Financially Inclusive Ecosystems: The Roles of Government Today

Financial inclusion today is about financial markets that serve more people with more products at lower cost. The term “microfinance,” once associated almost exclusively with small-value loans to the poor, is now increasingly used to refer to a broad array of products (including payments, savings, and insurance) tailored to meet the particular needs of low-income individuals. Two separate but related developments have spurred this more holistic approach to financial inclusion. First, a growing body of research is demonstrating that poor people use and need a wide array of financial products, not just credit. Second, innovative lower cost business models—especially electronic and agent banking models—hold the promise of reaching unbanked populations with a fuller range of products better suited to their needs.

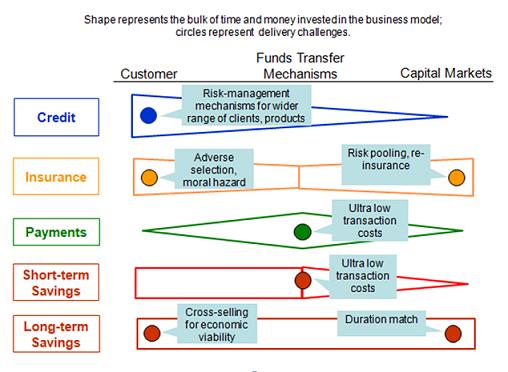

Different products present different risks and delivery challenges, and it is unlikely that a single class of service providers will effectively provide all the products poor people need. Financial products have delivery, intermediation, and risk mitigation challenges that often can be more efficiently managed through a number of specialized institutions acting together rather than one institution acting alone. Skill sets, capacities, and tools needed to deliver products on the liabilities side of a bank’s balance sheet are different than those needed to deliver products that fall on the asset side. As a result, businesses tend to develop specialties on either side of the balance sheet. Further, businesses providing the service to the end consumer are often not specialized in managing other parts of the value chain.

For example, insurance companies often function more effectively through use of specialized actuaries, independent agents selling policies, and reinsurers who aggregate risk. Payment service providers and providers of short-term savings products can benefit from access to a low-cost infrastructure of origination and delivery points that permit money transfers and savings services at prices acceptable to low-income individuals sending and saving low values. Providers offering long-term savings services need prudentially regulated financial institutions for deposit intermediation. For credit products, reliable credit bureaus are needed, at least in markets with a substantial number of available providers and increasing market penetration. And loan aggregators can diversify risk by consolidating different loan portfolios with varying geographic and other risks. See Figure 1.

Government Roles Today

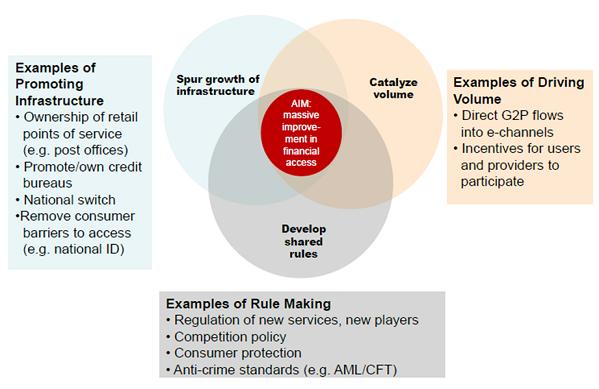

As governments become more actively involved in the financial inclusion agenda, a key challenge is defining roles for government in creating the market-based broader and interconnected ecosystem of market actors needed for safe and efficient product delivery to the poor. In its new Focus Note, CGAP explores three roles that have the potential for significant impact:

- Promoter of front- and back-end infrastructure: Existing banking infrastructure does not adequately reach the world’s poor. Bank branches are too expensive to construct in low-income areas and, even when present, rarely offer affordable services. Automated teller machines (ATMs) and point-of-sale (POS) devices have wider penetration but have been of little use to unbanked customers without the cards and accounts typically needed to access such delivery channels. Poor borrowers are unlikely to possess the types of collateral typically pledged in collateral registries. Nor do poor borrowers borrow from the types of lenders served by most credit bureaus. And even where cost and distance are not barriers, access to formal financial services is often blocked by the lack of perhaps the most basic component of a financially inclusive infrastructure—a reliable means of customer identification (ID).

- Rules maker with respect to infrastructure and its contribution to responsible market development: A government’s most obvious role—viewed by many as its primary role—is that of rule maker. As rule makers, governments determine not only what efforts may be undertaken to promote financial inclusion, but also by whom, how, and when. In addition to prudential and consumer protection rule making, this involves the potential to enable innovative financial inclusion business models, including permitting the entry of new actors into the financial service sector.

- Driver of transaction volume: Driving transaction volume has the potential not only to bring more low-income individuals into the formal financial sector but also to lower the per-transaction cost of the retail/transaction infrastructure for various market actors. Perhaps the government’s most powerful tool to drive transaction volume is government-to-person (G2P) payments—the spectrum of social transfers, wages, and pension payments made by governments to 170 million poor people worldwide.

While each of these roles can have significant impact, the application of these roles in any given jurisdiction will depend on country-specific factors, such as customer demand, market structure and maturity, government philosophy toward the market, and supervisory and other governmental capacity.

Keeping the Momentum

Governments are increasingly interested in promoting financial inclusion. More than 45 countries have drafted financial inclusion strategies, and more than 100 countries track key inclusion indicators. Government institutions from 78 countries have joined the global Alliance for Financial Inclusion, a regulator network launched in September 2009. Supra-national bodies are also focusing on financial inclusion. In 2010, the G-20 recognized financial inclusion as one of the key pillars of the global development agenda, not only endorsing its Financial Inclusion Action Plan but also creating the Global Partnership for Financial Inclusion (GPFI) as an implementing body open to G-20 countries, non-G-20 countries, and other relevant stakeholders. International standard-setting bodies (SSBs), such as FATF and the Basel Committee on Banking Supervision, are also engaging in the financial inclusion agenda.

Government actors need evidence from quantitative research, diagnostic tools, case studies, and consumer research to evaluate not only what options exist but also the likely impact of such options on financial inclusion. The development community can support government actors to focus their efforts on this new inclusive ecosystem by supporting (i) demonstration effects to crowd-in the private and social sector players needed for a vibrant ecosystem for the poor and (ii) the provision of public goods, where the private sector cannot or will not invest or coordinate (such as regulation and basic infrastructure).

A concerted effort by all stakeholders capitalizing on an unprecedented level of government interest and market innovation may make full financial inclusion a reality.

Comments

This is a great strategic

This is a great strategic piece that puts the role of governments into perspective. I am only wondering about the terminology used – “ecosystems” is normally associated with environmental issues rather than financial inclusion.

Moreover, “ecosystems services” refer to the benefits people derive from ecosystems. An associated term “payments for ecosystem services” is often deftined as economic instrument designed to provide incentives to land users, on behalf of service beneficiaries, for agricultural land, coastal, or marine management practices, that are expected to result in continued or improved service provision, so a specific user or society will benefit more broadly. These economic instruments are designed in many ways, and account for the needs / interests of the poor and financial inclusiveness, and – importantly in this context – involve an active role of the government. Since the post is not focused on this particular instrument, I was wondering about the reasons “ecosystems” was used.

Ekaterina,

Ekaterina,

I guess the financial inclusion field is borrowing from ecology, as it is easier to understand the financial system using the ecosystem. I know you know that but your concern in my opinion is pertinent and each field needs to develop its own terminology. For example, we in the financial inclusion debate should by now be talking of Finsystem or even Finclusystem. Finclusystem should be more pertinent as we are not just talking about the financial system in its raw form but finance from an inclusiveness point of view.

Good observation and if Tim picks it up and make us get used to the use, we shall be glad to build our language, as financial inclusions seems to be the last frontier!

Add new comment