Former PAYGo CFO: Smart Subsidies Can Scale Energy Financing

The solar home system (SHS) industry has seen exceptional growth, reaching millions of customers across Africa with clean, distributed energy. Playing a leadership role at two SHS industry leaders — ZOLA and Fenix International — gives me great pride, but also a feeling that we must find new ways to reach the over 600 million Africans who are without energy or financial services. In particular, the for-profit, credit-based business models used in our industry put solar energy at a severe disadvantage when competing with heavily subsidized products such as kerosene and grid connections. If the global development community believes that SHS are crucial for achieving universal energy access then we must embrace solutions that create a more sustainable balance sheet for operators and make the cost of a solar loan competitive with alternatives. Smart subsidies for pay-as-you-go (PAYGo) solar loans will level the playing field, allowing the industry to reach its long-term social and commercial aspirations.

PAYGo solar loans have been integral to the growth of the SHS industry, enabling millions of customers to acquire and eventually own their solar systems. Yet the PAYGo solar industry struggles with an existential problem: those in most need of modern energy are often those least able to pay for it. SHS providers need a way to reach the lowest income households with a credit-based energy solution without over-indebting those households and creating toxic portfolios. However, they cannot simply lower their prices. SHS providers are forced to thread the needle between customer affordability, scarce working capital, local currency risk, the danger of customer over-indebtedness and cheap generic alternatives. And they must solve this pricing puzzle while locating, acquiring and servicing low-income, rural customers who are not well-versed in mobile money or financial products.

Smart subsidies can help SHS providers reach the scale they need to compete with other energy sources, but designing a smart subsidy requires understanding the components of PAYGo pricing and how they affect customers’ behavior:

- Deposit is the upfront amount that a customer pays to acquire a system. The deposit ensures customers have skin in the game. Lower deposits lead to higher sales but a declining portfolio credit profile.

- Daily rate is what the customer pays to use the system for a day. All things being equal, a lower daily rate leads to higher use and repayment.

- Loan term determines the total cost of ownership for the customer (Daily Rate x Loan Term + Deposit = Total Cost of Ownership). Longer loan terms increase affordability but lead to lower loan completion because customers are exposed to more potential shocks and higher risk for local currency depreciation, which is the long-term trend for most African currencies.

A well-designed smart subsidy program will buy down the total cost of product ownership for customers by lowering the daily rate and shortening the loan term. This can drastically increase customer use, loan completions and portfolio quality. Maintaining the down payment limits the lender’s credit exposure while still making the product cheaper for customers, but subsequent versions could experiment with reducing the deposit as well.

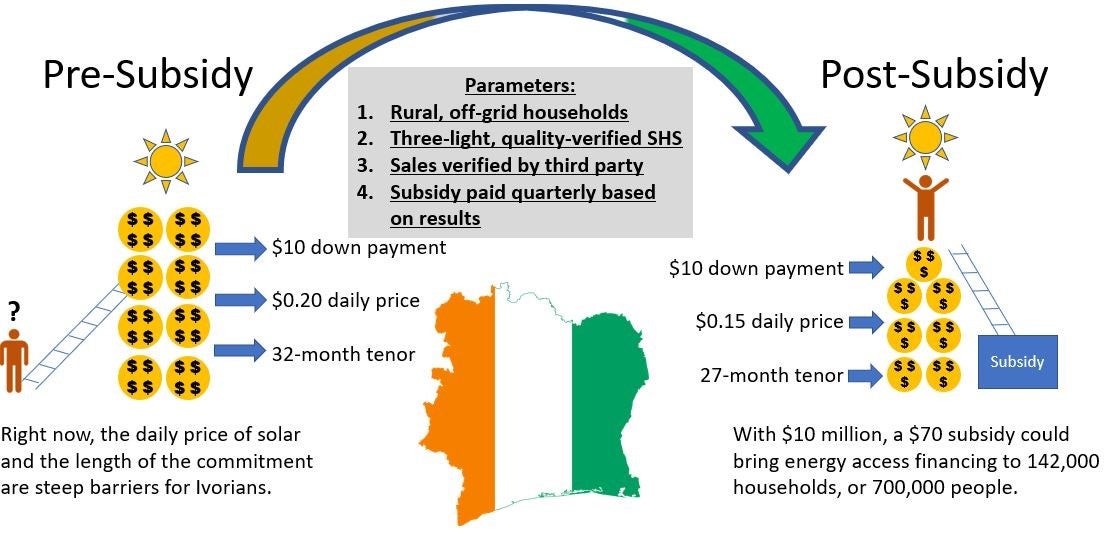

Let’s review a hypothetical example of how a smart subsidy could look like in action. Today, Côte d’Ivoire has a well-established SHS market with four major firms operating at scale. But it has been difficult for companies to gain traction in Côte d’Ivoire with a “lighting only” solar kit. This has pushed many SHS operators to focus on selling solar-powered television kits to increasingly middle-income consumers living in peri-urban areas. While providing a valued service, this does not fully encapsulate the impact goals of the sector. Using the firms’ pricing data, a $10 million smart subsidy program could be designed in the following manner:

The smart subsidy would buy down the total cost of product ownership by decreasing the daily rate and loan term while maintaining the down payment. Customers would pay less for energy and for a shorter length of time, which should increase their use of energy and help them finish their obligation. Operators, on the other hand, would take less risk on customers and have an easier time managing liabilities and foreign exchange risks.

The quarterly, results-based disbursements incentivize distributors to focus on value-add activities, such as customer sales and support, without which customers will not repay their loans and operators will not receive their subsidies. These functions are critical in delivering an exceptional customer experience and differentiating PAYGo SHS from low-quality cash competitors. Facilitating over 140,000 lighting kit sales in a difficult market will provide operators with empirical data on price sensitivity, repayment rates and average revenue per user. This data can be used to build lean, sustainable companies. The smart subsidy can phase out over time as operators acquire the scale and credit portfolio to price at market-determined levels.

In practice, smart subsidies would be designed through collaboration between governments, regulators, donors, operators and third parties who could monitor, verify and manage disbursements. The subsidies would define a geographic area and/or specific product to target, making use of industry-wide sales and pricing data to define parameters and target beneficiaries. That same data would be crucial for setting the appropriate subsidy levels to make SHS competitive with lower-quality alternatives and maximize uptake. The program would also create standards for products, service delivery and operator solvency to ensure customer satisfaction.

The SHS sector is full of passionate, mission-driven professionals working hard to solve a difficult challenge. With that said, we are not delivering the level of scale, sustainability or positive customer outcomes that will enable energy access across Africa. Smart subsidies are the solution. They can crowd market entrants into underserved countries, regions or customer segments; improve the quality of operator receivables portfolios; and free distributors to focus their efforts on providing excellent customer service. Ultimately, smart subsidies can create a stronger foundation for the entire SHS industry and enable it to continue growing and reaching more low-income customers without subsidies. Now is the time to come together to design, implement and iterate smart subsidy programs.

Joshua Romisher is an entrepreneur and former executive in Africa’s PAYGo solar sector.

Add new comment