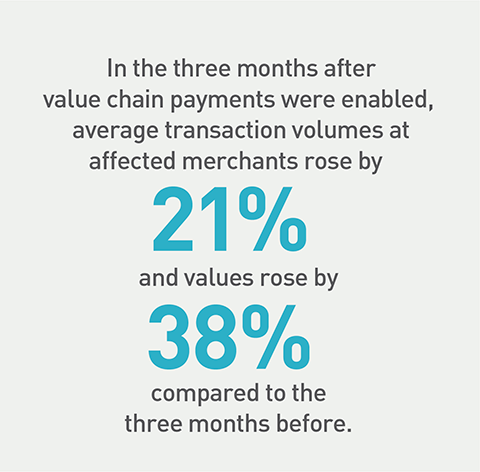

In the three months after value chain payments were enabled, average transaction volumes at affected merchants rose by 21 percent and values rose by 38 percent compared to the three months before. Value chain payments became a key differentiator in the market. Vodacom is now partnering with big, fast-moving consumer goods companies to drive the growth of a cashless society. For more on the role of value-added services to get merchants on board, see "The real value for merchants lies beyond payments".

The fifth change is real-time settlement to bank. One of the frustrations merchants often cite with digital payments is that the funds collected are stuck in an electronic wallet, whereas they typically need the funds in cash or in the bank to pay staff and suppliers. As outlined above, one key way to address this frustration is to enable supplier payments directly from the wallet. Another way is to ensure that merchants can settle to their bank accounts in real time whenever they want. This gives merchants the ability to manage their money with the greatest flexibility and the least frustration.

The result has been a turnaround for Vodacom Tanzania’s merchant payments business. While only a minority of the 30,000 registered merchants are actively driving the business, transaction volumes have grown by a factor of five year-on-year to $40 million per month in 1 million transactions. Vodacom now has 500,000 unique customers who make at least 10 transactions a month using Lipa. While there is still a long road ahead to usher in a cashless economy, Vodacom has been able to demonstrate what works and lay a solid foundation on which to build the future.