How Financial Services Can Help the Poor in the Climate Transition

The climate change crisis could force 100 million people into poverty and is reorienting a significant share of development funding toward climate change solutions. Calls amid COVID-19 to “build back better” are accelerating this trend. However, the role of inclusive financial services in supporting the poor throughout the climate transition is not yet well understood, and stakeholders have yet to align around common goals. Early evidence gathered by CGAP suggests that the financial sector could play a key role in helping low-income people prepare for and participate in this transition. However, greater coordination among funders and other sector stakeholders is needed to develop a well-functioning, sustainable market for climate transition financial services.

How can financial services help low-income people through the climate transition?

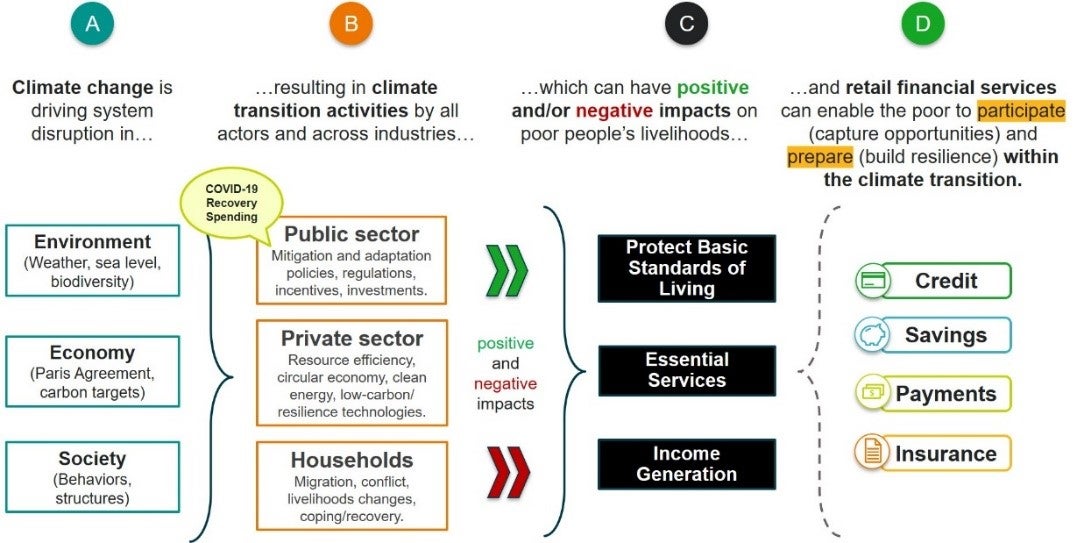

As CGAP CEO Greta Bull explained in a blog post last year, CGAP’s research going forward will focus on understanding how financial services can help low-income people improve their livelihoods in three key ways: generating income, accessing essential services, and protecting basic standards of living. Recently, we have been asking how climate change affects the ability of the poor to achieve these livelihood outcomes and what role financial services can play in helping them overcome disruptions associated with climate change and efforts to transition to low-emission, climate-smart economies.

To answer these questions, CGAP reviewed existing literature, interviewed experts and developed a narrative that offers a framework for further research and development. The narrative builds on the assumption that poor people’s livelihoods are not only affected by changes in their natural environment, but also by the positive or negative impacts of climate transition activities undertaken by public and private sector actors.

Our research has revealed numerous examples of how financial services help low-income people improve their livelihoods during the climate transition:

- Protecting basic standards of living. Food supply volatility, migration, conflict and other shocks related to climate change will require transition activities in many areas, such as data climate systems, resilient housing, enhanced social safety nets, price stabilization tools, and services for displaced communities. Savings, loans and insurance products can help the poor to absorb shocks and anticipate the impact of public and private sector-led transition activities. For example, in Kenya, households with index-based livestock insurance coverage had a lower rate of livestock sales made under distress and were less likely to reduce food consumption after a negative weather event. Around the world, payments services have helped governments to distribute social assistance to people affected by natural disasters.

- Accessing essential services. Climate change is affecting key sectors that provide or enable access to essential services for the poor, including energy, transportation, infrastructure and communications. Innovations in PAYGO technologies and community energy finance are creating new financing models for low-carbon and distributed energy solutions. For example, M-KOPA has introduced super-efficient fridges into solar home systems, saving households both time and money. We have found fewer examples of how financial services can enable access to other climate resilient essential services like water, sanitation and health care, and these could be explored further.

- Generating income. As key industrial sectors undergo massive transformation and economies move toward climate-smart, low-carbon industries, jobs incompatible with the transition will become obsolete. New, low-carbon jobs will require financing for both reskilling and technology upgrades. Cleantech, for example, is an estimated $6 trillion market opportunity in developing countries. Programs and products like EBRD’s Green Economy Financing Facility, which extends technical know-how and credit lines to help small and medium enterprises invest in cleantech, or Pula’s bundled input insurance product to incentivize and protect farmers to switch to resilient seeds, will need to scale up massively to ensure low-income people can continue generating income in the climate transition.

Strengthening the market system for climate transition financial services

There is a growing market of climate transition financial services. A variety of funders and sector organizations are actively researching customer needs, supporting financial service providers, strengthening market support functions through capacity building and market research, and promoting regulatory and policy action, such as green finance standards. However, many financial services that can enable the poor to participate in and prepare for the climate transition are not marketed as such. More can be done to leverage existing solutions and develop new ones.

Our research indicates a need for greater coordination among funders and other sector stakeholders to jointly support the development of a well-functioning, sustainable market for climate transition financial services. We also see a need for additional market research to better understand customer needs and quantify market opportunities; more capacity building for financial services providers, clean tech actors, and policy makers; and opportunities to learn from the early experiences and business models of financial services providers that are offering climate transition-related savings, credit, insurance and payments products.

This research will help CGAP engage with funders and sector stakeholders to further build our shared understanding of how inclusive finance can contribute to a smooth and just climate transition for the poor. For more background research on the intersection between climate change, livelihoods, and financial services , please see this slide deck.

Add new comment