Buying Insurance – With Your Groceries – in Brazil, Colombia

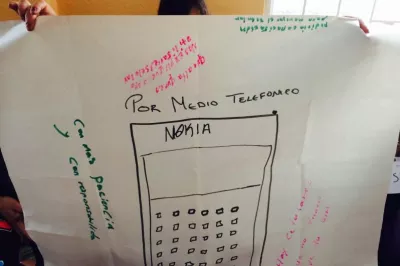

On a visit to Bogotá, Colombia last year, I went “mystery shopping” at a well-known supermarket chain that offers small insurance policies to its customers. I bought a chocolate croissant at the supermarket’s bakery (the price of investigative research!), and asked the cashier if they sold insurance. He looked stunned – this was, apparently, an uncommon request – but he confirmed that I could buy insurance with my purchase. I asked a few questions about the policy, which he answered tersely, glancing with growing impatience at the customers waiting behind me. He finally directed me to call the number on my receipt for further information and to activate my policy.

Only after the purchase did I realize that the policy only paid in the case of accidental death, with a 30-day window of coverage and a sum assured of $84.

A man holds coins

A man holds coins

Photo Credit: Fernando Decillis

My experience in Colombia was echoed by that of a colleague who recently “shopped” for insurance at a retail outlet in Brazil. She visited a women’s fashion store in a shopping mall that offers insurance products to its loyalty and credit card clients. Retail distribution of insurance is very common in Brazil, generally led by insurers that have identified intermediaries already reaching target insurance markets, whether the core offerings of those intermediaries are well-aligned with insurance sales or not. When asked directly about the store’s insurance offerings, the store’s cashier only mentioned an obscure policy that would provide some coverage if her purse was stolen and none of the many other insurance products offered. She could not offer any details.

These anecdotes highlight just some of the challenges surrounding the retail distribution of insurance – a topic I grapple with, along with Emily Zimmerman and Andrea Camargo, in a recent paper we coauthored. Understanding these challenges, and opportunities, requires first considering country-specific regulations.

Different Regulatory Approaches

Although our efforts to purchase insurance at retailers in Colombia and Brazil were quite similar, the two countries have very different regulatory approaches to insurance distribution.

Colombia, like most countries, limits the role that retail distributors and their employees may play in selling insurance to a relatively passive one. Retail channels and others that do not have an agency license are permitted to offer insurance but not to actively “sell” or market it. These restrictions aim to prevent unlicensed salespeople from misleading or pressuring prospective policyholders. But they also limit the effectiveness of retail channels in both significantly increasing microinsurance coverage and effectively explaining products to new clients.

Insurance regulation in Brazil, by contrast, takes a flexible approach to retail distribution, creating a category of an “estipulante” (representative) to actively sell insurance on behalf of the insurer without the more stringent agency license that is required for active sales in most countries. Despite the enabling regulation, many retail distributors in Brazil, like the one my colleague encountered, still take a very “hands-off” approach to selling insurance.

New regulations aim to increase information offered to consumers and improve transparency about the products sold through retail outlets in Brazil. But even with these additional protections, supporting consumers in navigating the process of buying and using insurance can be difficult and time consuming for sales staff. The competing challenges of sales and time constraints, coupled with high turnover, add to this challenge when selling through retail outlets.

In our recent paper, we offer a framework for understanding these consumer protection challenges. Through case studies and examples that explore the issues in depth, we examine the effectiveness of various efforts to overcome them. We also address the roles that stakeholders – such as retail outlets, insurance associations, and consumers themselves – might play in improving outcomes.

The ‘Consumer’ in Consumer Protection

The role of consumers is an especially interesting consideration. We define consumer protection as “the effective use of microinsurance products by low-income consumers to protect themselves against risk.” By highlighting the responsibility that consumers have to protect themselves, we can consider how other stakeholders can help ensure consumers have the necessary tools to make sound decisions and advocate for their needs.

One of these tools is appropriate education and disclosure of relevant and transparent information. Education aimed at consumers can help them be active purchasers, asking questions and advocating for themselves. CNSeg, a Brazilian insurance association, is implementing a multifaceted financial education strategy as part of a broader consumer protection effort that aims to balance education (and the increased consumer capacity that it creates) with product improvements and other consumer protection efforts.

Furthering efforts to provide tools for consumers to advocate for themselves and ask the right questions can offer a useful complement to the appropriate training of sales agents. For this, we see a broad scope for the various actors in the industry in Brazil and elsewhere to join forces and work toward this common goal.

Ultimately, these efforts will help ensure clients do not leave the supermarket with an insurance plan they do not understand, or without one that could help them bounce back from unexpected financial losses.

Add new comment