From More Accounts to More Account Activity in India

At the launch event of India’s now world famous financial inclusion scheme, Prime Minister Modi shared a story. As a child he was part of an account opening drive by a public sector bank in his village. He never had enough money to really use the account. As the account remained inactive, the banks chased him down well into adulthood to close it. “There was a time when banks chased you to close accounts,” Modi said, leaning over the podium as he stared into the gathering of government officials, business leaders, donors, journalists and others handpicked to attend the launch of his eponymous financial inclusion scheme, “now we will make banks chase you to open them.”

And so it began, an extraordinary and fast moving drive to open millions of accounts, with mainly India’s public sector banks out front being pushed and goaded into action by the Ministry of Finance, the Prime Minister’s Office and the Prime Minister himself. Over 18 million accounts were opened in the first week through at least 80,000 special account-opening camps, earning the scheme a world record. As of last month, an estimated 147 million accounts have been opened, twice the target originally set by Modi. It is unclear exactly how many are truly first time bank customers but early studies suggest that it might be the majority.

The full effect of Modi’s push is not likely to be captured in the latest Global Findex report which has found that India has advanced on broad financial inclusion measures nonetheless. Account penetration in India grew from 35% to 53%, meaning that an additional 175 million adults in India become account holders between 2011 and 2014. India and China together account for half the 700 million new account holders globally as reported by the latest figures from Findex.

Even as India moves aggressively to close the financial inclusion gap, the picture of financial inclusion in that country as captured in the latest Findex report reminds us that we have a long way to go:

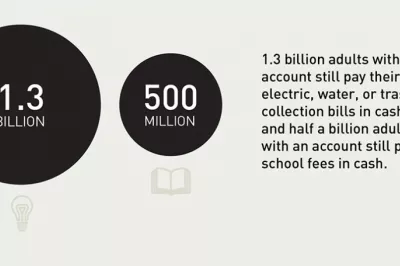

- Despite growth in penetration, India has both the lowest account penetration and lowest use of account for payments among all BRIC countries. Just 15% of adults report using an account to make or receive payments, compared to about 40% for Brazil and China and over 50% for Russia and South Africa.

- While India’s growth in account penetration did not vary substantially across different demographic groups , 18% growth is evenly reflected across all groups between 2011 and 2014; women, youth and and the poorest 40% still lag behind overall. Account penetration grew to 43-44% for all three groups compared to rougly 60% for men, adults age 25 and older, and the richest 60%.

- India has one of the highest dormancy rates at 43%, accounting for about 195 million of the 460 million adults with a dormant account in the world. This contributes to a high dormancy rate in South Asia as a whole which has double the average dormancy rate across all other development regions and eight times the dormancy rates in high-income OECD economies.

Prime Minister Modi’s scheme aims to change that picture in one notable way. There is an attempt to take aim at dormancy and figure out ways to make sure accounts are truly the beginning, not the dead end they have been. The first step is to make it possible for people to receive their government benefits in that account so accounts are not all zero balance and there are transactions taking place. According to the latest data from the government, zero balance accounts have gone down from 77% in September 2014 in the early days of scheme to 58% in April 2015, attributed largely to the introduction of the first digitized government scheme, one of the largest in the world. The accounts are the foundation of other financial services including an overdraft facility and insurance schemes that financial providers are expected to provide. The overdraft facility is linked to transaction activity on Rupay cards, which the government claims has been issued to close to 90% of account holders, although, as critics note, the point-of-sale network to use them barely exists. Later this month, Prime Minister Modi is expected to do another official launch of two insurance schemes first made public in the Finance Minister’s budget speech a couple of months back.

There are other changes taking place to the financial inclusion landscape in India. If those efforts add up, India is likely to show gains in both accounts and account use in the next Findex report. In the meantime, hopefully, Prime Minister Modi is as effective at making banks chase customers to use those accounts as he has been to get them to open them in the first place.

Comments

All the good work done in

All the good work done in enrolling 140+ million persons into the PMJDY is about to go to waste. Very quickly. As indeed the previous FI schemes have. The promises and the ground swell created would go create a wave on negativity.

It doesn’t take a genius to figure that PMJDY’s success is preconditioned on propagation of branchless banking, which requires qualified and economically motivated business correspondents (BCs) managed by BC network managers (BCNMs) on one hand, and interoperability on the other coupled with recognition for self-regulation. And all these must operate under the artillery-cover of sustained advertising and on-ground promotions done by Government of India.

Government expects BCs to spread financial literacy, customer awareness and protection. They also expect him/her to operate from a fixed point that is branded, and that he/she be available to deliver services as and when the customer walks in. And do all this for a princely sum of Rs 5,000 per month – when an unskilled worker gets government notified minimum wage of Rs 7,500/month! The notified average minimum wage for a graduate is Rs 15,000/month. The moot question is – are we expecting an unskilled worker to spread financial literacy, customer awareness, and service the customer?

Let us now move to the 1% service charges. Various studies including Nilekani Committee have recommended it to be atleast 3.14%. What is rationale of 1%? It’s like some time ago one member of the erstwhile Planning Commission has said that one would have three meals a day for under Rs 30!! Does government really expect a BC to be able to put food on his plate (let alone his family’s) making less than Rs 5 on an average transaction?

And how a corporate BC networks managers who have been yoked by the banks to acquire quality persons as BC, train them, ensure quality of service delivery, financial literacy, customer awareness and protection et al do all this unless there is economic viability?

While it’s fashionable in India to talk about FI, no one really wants it. When Business Correspondents Federation of India (BCFI) which has participation of about 20 corporate BCNMs who manage over 150,000 BCs approached RBI in August 2014 requesting it to recognize it as a self-regulating organization (SRO) and asking it to tell banks to fix the economics – after seven months RBI asked it to go to Indian Banks Association (IBA) for solution. And banks attitudinally would like this small ticket customer business (they won’t admit it) to somehow go away from them. They need to make money too.

Next BCFI requested RBI to direct NPCI enable corporate BCs on its IMPS switch that would make all the 150,000+ BCs interoperable and thus make remittances easier for the common man. Regrettably, for reasons best known, nothing happened here too.

So it all circles back to government to be bold and decisive.

Let’s wake up. As Prime Minister Modi rightly declared in his speech on 15th August when announcing PMJDY “Sukhasya Mulam Dharmah / Dharmasya Mulam Arthah” – Chanakya (Kautilya Arthshastra) - translated – Righteousness is at the happiness / And economic (well-being) is at the root of righteousness.

Unless the economics is going to be made right, even a fool can predict which way PMJDY would go. The best part is, there are well meaning and right thinking policy makers. All that is required is quick and bold decisions on economics, recognition and interoperability. Just three letters from government would do the trick and ensure success of PMJDY.

Add new comment