On Gig Platforms, Women Workers Face Triple Barriers to Inclusion

Gig platforms continue to transform the global workforce, and women’s work is no exception. Doordash, a delivery platform in the U.S., recently announced that 58% of its delivery workers, known as Dashers, are women. In emerging markets like India too, women are entering the fray, with 10% of the estimated 14.5 million platform workers in India being women. Women in India are not alone — there is a growing group of women in emerging markets experiencing new forms of digitized livelihoods.

Women join gig platforms in their quest for greater flexibility and increased income, but face obstacles in leveraging these opportunities. Further, platform-based financial services for gig workers have been on the rise, but most of them do not reach women, inhibiting their financial inclusion. Alongside our partners BFA Global and Caribou Digital, we studied six platforms and tried to understand why fintech innovation does not reach their women workers. We found three key barriers, outlined below.

Figure 1: Women workers face triple barriers in leveraging the growth opportunities in the platform ecosystem

Gender norms dictate the spaces women occupy and the experiences they have on the platform ecosystem

CGAP’s prior research with gig workers showed that gender norms confine women to "female sectors" such as home cleaning, childcare, beauty services, or home-based retail microenterprises. When venturing into male-dominated sectors like ride-hailing, women earn less than men while facing challenges to their safety and well-being. These risks persist even in niche sectors without proper safeguards. Current regulations, even those aiming at fairness, frequently overlook the unique challenges women face regarding safety, harassment, and discrimination.

Women-focused platforms grow at a slow pace and find it harder to build the right partnerships with fintechs to offer services for their women workers

New platforms predominantly employing women and offering home, personal care services and e-commerce are emerging. We interviewed founders of such platforms including Homely (Mexico), Hogaru (Colombia), Frontier Markets, and Urban Company in India.

The majority-female workforce and personalized nature of the services set these platforms apart. Services like home cleaning occur in customers' homes, necessitating more time investment in onboarding and training to ensure reliability and customer satisfaction. Second, women workers often having lower digital literacy, require more hands-on assistance with app use. This potentially slows their growth compared to platforms providing services like deliveries where workers come with their vehicle and require minimal onboarding and basic in-app training.

Homely, a cleaning platform from Mexico, has experimented with offering commonly available salary advances to their full-time workers as an incentive. These advances were successful; women utilized them, repayments were auto-deducted and there was a modest impact on retention. However, this cash advance alone doesn’t meet the cleaners’ aspirations for bigger, long-term loans for housing, children’s education, or business expansion. Being a relatively small platform with a modest workforce of a few thousand, Homely cannot offer these financial services independently and has struggled to find fintech partners willing to tailor solutions for a smaller workforce.

For Frontier Markets, a rural digital marketplace in India employing over 35,000 women agents who collect data, facilitate trainings, and sell consumer durables, healthcare essentials, and financial services within their villages, even providing basic working capital loans to its women agents has been challenging. Most fintech loans must be plugged in and offered in a fully digital model. But Frontier Markets’ model for working with rural women agents, balances tech and touch, and therefore embedding such fintech products into their ecosystem has not been an instant success. There is a need for orientation and customized message formulation that the fintech is unwilling to do, and Frontier Market may not be able to fully invest in either, given its investor priorities to grow and stabilize the ecosystem first.

Existing short-term plug-and-play loans do not align with women workers’ financial goals; however,

Fintech innovation that can support women gig workers is underdeveloped

With a few exceptions, fintech innovation in most emerging markets is not tailored for a female working-class customer that may have lower digital financial literacy and trust. This is a crucial third barrier to women workers’ financial inclusion on gig platforms. So, even as platforms like Homely are strengthened by their post-pandemic growth, finding the right fintechs to partner with has been tough. Few, if any, fintechs in Mexico currently design financial solutions with an understanding of women’s digital realities.

Ajaita Shah, founder of Frontier Markets recognizes that appropriate savings and insurance tools would improve their women agents’ progress. However, like Homely, she found that Indian fintechs offerings are largely gender-blind. Current gig worker insurance largely focuses on auto insurance, while much-needed bite-sized insurance products for childcare or family health are absent. While there are a few instances in India of underwriting gig worker loans based on work data, these practices have not been applied to the women’s work ecosystem or used to underwrite loans for women’s skill-building.

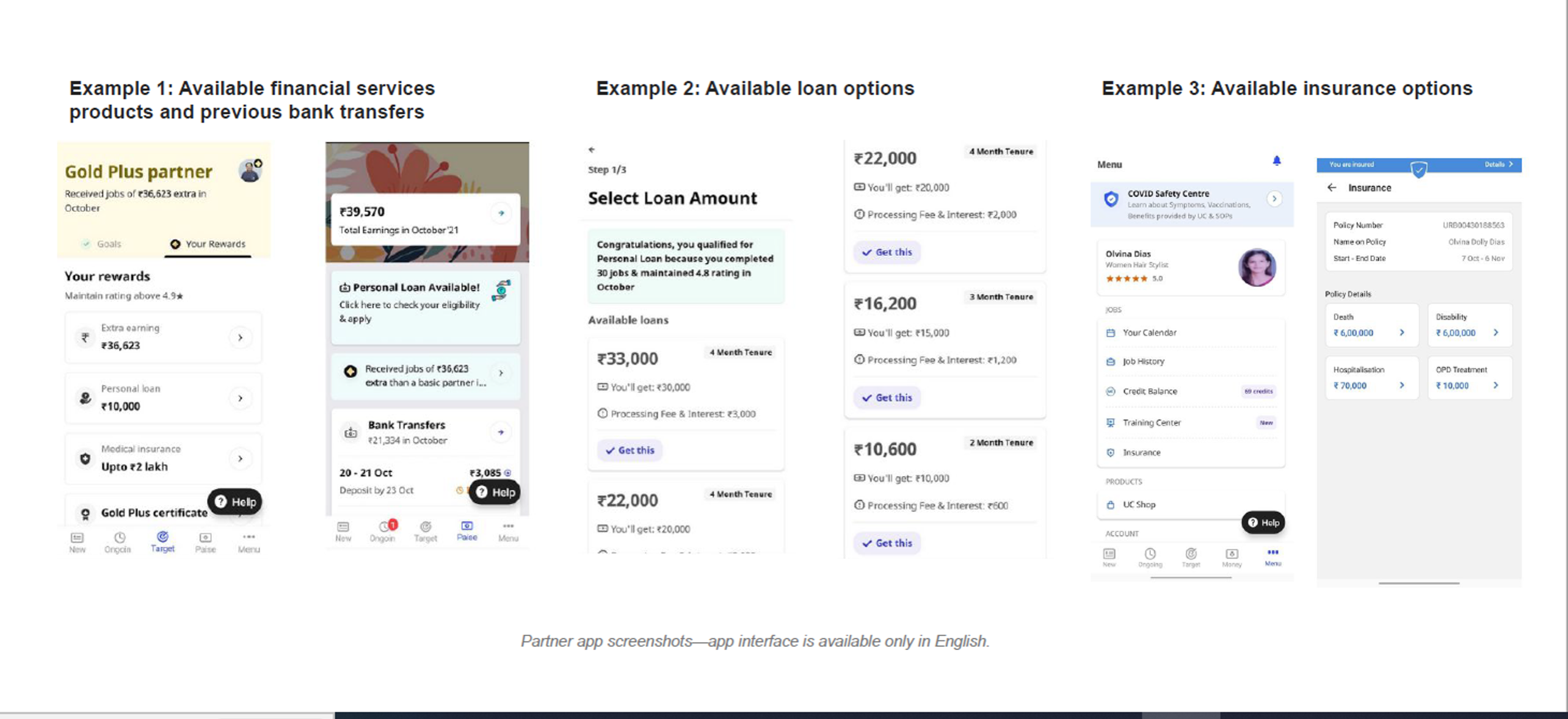

Urban Company, an Indian platform providing home-based services with a workforce of over 50,000 (a third of these are female) in 54 cities, is a rare exception. Their size and unicorn status has enabled partnerships with large fintechs and insuretechs to create bespoke financial products including loans for worker starter kits, personal loans during the pandemic, and health insurance, all integrated within their app. This sizeable, urban, digitally active workforce of women and men makes them a desirable partner for financial institutions looking to reach this segment. The same is true for other large platforms like Tokopedia (now a part of the GoTo group) in Indonesia that have created partnerships with fintechs and the Indonesian government to offer financial services to its women sellers. However, these rare arrangements demand support from funders, investors, and regulators for replication.

Figure 2: Urban Company is a rare, large platform focused on women workers that can illicit deep partnerships with fintechs and create bespoke credit and insurance offerings for its women workers. Source: Caribou Digital’s research with Urban Company

Women will continue to enter the platform ecosystem, despite its challenges, perhaps because the digital marketplace represents a new set of opportunities for them. But their journey on these platforms will be more challenging than men, and without the tools and services that can help them truly reap their gains. Here are some recommendations:

Impact investors and funders focused on women’s livelihoods and empowerment can support early-stage women-focused platforms to develop and test services beyond credit

While many platforms hiring women for work have the right intent, their young business models and lack of suitable financial products for women limit impact. Demonstrating the value of well-designed solutions could spur other innovators.

Funders and regulators can promote deeper partnerships between women-focused platforms and fintechs to customize and expand financial services catering to women’s needs and aspirations

Generic fintech products added to platform apps won't suffice for this segment. Product design must consider gender-specific constraints and a balanced tech-touch approach is crucial for delivery. Women-focused regulatory sandboxes could promote more innovations.

Policymakers must support gender equality in the digital economy through policies and regulations

Addressing women workers' challenges on digital platforms is crucial, requiring policy interventions, technology solutions, and social norms change. Actions like gender-informed investments, equitable education and training, and protective labor laws can boost women workers' rights and participation.

The authors would like to acknowledge Savita Bailur, Marissa Dean, Maria Gabriela Coloma Ponce de Leon, and Vartika Shukla from Caribou Digital; and Priyanka, Amolo Ng’weno and their research team from BFA Global for their contribution to the ideas and insights presented in this blog.

Add new comment