Context and Culture: Designing Relevant Financial Services

Humans have a propensity to label people, ideas or things based on our initial opinions of them. Ori and Ron Brafman, the authors of “Sway – the irresistible pull of irrational behaviour” term this the “diagnosis bias,” and it includes our inability to reconsider those initial value judgments once we’ve made them. Once a person is given a label (and even indirectly, a diagnosis), it’s hard for us to see other people in a way that isn’t biased by that label.

One-off quantitative demand surveys have a tendency to do this – by capturing information of people at a single point in time, they tend to infer that whatever the person was doing at that moment in time is all they ever do, and of course that isn’t the case. Making strategic decisions based on a limited set of data is referred to by behavioural economists as the “what you see is all there is” mindset – and can often set you off down the wrong track.

As a tool to help a mobile financial services provider design a business strategy, therefore, a point-in-time one-off research exercise is arguably not going to be much help. People’s financial behaviour and needs tend to fluctuate based on varying circumstances – the season, time of month, even time of day can have an impact – and therefore the answers that may be given when they’re planting this season’s crop are unlikely to be the ones you may have obtained at 3pm on the Wednesday afternoon when they were interviewed.

Our previous research, conducted to help financial institutions determine people’s needs for financial services, has highlighted that people tend to use a range of financial services simultaneously – both several sources of borrowing and several forms of savings – and that they often continue (or even increase) their use of informal services when they get access to formal financial services. In order to gain true insight into the “big question” of the type of services that a low-income customer will recognize as having value to them, an in-depth understanding is required of what they do now; how often; where; why; how much they pay; and what the challenges (pain points) are of the current methods.

At the same time, it is important to record not just facts, but the individuals’ perception of the facts. Why do they make the choices they currently make? What is their own perception of their current coping strategies? How much do local culture, informal networks, and immediate community have on the decisions they make? Are ways of doing things that seem perfectly normal to them, totally abnormal in another setting?

The main driving force behind gaining this kind of insight is to determine how (or whether!) the proposed service will be perceived as valuable to the intended customer base. It won’t be “new” to them; it will be an alternative to what they’re using already. The mobile money provider is not inventing money transfer – their target market has been doing it through informal channels ever since they discovered that more work was available in urban areas (a very, very long time). The bank is not inventing savings – their target market is already saving with local cooperative groups or buying appreciating assets such as gold or cows.

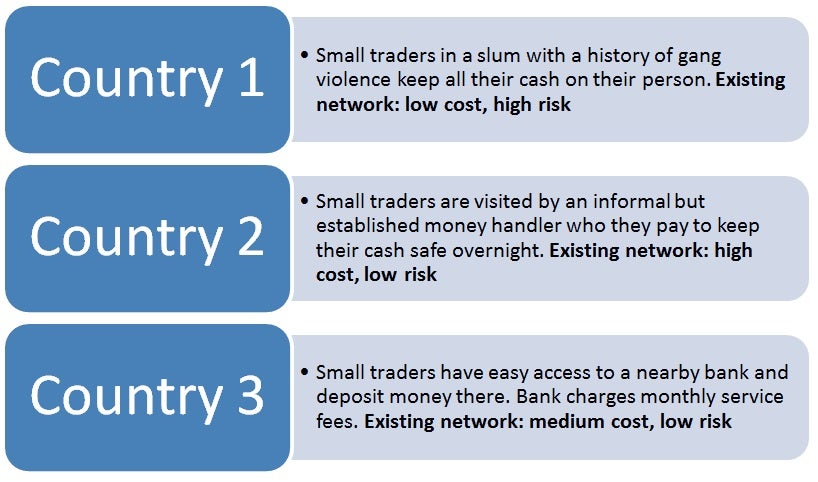

To further understand how context and current networks can have such an impact on the value proposition of a planned new service, here are a number of real-life existing safekeeping scenarios, with an (evidence-based) evaluation of the cost and risk of each.

The value proposition of any new service will therefore be evaluated and compared against the services that the customer is using already. Is the money transfer cheaper/quicker/more convenient? Is the savings account more flexible/safer/easily accessible in an emergency? This is one key reason why there is no “one size fits all” solution – the answers to these questions will not be the same in Kenya as they are in Bangladesh; will not be the same for urban rickshaw drivers and rural farmers.

The impact of failing to consider local context and the customer value proposition is low adoption levels. The phrase “you can’t market someone into using something that doesn’t make sense for them” is particularly applicable to low-income populations – who are extremely difficult to sell to, and capable of quickly working out whether something is useful, relevant and valuable. By ensuring you really understand the complexity of the lives of your customers, not just as it is on the 3pm on a Wednesday, you can make sure your “something” is.

Comments

Financial services provider

Financial services provider design a business strategy and financial institutions determine peoples needs for financial services.

Given demographic features in

Given demographic features in most of the under developing and developing countries, context and culture demands non -digitalised pedagogical approach through community based institutions(social capital ) rather than financial service providers patronised by the lending institutions.

In today context it appears that digitalization is too fast to get adopted by the community in the last mile there by causing only digital divide and exclsuion

Dr V.Rengarajan

Add new comment