Digital Finance and Illiteracy: Four Critical Risks

For financial service providers trying to garner new clients in the developing world, illiteracy awareness is extremely important. Many countries around the developing world still have high rates of illiteracy, and most financial services are not designed well for illiterate users. This means that tens of millions of people around the world cannot be effectively reached with financial services. At the Helix Institute, we are working with financial service providers to help them earn new clients and increase profits. Part of this equation is understanding how products and services can better serve those who cannot read.

The Data

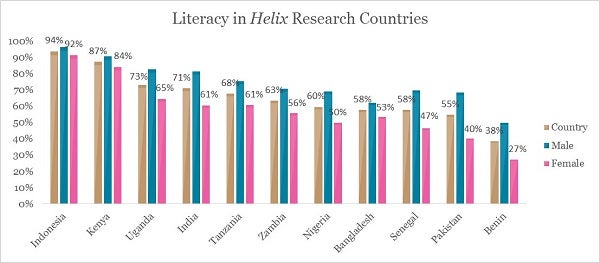

While countries like Indonesia and Kenya report high rates of literacy, in the other nine countries where The Helix Institute conducts its research, 27%-62% of adults are not literate. These are enormous groups of people that may not be able to effectively benefit from digital finance, and the gender break down in the table below further shows how this disproportionately affects women.

The Case of Uganda

For the Agent Network Accelerator (ANA) project, researchers conducted over 30 qualitative interviews with agents and customers in Uganda. We found four major risk areas for illiterate people and recommend investigating in other countries where illiteracy is prevalent:

1. Enrollment without Informed Consent

2. Public Secret PIN

3. The Dubious Office Fee

4. Inability to Conduct P2P Transfers

Enrollment without Informed Consent: The issues we observed start with the enrolment process, in which forms need to be filled out in English. The clients we spoke with noted they went to a local agent, who would verbally ask them questions and then fill the form in for them. The clients have no idea what is actually entered into the form, much less what is stipulated in the terms and conditions that are included in the small print on it, yet at the end, they diligently dip their thumbs in ink and stamp their agreement to the foreign characters on the page in front of them.

Beyond the legal question of informed consent, there are practical issues about the understanding these clients have about the contract. The content of these terms is actually important and seems to contain dubious provisions. For example, The Bank of Uganda Mobile Money Guidelines (2013) Article 3.b.i, hold a mobile money service provider liable for the actions of its agents. However, one major provider’s terms and conditions state:

“...no agency relationship exists between [the provider] and the Agents and we accordingly bear no responsibility or liability for any default or negligence on the part of the Agents in providing the MOBILE MONEY Services” and “You [the customer] are responsible for resolving any disputes arising with any other Customer or an Authorized Retailer.”

Further, Article 12.b of the BoU Guidelines stipulates that, “The agreement shall be explained by the agent clearly and in plain language”, which makes us wonder whether illiterate people would still sign up for the service if they were to read a statement that said, “While we brand the agents with our logos, any transaction you do with them is between you and them, and if for some reason something goes wrong, you are on your own”. It seems clear that this form-based enrollment process is not designed for illiterate people and exposes them to risks that they may be unaware of having taken.

Public Secret PIN: For some services, PIN creation is done at the time of registration, and for others it is done later once the registration has been processed and the account is activated. Either way, it is not designed for those that cannot read. Prompts, which must be followed, are given on the screen of the mobile phone. The clients we consulted reported that the agent had to do this for them as they could not understand the process. The agent asks them for a four digit code; the client selects a code, which the agent sets for them. The code is repeated verbally and might also be recorded on a piece of paper that is then given to the client so that they can remember it.

This practical solution does allow illiterate people to sign up for the service, but it completely disregards the necessary secrecy of the PIN. Customers reported having to hide this code in their house, so that even their family members could not find it. Another direct impact of this is that it ties the client to that specific agent, which creates a completely skewed power dynamic between the customer and the agent. Since the customer cannot read the prompts on the phone, they need an agent’s help to conduct their future transactions, and would therefore have to disclose their PIN to an additional agent if they decided to transact elsewhere. Some customers can memorize the PIN and the series of steps on the interface, however this does not seem like the norm as many people are afraid of sending money to the wrong number, or of their PIN being blocked.

The Dubious “Office Fee”: The clients also reported a disturbing process for withdrawing money at agents. The agent first asks them how much they want to withdraw from their mobile wallet, and then tells them how much it will cost. The customer hands over the handset to the agent who conducts the transaction for them including entering the PIN. The agent returns the handset, with the cash withdrawn, minus the verbally stated fee, and an additional “Office Fee”, which the agent levies by withdrawing an additional 1,000 USH (US$0.27). The clients reported that they knew this was not an official charge (it is also prohibited in The Bank of Uganda Mobile Money Guidelines (2013), but did not feel that they could do anything about it. The tariff rates are usually displayed on the agency wall, but they cannot be effectively cited by someone that cannot read them.

Inability to Conduct P2P Transfers: When an SMS is sent to the clients, they take the phone to a trusted relative who can read it. Since the USSD prompts combined with SMS confirmations of transactions are crucial to being able to conduct a P2P transaction, they feel that it is not within their ability to use this functionality. When given the scenario of having e-float but no cash and being with a friend in the village to whom they owed money, they reported they might be able to find someone to conduct the transaction for them, but might also have to make the 15 kilometer journey to town to withdraw money so they could pay their friend in cash.

What Next?

As an industry, we need a better understanding of the prevalence of these issues. We can safely say that the majority of mobile money systems are just not set up for people who can’t read, and their use of the system exposes them to heightened risk of fraud, usurious fees, and only limited use of their m-wallet’s functionality. These issues need to be addressed head on.

Techniques like regular mystery shopping by providers to identify agents levying extra charges; voice recorded readings of key points in terms and conditions in the local vernacular; and IVR or more streamlined interfaces would help to minimize the risks faced by illiterate people and increase their use of digital finance.

We look forward to more efforts from digital finance providers and policymakers to address these issues.

Comments

I have a company that

I have a company that develops mobile money apps.

I think will have to move beyond simple text apps (USSD & SMS) to resolve this issues. Lets face it , text based apps have a horrible user experience , even literate people find them hard to use beyond the basics of send money home. There many steps , issues with timeouts , unclear instructions etc. If your illiterate your definitely need OTC support. Only smarter application will put the power back into users hands and that will take time. For now the power is with agents.

A serious problem right from

A serious problem right from the regulator's doorstep. It is a serious flow if the regulator and service providers do exposes illiterate clients.

I remember during a research in rural Eastern Uganda, Most farmers said they would send their kids to transact and give them their PIN (written to them on a piece of paper by an Agent).

Hi Justus,

Hi Justus,

Yes, great example of one of the solutions that is being used. I think it is common with older parents/grandparents. It would be interesting to look deeper into how well the system works. We also heard people reporting hiding the piece of paper with the PIN on it at home so family members could not find it. I guess it depends on the family!

Best,

Mike McCaffrey

It is good to see this

It is good to see this article, Mike and Doreen! I agree with most of what you say, and while I might have a few quibbles I certainly won't make them before welcoming you both warmly to a very important discussion! My own work,is very similar to yours, centering on oral culture in the context of financial inclusion.

Illiteracy and innumeracy are the capabilities dimension of oral culture. Orality in the broader sense is a cultural dimension that drives behavior, incentives, practices, and the proclivity to learn, both among those who are technically illiterate, and those who inhabit communities where illiteracy is the dominant capability profile. Risks (such as those you point out on the capabilities side) exist everywhere in our engagement with oral culture, and so do opportunities once we can understand what we are up against.

If you are interested I just posted a short piece on the cultural side on Linked in (Why won't he use a map?) and earlier CGAP blog on capabilities which addresses some of your points above (A multi-digit divide?).

I look forward to a fruitful continuing discussion that opens a path to financial inclusion for nearly a billion oral adults.

Warm regards -- Brett

Hi Brett,

Hi Brett,

Thanks for your kind comments, and I am glad to hear you are doing work on this topic. I read through your pieces, and I agree that we often do not pay enough attention to the way information in transmitted generally. I think it will be an important piece of the puzzle for getting more low income people onto digital finance systems, helping evolve products, and also increasing the activity rates, which still remain very low. I am curious to hear if you have found successful ways to make inroads for the illiterate in digital finance.

Best,

Mike McCaffrey

I am glad I read this article

I am glad I read this article. With financial and banking transactions becoming more digitalized, it is quite a challenge for illiterate people to take advantage of new technologies, and an increase in dependency on others to navigate through it. Considering how women have lower literacy rates when compared to men, as seen in your cross-country analysis, it is a set-back in the effort to make women more financially independent. The risks faced by illiterate people due to the dubious practices of agents is very similar to the problems faced by illiterate people taking loans from moneylenders; both print their thumb on a document they cannot read, and are charged fees they know are unfair. There are techniques in place to prevent agents from defrauding the illiterates, but as you mentioned, more “streamlined interfaces” are required. The use of fewer texts and more culturally and universally recognized icons/pictures may be more helpful in combatting this problem than simply monitoring agents.

Hi Chimi, Great comments. I

Hi Chimi, Great comments. I did want to add that while some agents are definitely part of the problem, others can be part of the solution, and not all these issues are on the agent-level. Some are certainly at the provider-level in terms of product design and delivery.

Best,

Mike McCaffrey

The solution is multi-faceted

The solution is multi-faceted, as it must address capabilities, incentives, habits and practices at once. I would encourage you to look at the Oral Tools Gallery in my paper, Oral Information Management Tools (http://www.microfinancegateway.org/organization/my-oral-village). The basic principles of oral tool design are also outlined there (as well as here: https://www.linkedin.com/pulse/principles-oim-design-building-trust-amo…). Of course, every situation requires intelligent contextualization that optimizes oralization with respect to local context, transactional design, and interface/channel specifics.

Hi Allan,

Hi Allan,

Thanks for your comment. I agree, I would just qualify by saying for now the assistance will have to come from a person. I think the agent is the obvious choice, but not all agents will do a good job of this (issues of honesty and competence). Especially in countries where illiteracy is high, I think some blue sky thinking should be done on this. The great irony of mobile money is still how many people it takes on the ground to try and go digital. I think you are right that we should continue improving and digitalizing systems, but the questions remain as how to best implement them, and what are reasonable time frames for adoption.

Best,

Mike McCaffrey

The biggest problem comes

The biggest problem comes right away from the service provider.HOTLINE for stopping a transaction gone wrong say you sent to the wrong number does not exist.Receiving money back to your account becomes very hard as it will involve headquarters when clearly all can be seen the money came from your phone a few seconds ago.

illiteracy in DFS is indeed

illiteracy in DFS is indeed quite a challenge for both regulators and service providers in the industry. A recent discussion raised the question whether communication can be provided in local dialect for illiterate users. This perhaps sounds costly as developers may have to translate SMS codes, etc. We sure need a better understanding of the issue as we push to extent financial services to the "unbanked". government efforts in local content development and basic education will be key.

Hi Doreen,

Hi Doreen,

Yes there has been a lot of talk around IVR solutions, and I know they have been tried in places like Afghanistan, Chad, Somaliland, and Ghana. MicroSave wrote a blog comparing the solution to some others and found it to be expensive and cited issues with voice authentication. Check it out here:

http://blog.microsave.net/designing-an-effective-user-interface-for-uss…

Best,

Mike McCaffrey

True story especially mobile

True story especially mobile money terms and conditions are sickening.The moment money is wired to a non-registered mobile number the money vanishes.

Hi Sydney,

Hi Sydney,

Yes, I felt like we could have written a whole other piece of the terms and conditions. Even for those that can read, few take the time to read through them, but when you do, you realize there are often stipulations included that seem a bit dubious. However, this is not just a problem with digital finance, this has been a problem in finance generally. It is a common corporate practice and something we need to monitor closely. Agreeing to these contracts is becoming more common as corporates go down market and then we have situations where people who cannot read are signing them without understanding what they are agreeing to.

Best,

Mike McCaffrey

Hi Sydney,

Hi Sydney,

Interesting comment. How could this be made easier for the illiterate?

Best,

Mike McCaffrey

I am interested to know how

I am interested to know how those examples in Uganda which you cite, have not been corrected by the Central Bank, whose regulations they contravene? When we audited the mobile money businesses in Nigeria, that was an important area to check compliance.

Thanks for the article; it

Thanks for the article; it highlights a huge stumbling block in service usage for product/service targeting the bottom of the pyramid. I have done Consumer Education work and it is a huge challenge...there are no shortcuts (IVR is not a viable solution either) and service providers do not know how to deal with this reality..if you look at products that have succeeded in such markets... you will notice that a lot of time and effort is spent on Consumer education, using Influencers, local community champions and public forums...

Hi Judyth,

Hi Judyth,

Thanks for your comments. I agree, and I feel like it is common in our industry for people to expect things to move fast because we working with technology that allows scale, and evolves quickly itself. However, what we better need to understand is it takes a long time for people to get used to new technologies, much less the products offered over them. It takes people on the ground, and a lot of hard work that we see few providers really willing to invest in.

I would love to hear more about the examples where you have seen success. Those stories always help us remember what is possible..

Best,

Mike McCaffrey

Illiteracy is a demographic

Illiteracy is a demographic aspect that impedes uptake and usage of digital financial services. It is also a key consideration in the design of customer safety measures in the digital finance space. Its therefore paramount for regulators, MNOs, and other players to rethink digital finance delivery mechanism that address this key demographic aspect. This points to simplification of enrollment requirements, developing user friendly mobile money applications, probably with images, and using customer centered research approaches to design mobile money applications and developing experiential digital finance awareness campaigns.

Hi Robert,

Hi Robert,

Great comments. It would be wonderful if we could really focus on making digital finance systems more user friendly. I agree there is a lot to do in terms of streamlining enrollment and other processes. I think there are some quick wins, and other systems will take more time, for example, there is only so much we can do with a USSD interface. The trick will be finding the balance between innovative new approaches, and the bottom-line, as this type of work will definitely require both time and money.

Best,

Mike McCaffrey

Increasing usage for

Increasing usage for illiterate users lies in understanding their current practices. How they are overcoming user interface challenges; mapping their trust environment and understanding how they choose the people they transact with. Further understanding the usage behaviors and their journey towards adopting digital financial services will help to inform future design of related delivery mechanisms. Their most common behavior is using scraps of paper as their address book, which later transits to a self generating contact list, as they use the "call logs" function on the phone.

Hi Jenny,

Hi Jenny,

Valid question. You kind of get the feeling that no one bothers to read the fine print on the terms and conditions. Admittedly, I still have not read them for the majority of providers I have worked with, nor the services I use. It would be interesting to know how common these types of issues are, and therefore the general scope of the problem.

Best,

Mike McCaffrey

No I absolutely agree that it

No I absolutely agree that it would be naive to expect the end user to read and understand the t&c's but I would expect the regulator and maybe auditor to pick up clear non compliance before granting a licence.

Add new comment