How Are Funders Looking to Add Value in Digital Financial Inclusion?

Recent analysis of the international funding flows captured in the latest CGAP Funder Survey shows a striking difference between what funders support to advance digital financial inclusion and what they fund to advance financial inclusion more broadly. For example, funding for digital financial services (DFS) is more market-building in character than overall total funding for financial inclusion. This means that it is more likely about developing the ecosystem that supports DFS provision, rather than going directly to financial service providers (FSPs). Only 46% of funding for DFS goes to providers, compared to 86% of financial inclusion funding.

If development funders aren’t directing as much money to DFS providers to finance lending portfolios, what are they funding instead? The data suggest that there are three interesting ways that funders are seeking to create additionality in the DFS ecosystem.

- Funding market infrastructure and other support functions. About 30% of the development funding provided for DFS goes to market infrastructure – the range of functions that support, inform and enable the interactions between digital financial service providers and users. This compares to just 5% of broader financial inclusion funding for similar purposes. This makes sense: DFS is a relatively nascent market system and it takes time (and funding) to develop the building blocks.

The theories of change the funders have for these investments are generally indirect and aim to add value by enabling and incentivizing innovation from market actors. Of the projects working on the support functions in the 2019 Funder Survey, one-third relate to information infrastructure – including DFS-related research projects and data initiatives – to reduce the information asymmetries that are often a major constraint to market activity. A further 15% of these projects are helping to build payments systems, agent networks and other critical pieces of market infrastructure. A key test for the sustainability of this funding will be whether funders are able to ultimately reduce their funding as market actors are incentivized to take on appropriate roles over the long term.

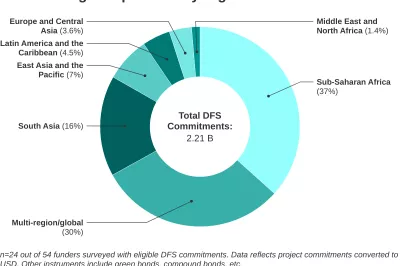

DFS funding commitments compared to total financial inclusion commitments (2019)

- Developing the investing ecosystem for DFS. Within the support functions for DFS, funders are playing a particular role in developing new frontiers for investment in DFS. While there are plenty of examples of development funders investing directly in DFS providers (particularly DFI investments in growth-stage fintechs), funders are also providing seed funding to new types of investment vehicles that can become part of the DFS ecosystem and support growth over time.

Some of these are specialist vehicles designed to pool development funds to invest in DFS – for example, Accion Venture Lab (which channels money from FMO, Proparco, MasterCard Foundation and others into early-stage inclusive fintechs). Other funds are explicitly seeking to crowd-in investors and demonstrate the potential in fledgling markets. For example, when IFC invested in Partech Africa Fund (an Africa-focused venture capital fund investing in tech-led businesses), a stated objective was “to develop the VC eco-system in Africa, which will create a stronger venture investment market in SSA.” According to the latest Funder Survey data, development funders have to date invested almost $250 million in funds that finance DFS.

At the same time, funders are supporting incubators, accelerators and networks to help the next generation of fintechs become investment-ready. Research on inclusive fintechs has found that, at seed stage, 32% of funding comes from incubators and accelerators. Funders are increasingly supporting initiatives like the Catalyst Fund, which receives funding from the Gates Foundation, the UK Foreign, Commonwealth & Development Office (FCDO), Mastercard Foundation and others to offer early-stage fintechs a combination of funding, technical support and networking.

These investments are good examples of how development funders can play a dual role of channeling capital to DFS providers and have a catalytic effect in developing the markets for future investment. But they also provide a challenge to funders - ensure that they are crowding-in investment (by encouraging and incentivizing new investors and investments), and not crowding it out (by making investments that would otherwise have been provided by the market).

- Improving the digital operations of incumbent FSPs. Roughly 12% of development funding for DFS goes to build capacity of FSPs, compared to just 4% in broader financial inclusion. A qualitative survey that accompanied the 2019 Funder Survey found the digital transformation of FSPs was the highest priority for development funders in DFS, a trend further accelerated by COVID-19. This reflects the idea that FSPs need to embrace the efficiencies associated with digitalization and the internal transformations needed to become effective digital operators. For example, when CDC invested in Kenya’s I&M Bank in 2016, part of the funding was to “set up a dedicated digital unit to implement initiatives in automation, advanced analytics and front-end solutions, hiring the unit’s leader and data scientists.”

In supporting the digitization of traditional financial institutions, funders can help these FSPs establish new models and efficiencies that can support their long-term strategies. However, these investments can be big and complex. Digitization needs to be accompanied by institutional and cultural changes, and funders may also need to support these other aspects of change management if the impacts of digitization are to be fully realized.

The fact that development funders are for the most part spreading funding across the ecosystem is encouraging, but funding such initiatives is only the starting point. In supporting DFS, funders need to continue to establish new theories of change articulating how their interventions address the root causes of structural problems that disadvantage low-income populations. Their vision can lead to systemic, sustainable outcomes at scale while recognizing that such impact might only happen in the long term.

Learn more about the CGAP Funder Survey and explore the data here.

Add new comment