Investing in Half the Sky: Funders and Women’s Financial Inclusion

Despite the famous Chinese saying, “women hold up half the sky,” women still remain disproportionately excluded from meaningful financial services, digital technologies and economic opportunities. So it is not surprising that in recent years, advancing gender equity and women’s economic empowerment (WEE) has been high on the agenda for development funders. Many funders have developed official gender-in-aid policies (e.g. France, Canada, USAID) or joined women-focused funder initiatives implemented by multilateral development banks and partners, such as the 2X Challenge for development finance institutions and the Women Entrepreneurs Finance Initiative (We-Fi).

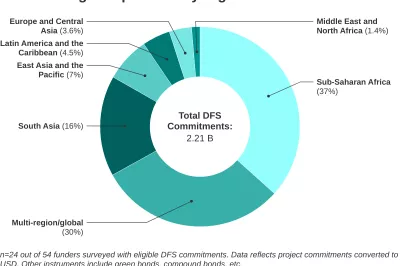

How has this momentum translated into funders’ financial inclusion activities? Approximately 10% of financial inclusion projects reported to the latest CGAP Funder Survey had a gender objective (self-reported, using the funder’s own tagging criteria), consistent with what was reported a year ago. To better understand how funders are approaching women’s financial inclusion and to map the challenges they are encountering, we conducted a supplemental survey of 30 different funders in August of 2020.

What did we learn?

1. Most funders are focused on expanding the range of suitable and meaningful financial services for women, improving women’s financial capabilities and addressing gendered barriers to entrepreneurship

For example:

- The Switzerland State Secretariat for Economic Affairs' (SECO) Women Banking Champions MENA project targets gender gaps in access to finance by helping providers “expand their offering, including financial and non-financial services, such as networking opportunities and trainings to women clients.”

- Among other objectives, IFAD’s Project for Financial Inclusion in Rural Areas in Uganda looks to empower women “through advanced financial literacy training, business development services, access to mobile money and agency banking, and linkage to outside financial services.”

- Global Affairs Canada’s Catalyzing Women’s Entrepreneurship - Creating a Gender-Responsive Entrepreneurial Ecosystem project in South Asia and East Asia and the Pacific aims to “address the particular challenges that women-owned micro, small and medium-sized enterprises face in growing their businesses, including access to finance and new technologies.”

2. Beyond their funding commitments, funders are deploying various gender-sensitive internal systems and processes to support women’s financial inclusion

At least two-thirds of the funders that responded to the survey:

- Require measurement and reporting on progress toward specific gender targets/outcomes. For example, Global Affairs Canada’s Feminist International Assistance Policy Indicators enable measurement and monitoring of progress on gender objectives (including several that directly reference financial inclusion).

- Have explicit objectives on women’s financial inclusion. These could exist at the individual project or institutional level. For example, the Japan International Cooperation Agency’s (JICA’s) Micro Finance Project for Poverty Reduction in Pakistan project defined an initial target of increasing the number of women borrowers at a microfinance institution by 38%.

- Have the ability to tag and track projects with gender components in their internal information systems. For example, the African Development Bank’s (AfDB's) Gender Marker System facilitates and systematizes gender mainstreaming in AfDB operations, tracking impact on reducing gender gaps and improving accountability on resources dedicated to gender.

3. Despite these deployments, funders report internal challenges that might hinder progress on women’s financial inclusion

The most common challenge is difficulty measuring the impact of financial inclusion interventions on women’s equality or WEE. Many of the more formal gender commitments that funders have made go well beyond financial inclusion. Funders are facing constraints around sufficient evidence and expertise to make the connection between women’s financial inclusion and broader gender objectives, and how to translate this into programming. On a more positive note, only 2 out of 30 funders indicated that gender is not an internal priority, suggesting that lack of institutional will to focus on women is not a major challenge. This indicates that funders are convinced that women’s financial inclusion is worth their attention, and the internal barriers are largely operational rather than existential.

Working together for a more equitable future

Despite positive signs that funders are organizing to deliver for women’s financial inclusion, there's still work to be done if funders are to be impactful. It’s unlikely that only 10% of financial inclusion projects will overcome persistent gender gaps, and quantity says nothing about the quality of projects or how well such projects are contributing to broader WEE objectives. Knowing what funders are looking to achieve and where they are struggling, CGAP is working to build the evidence base around women’s financial inclusion and WEE, help funders overcome their operational challenges, and share good practices with peers. For example:

- Co-Lab on diagnosing social norms. Fewer funders are focusing on more recently recognized barriers like social norms or gender-sensitive infrastructure. In this context, CGAP and FinEquity (a women’s financial inclusion community of practice convened by CGAP) are leading a peer-learning effort to diagnose social practices affecting women’s financial inclusion. This collaborative effort between AFR in Rwanda, the Bill & Melinda Gates Foundation in Bangladesh, FSDZ in Zambia, GIZ in Tunisia and UNCDF in India will explore drivers of women’s financial behaviors that are rooted in social and cultural expectations for what a woman can and cannot do in the household, community and economy. Each partner will use the findings to inform their program development processes and design social norms-informed interventions that can advance women’s financial inclusion and livelihood opportunities by creating a more equitable financial market system.

- FinEquity’s Impact Pathways learning theme. FinEquity published a mapping of relevant WEE measurement tools for financial inclusion. FinEquity is working with its members to develop a common approach to integrating women’s empowerment metrics into financial inclusion initiatives.

- A review of funders’ organizational processes and culture for impact in financial inclusion. Funders’ internal management systems and culture influence their performance and projects in the field. And when it comes to women’s financial inclusion, the survey results show that there is room to improve these processes. In this context, CGAP has introduced the Financial Inclusion Navigator, a review of funders’ organizational processes and culture to identify how they enable or inhibit funders deliver on four priority focus areas, including women’s financial inclusion. In particular, the Navigator checks whether the way funders integrate gender considerations in their financial inclusion operations are in line with their ambitions. The Navigator will help participating funders identify achievements and areas for improvement and to make concrete recommendations.

Learn more about the CGAP Funder Survey and explore the data here.

Add new comment