10 Insights on Financial Inclusion from the 2014 Global Findex

How many adults in the world have a bank account? How do people save, borrow, and manage financial risk? How is mobile money shaking up the financial inclusion world? These are the sorts of questions we can answer with the newly released 2014 Global Findex. The database covers 800 indicators and draws from survey data covering almost 150,000 people in 143 economies. We present 10 takeaways we think you should know:

1. Account ownership is increasing almost everywhere in the world. 700 million adults (above 15 years old) worldwide became account holders between 2011 and 2014 (accounting for a population growth of 200 million). Worldwide, account ownership increased to 62%in 2014, up from 51% three years ago (including one percent of adults that use only a mobile money account and do not have an account at a financial institution). In high-income OECD economies, account ownership is almost universal, at 94%; in developing economies, 54% of adults have an account.

2. The gap between rich and poor in account ownership is shrinking – but still persists. In developing economies, 46% of adults living in the poorest 40% of households have an account – up from 29% in 2011. Meanwhile, 60% of adults living in the richest 60% of households have an account. A significant gap still separates these groups, but it has decreased by six percentage points since 2011.

3. The gender gap in account ownership isn’t significantly narrowing. In every region, the number of women with an account has increased compared to 2011. Yet, the gender gap hasn’t budged. In developing countries, 59% of men have an account—compared to 50% of women. The gap in account ownership between men and women is unchanged from 2011. That being said, the extent of the gender gap does vary across regions; from four percentage points in East Asia and the Pacific up to 18 percentage points in South Asia.

4. Mobile money is transforming Sub-Saharan Africa’s financial inclusion landscape. Sub-Saharan Africa is the global epicenter of mobile money accounts. Worldwide, just two percent of adults use a mobile money account, compared to 12% in Sub-Saharan Africa. There are only 13 countries in the world where more than 10% or more of adults have a mobile money account, and Sub-Saharan Africa is home to all of them. East Africa – where 20% of adults have a mobile money account, and 10% have a mobile money account only (no bank account) – leads the continent. Digital payments made through these accounts have benefitted groups that were long excluded from the formal financial system, such as farmers.

5. In a few countries, mobile money accounts are more common than financial institution accounts. Mobile money accounts are still pretty rare outside of Sub-Saharan Africa, but in five Sub-Saharan African countries -- Cote d’Ivoire, Somalia, Tanzania, Uganda, and Zimbabwe -- more adults have a mobile money account than an account at a financial institution. Kenya has the world’s highest share, at 58 percent, followed by Somalia, Tanzania, and Uganda, with about 35% each.

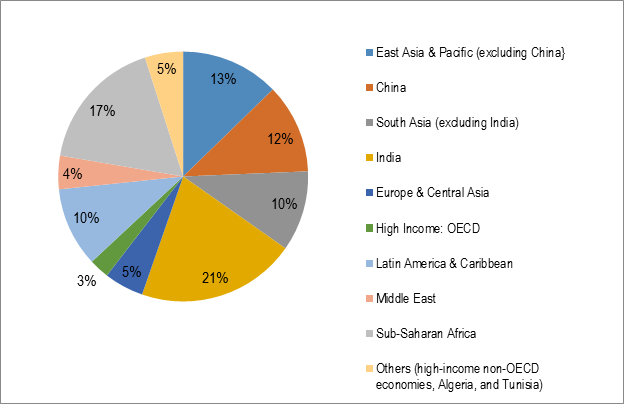

6. 2 billion adults are still unbanked – most in East and South Asia (including India, China and the Pacific). Thanks in no small part to new technologies, bold government reforms, and ambitious business models, the number of unbanked adults has dropped from 2.5 billion in 2011.

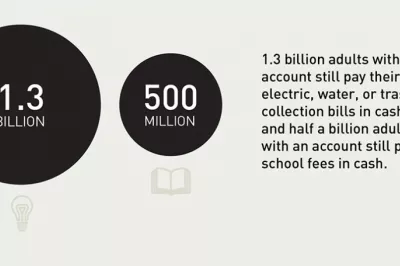

8. 1.3 billion account-owning adults still use cash to pay utility bills. In addition to account ownership, the 2014 Global Findex measures the ways people use their accounts to make and receive payments. For example, in developing countries, 56% of adults make utility payments – but almost 90%use cash to do so.

7. Hundreds of millions of people could join the formal financial system if governments and businesses made payments into accounts instead of in cash. The Global Findex data point to several big opportunities to help the unbanked get access to financial services. Globally, shifting government wages and transfer payments from cash into accounts could increase the number of adults with an account by up to 160 million; doing the same for private-sector wages could increase the number by up to 280 million.

9. In developing economies, most people who save money don’t use an account to do so. In high-income OECD countries, about 70% of savers keep their savings at a bank or another financial institution, compared to about only 40% of savers in developing economies. A common alternative in developing economies is to save using a person outside the family or a semiformal savings club, including rotating savings and credit associations (ROSCAs). ROSCAs operate by pooling weekly member deposits, which are generally kept in some community member’s home, and disbursing the entire sum to a different member each week. Such practices are especially common in Sub-Saharan Africa, where 40% of savers use semiformal methods. About 46%of savers exclusively use other ways of saving – such as stuffing cash under the mattress, or saving in the form of jewelry, livestock, or real estate.

10. Almost 75% of adults in developing countries report they could come up with money for an emergency within a month. The 2014 Global Findex tries to better understand how people around the world would respond to unexpected expenses equaling about one-twentieth of per capita income [$2,600 in the US]. About 1.2 billion adults (28% of adults) in developing countries report they would use their savings in case of an emergency. Yet 56% of these adults do not save at a financial institution. Keeping these emergency reserves in cash presents a real risk that the money won’t be there when needed.

Comments

It is exciting to see how

It is exciting to see how institutional finance is expanding and especially mobile money. At the same time informal and semi formal ways of saving and borrowing predominate and the majority of the 40% who have savings accounts scarcely use them. ROSCAS, ASCAS, Savings Groups, Self-Help Groups and storing assets in the form of animals, grain and jewelry are doing the heavy lifting of cash management in poor countries as these statistics clearly show. After all in ROSCAS, ASCAS and Savings 100% are actively saving and the great majority are actively borrowing as they develop solidarity, mutual support ("virtual insurance") and financial management skills. Since this is where the action is wouldn't it be prudent to invest resources into understanding better how these groups work and spread and explore ways to lower the cost of saving group promotion? Least you believe that informal money management disappears in rich countries immigrant ROSCAS are alive and well throughout America and may be the major means of business financing in poor communities. How could this creativity be used to develop locally managed institutions that benefit the poor? Banks, MFIs and mobile money are all important but understanding and tapping into the creative energy of untold millions of grassroots villagers and slum dwellers who are working to better the lot of their neighbors by organizing and managing their own mini-financial institutions is important as well. See "In Their Own Hands: How Savings Groups are Revolutionizing Development" www.intheirownhands.com

Add new comment