Can a Good Customer Experience for the Poor Benefit Business?

Is it important that financial service providers (FSPs) provide a good customer experience when serving poor, underbanked customers? A good customer experience is, at the bare minimum, respectful of the customer and reflects her needs and life goals. Few FSPs work on a good customer experience for poor customers because margins are lower, resources are tighter, bank branches or agents for such customers are located in congested slums or remote villages, and customers end up with a “no-frill” version of products and services. In short, there is rarely a clear business case for designing a better customer experience for the poor.

But massive gains in access to accounts for the poor, without commensurate active use points to a clear need to change the status quo. At CGAP, we believe that a positive customer experience is key for FSPs seeking to increase use, relevance and ultimately profit margins from this segment. Earlier this year, we partnered with Janalakshmi, the largest urban microfinance institution in India serving 3 million poor Indian women, and global development advisory, Dalberg, to understand the Janalakshmi customers’ journey and design and test customer experience improvements for them.

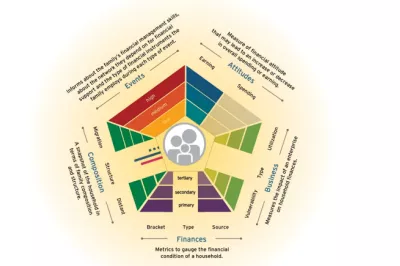

Janalakshmi has been CGAP’s long-term partner on customer centricity and we’ve collaborated in 2013 on the Kaleido tool, to understand customers’ lives and tailor services to better suit their needs. In September 2015, Janalakshmi was awarded the small finance bank license in India, along with nine other institutions, allowing them to expand their range of services beyond group loans. With 11 payment banks licensed by the central bank, and several banks, mobile payment operators and MFIs already in the picture, India will soon be a competitive market for financial services for the poor.

Now, more than ever, Janalakshmi believes that a good customer experience could be the key factor that distinguishes it from its competition, and therefore good for business. Head of products and marketing, Ashwini Jain estimates that a quarter of Janalakshmi’s current group loan customers will graduate from group loans to using a broader range of financial services such as savings, insurance and SME loans. “And if you have treated them well, then these are just the customers who will stay with you rather than go elsewhere.”

With this in mind, the customer experience project began by creating a collaborative working group with staff drawn from diverse functions within Janalakshmi including marketing, product design, branch management and compliance. The working group was guided by experts from Dalberg through the project. First, the working group conducted research and immersion exercises with customers to identify current gaps in delivering a positive customer experience. The focus was on moving from, in founder Ramesh Ramanathan’s words, “a somewhat average experience [for customers] to an experience of delight.” The findings from these exercises revealed areas where Janalakshmi could rapidly test improvements and gather feedback from customers. After several brainstorming, the Janalakshmi working group tested three prototypes, over a six-week period.

Quick reactions from customers is helping Janalakshmi improve and scale these prototypes nationally. Basic improvements at a branch are relatively easier to scale whereas a prototype testing fulfillment of loans anytime of the day needs more piloting evidence and redesign before it can be scaled up. But aside from the prototypes’ impact, we also learned that strategic modifications are necessary in the long-term for an organization to provide a better customer experience in a way that is game-changing, yet profitable. Some of these are mentioned in the film such as building a culture of innovation and empowering frontline staff. We will discuss these and other insights in detail in our next blog. Watch this space!

Comments

I would say that the research

I would say that the research conducted to find & understand gaps in good customer experience is the key to an enhanced acceptance of such projects that in turn encourages ,engagement & enthusiasm within the donor & enabling organisations and the beneficiaries.

Great piece of customer

Great piece of customer experience journey. I like the innovation part and empowering the front staff in line with strategic modifications

Add new comment