Creating an Insights Engine for a Customer Centric Organization

In my previous post on CGAP’s collaboration with Janalakshmi Financial Services, I shared how one of India’s largest urban microfinance institutions, is starting down the path to customer centricity. In the first phase of this partnership, Janalakshmi and CGAP studied the lives of customers with the objective of building a nuanced household profile, which we detail in this newly released video.

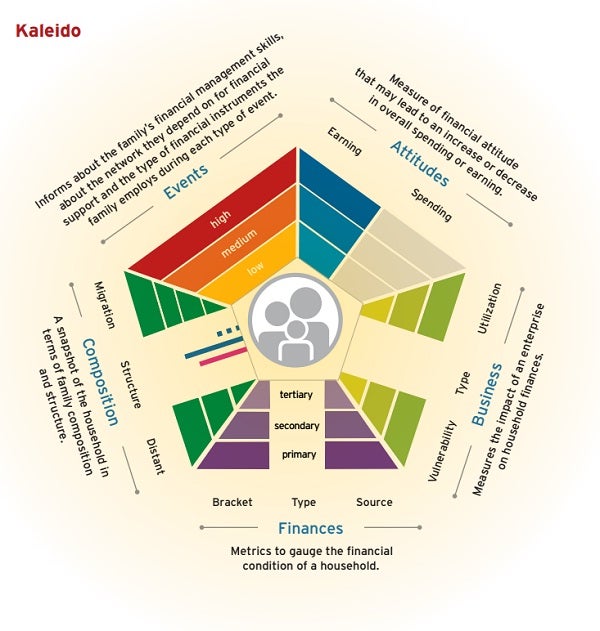

The result of the first phase of the project is a tool called Kaleido which builds a customer profile using nuanced information about each client, achieved by mapping the financial context of a household. The name is derived from the word “kaleidoscope” and used as a metaphor to describe the changing dynamics of a household or family. Information obtained from customers at the time of enrollment is mapped visually to provide a holistic view of a household’s financial needs. The goal is to update and build on the customer profile as the relationship progresses. Over time, Kaleido is expected to evolve into a rich source of data that can be used to develop new products and assess the household’s financial progress. Kaleido aggregates information that influences a household’s finances into a unique visual map focusing on five sections:

You can learn more about Kaleido in this newly published brochure.

Mapping profiles to products is only one potential use of Kaleido because it acts as the bedrock of customer centricity within the organization. As robust household data is fed into Kaleido, it can be used to segment customers, design new products for different segments and better align customer needs with products on offer. Most importantly, it establishes a database of layered information about the customer that is updated on a regular basis. This forms the foundation for on-going customer insights. The next challenge is to develop design criteria that translate this information into products and services on the ground.

Janalakshmi is still in the early days of implementing Kaleido. It is quantitative testing aspects of Kaleido derived through qualitative interviews to ensure that it is robust. Simultaneously, it is piloting the tool with a limited set of customers to better understand any challenges of implementation. Over the next few months, Kaleido will be refined and integrated into Janalakshmi’s core operations. Already showing great promise for financial inclusion, CGAP and Janalakshmi are eager to learn from this implementation and then test the tool in other settings.

Add new comment