Closing the MSME Credit Gap for the Informal Sector

An estimated 80 percent of enterprises in developing economies—approximately 280-340 million—are informal firms. Characterizing what constitutes an informal firm can be challenging because there is no standard definition across or even within countries. For example, a firm in the Philippines is required to have a business license, tax ID, and municipal license in order to open a bank account and qualify as “formal.” However, in Bangladesh, an enterprise with no tax ID but with a trade license and a record of operations for at least 2-3 years, is considered sufficiently formal to open a bank account.

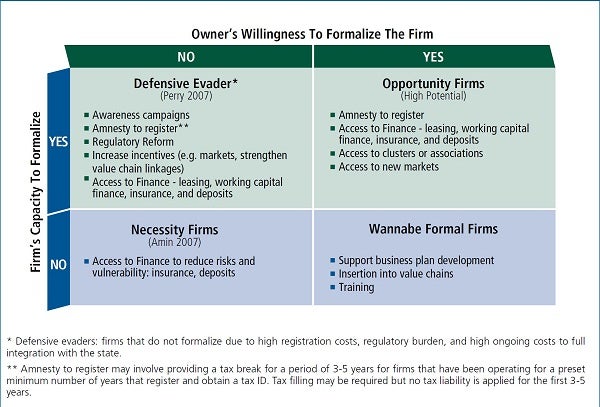

This multiplicity of definitions, the varying degree of informality across countries, and the wide variety of motivating factors driving people to do business require policy makers, practitioners, and private sector actors to devise differentiated approaches when working with the informal sector. Formalizing MSMEs is an important step toward closing the credit gap for informal entities, but it may not work for all firms.

There are three main reasons why:

- Formalization is only a step toward ensuring improved access to finance, but it is not sufficient. Many formal MSMEs also lack the appropriate financing they need.

- Not all informal enterprises have the capacity or the willingness to formalize.

- Although formalization is desirable, creating the appropriate environment for firms to formalize may take a long time as it not only requires building an enabling environment—with solid institutions, laws and regulations, infrastructure and education—but there is also a need to continue to identify business-oriented incentives for firms to register their business in the future.

So how can we segment the informal sector in a meaningful way that allows for effective, differentiated and targeted interventions? Part of the IFC's report Closing the Credit Gap for Formal and Informal Micro, Small, and Medium Enterprises considers this question. The figure below maps a range of potential interventions that consider characteristics unique to each segment. Interventions should be designed with each firm’s capacity and willingness to formalize in mind. For example, “Defensive Evaders,” in the upper left corner, have the capacity to formalize but not the willingness, due to the cost and regulatory burden of completing the process. “Wannabe Formal Firms,” in the lower right corner, have the willingness, but not the capacity. The approach in each case is drastically different.

In cases where formalization is either not possible or is otherwise a long time off, other approaches may benefit the informal sector in the short run. A number of private sector models and approaches that directly or indirectly target small and informal firms have applicable lessons for informal MSMEs. These include:

- a micro distribution and retail model that manufacturers and wholesalers use to integrate micro and small retail firms into their business distribution chains;

- mobile and e-transaction platforms that can be leveraged to overcome problems with high transaction costs and to increase penetration rates in the small and informal sectors;

- small business banking solutions to overcome the typical barriers that financial intermediaries face when servicing micro and small firms;

- supply and value chains to better integrate the small and informal businesses, providing them with new market opportunities to increase their business potential and profitability.

Private sector models could also be leveraged to approach “high potential firms”, enterprises that have the greatest potential for growth and job creation, as well as for formalization in the future. However, identifying these “high potential firms” requires better data and well-designed segmentation methodologies to effectively target these enterprises. Once identified, the solution set should be holistic in nature combining a series of elements such as access to market opportunities, access to finance, capacity building, and business registration simplification thereby making registration a suitable business decision that is sustainable in the future.

Martin Hommes and Oya Pinar Ardic are both with IFC.

Additional Sources:

Informality Trends and Cycles: http://elibrary.worldbank.org/doi/book/10.1596/1813-9450-4078

Informality: Exit and Exclusion: http://elibrary.worldbank.org/doi/abs/10.1596/978-0-8213-7092-6

Statistical Update on Employment in the Informal Economy: http://laborsta.ilo.org/sti/DATA_FILES/20110610_Informal_Economy.pdf

Size and Measurement of the Informal Economy in 110 Countries Around the World: http://www.econ.puc-rio.br/gfranco/Schneider_informal_economy.pdf

Necessity vs. Opportunity Entrepreneurs in the Informal Sector: http://works.bepress.com/mohammad_amin/15

Add new comment