Back To The Future Of Performance Reporting On Financial Services

For those of us familiar with the development of reporting standards for microfinance institutions (MFIs) over the last two decades, there is a mild sense of déjà vu with the conversation on reporting standards for branchless banking (BB) and mobile financial services (MFS). Many different stakeholders are grappling with basic questions necessary to run these businesses, find investment opportunities and support sector development and they are experimenting with how they can measure and monitor these activities.

How do we move from the detailed case studies on Safaricom’s M-Pesa today (like those on BancoSol two decades ago) to common reporting standards? As we head down this road with BB and MFS, what can we learn from the experience with MFIs 20 years ago? This blog, part of the series on the emerging global data architecture of branchless banking looks at four short lessons from the MFI experience to see if we might shorten the journey.

1. Make the standards meaningful to the operators

It all started with a group of practitioners and a little blue book. In 1995 SEEP Network (see GSMA) and Calmeadow published the Financial Ratio Analysis of Micro-finance institutions (print only!) as an early provider-led effort to harmonize terminology of microfinance. The blue book helped MFIs to create comparable metrics, based on standard definitions and easy-to-use reporting formats. The relative success of that book, and revised guides and tools on MFI reporting published by SEEP in 2002 and 2005 came from being provider-led. MFI networks collaborated to build these standards because they were meaningful for providers (today’s mobile network operators (MNOs), particularly for their own global network monitoring.

This incentive led them to join initiatives like the MicroBanking Standards Project (aka MicroBanking Bulletin, and a precursor to MIX) because it provided them performance tools: data and benchmarking reports to compare their performance with that of their peers on an anonymous basis. Benchmarking made the price of conforming to evolving industry reporting standards worth it. At the same time, the direct cooperation of the MFIs built an industry data set, allowing for the development of industry performance standards that funders and others sought to improve the sector’s performance.

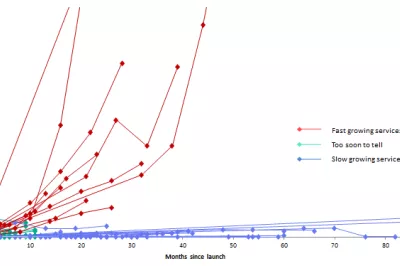

Something similar is now afoot with GSMA’s MMU experience with the Mobile Money Adoption Survey (PDF only), which includes customized performance reports in return for data. Like the blue book and the early MicroBanking Bulletin, the GSMA survey is simple and it lays the ground for basic industry data and it might provide a short-cut to drive the industry to consensus on key terms and indicators. The growing number of operators participating in this survey suggests that MFS operators are also motivated by possibility of comparing their performance to others.

2. Share what you know already

Information on the credit portfolio and overall financial portfolio is where MFIs began. This is what they knew best and what they wanted to improve most. With this focus the anonymous peer groups of standardized metrics published by the MicroBanking Bulletin on a few hundred MFIs emerged and evolved into today’s MIX Market, an online database of thousands of MFIs and hundreds of metrics. In this move from anonymous to public, MIX Market attracted different types of providers, including credit unions and banks, which had their own distinct reporting standards but saw value in being compared to the more traditional microfinance peers. It also expanded beyond its primary focus on financial performance and financial condition of primarily credit-led providers to include indicators on efficiency, outreach and more recently on growing product lines and social performance. Key to this evolution was its location, a public forum that allowed the industry to use that information inform vibrant debates and identify new areas of performance reporting necessary to support the sector’s growth.

It is likely BB and MFS already collectively track hundreds of metrics from customer activity levels to average revenue per client (ARPU). But the types of operators of BB and MFS — banks, MNOs, and other payment service providers (PSPs) —may not have as much in common as the institutions reporting on MIX Market. While both banks and MNOs do report to the MMU’s survey, it is still not clear if there are a large number of meaningful metrics than apply to operators of all types. Measuring financial performance of BB and MFS is particularly tricky compared to microfinance; it is usually intertwined with a bank’s or an MNO’s overall business and its costs and benefits difficult to isolate. While ARPU drives MNOs, banks might be motivated by a reduced cost of funds instead.

Also unclear is what factors would motivate whether operators to public disclosure as MFIs have done for over a decade through MIX Market. The MFI industry was rooted in non-profit and publicly funded institutions and disclosure was expected. It is true that banks are also accustomed to rigorous, detailed reporting to regulators. However, MNOs are primarily privately funded commercial actors operating in a fast-paced, highly competitive markets and guard their performance data carefully. This may well work against more public reporting, even anonymously. So the road to transparency might be windy. At the same time we can drive a lot faster with BB and MFS thanks to the use of technology.

3. Leverage technology

From a faxed (!) standard paper format to macro-laden Excel tools, each development of MFI reporting standards has tried to leverage technology to embed standards closer to an MFI’s own systems. Surprisingly, reporting standards have been successful despite the technology deployed to help enable them. Twenty years after the movement kicked off, MFIs are still spending hundreds of hours each year reformatting data from their systems into various online reporting formats for their funders, regulators and partners. While ease of reporting is arguably an efficiency frontier indicative of a certain maturity level for a sector, MIX, MIS providers and others still work today to create a more seamless reporting environment for MFIs and their partners through use of technology reporting standards like XBRL, adopted by an increasing number of financial reporting regulators that regulate microfinance, like RBI in India.

The world of MFS has a distinct technology advantage, born in an ultra-rich, instantly accessible data environment. Reporting projects like those from MMU have the potential to quickly leapfrog the successes of MicroBanking Bulletin and the MIX Market in their early years -- if they have some standards. Unlike core banking systems that sort and transmit data using regulatory and ISO standards, MFS platforms do not at present. This makes consensus on key data items all the more important if operators are to compare their performance or be transparent. Even when the technology is in place, building consensus still requires the right alignment of incentives, and those incentives might just come from a different place than they did for MFIs: the regulators.

4. Crowd in others

MFIs were largely unregulated in the 1990s, so the reporting standards were practitioner-focused and led by partners of large, international networks. Smaller or independent MFIs were not part of the discussion or the process. Starting in 2002 with the publication of the Consensus Guidelines , CGAP expanded on the initial reporting standards work to gather a diverse group of MFI Networks, raters, consultants, public funders and a new group of commercial investors to propose standard terms and ratios acceptable to all. The presence of funders strengthened incentives for adoption of reporting standards for a much broader array of MFIs. Increasingly, funders and investors required standard reporting and participation in industry information platforms like MIX Market. MFIs suddenly saw in these standards a means to attract funding.

There are many actors eager to speed up the development of BB and MFS reporting and performance standards, including funding agencies and research firms. But seeking funding is not a major priority for most banks and MNOs, limiting funder leverage. So funders have sought to move the industry to more transparency by comparing their own reporting requirements, as well as supporting initiatives such as the Adoption Survey and other industry efforts to catalogue information on these news activities. But the real influence is likely to come from a different watchful eye – regulators. As the microfinance world has expanded its gaze from dedicated, specialized MFIs to a wider range of service providers, regulators and policy makers have been actively organizing their approaches to measuring financial inclusion. Already AFI’s MFS working group has come up with a Guideline note on terminology for regulators that is working its way into other stakeholders’ lexicons. If AFI’s work catches on, regulators might be the one’s driving the consensus process.

Till Bruett is UN Capital Development Fund’s Project Manager for the Mobile Money for the Poor program, funded by Sida, AusAID and UNCDF.

Blaine Stephens is the Chief Operating Officer for MIX.

Add new comment