Instant, Automated, Remote: The Key Attributes of Digital Credit

The expanding number of digital credit services has been headlined by the amazing early story of M-Shwari out of Kenya, which launched in 2012. But there has been a further wave of services many of which have been launched as recently as 2014 and 2015. This includes M-Jara in Cote d’Ivoire, M-Pawa in Tanzania, and Kubo in Mexico, to name just a few examples. Many of these are in Sub Saharan Africa where digital payments are more widely used, but several deployments are emerging in Asia and Latin America as well.

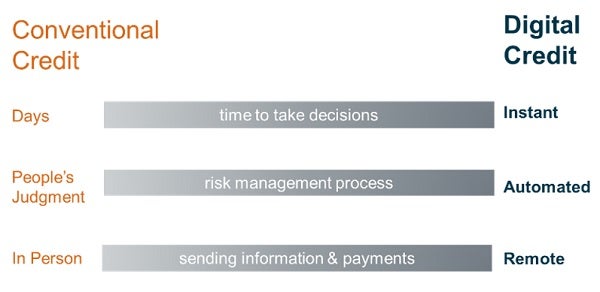

What is it that differentiates the new digital credit models from typical consumer credit options, or even microfinance, which has been around for 40 years? While digital credit has many of the same considerations as conventionally delivered credit, we hold that there are three key attributes of digital credit that differentiate it from traditional credit products: —instant, automated, and remote. These three attributes, when combined, underscore the power of digital credit and its ability to scale quickly.

- Instant. Leveraging the availability of digital data on customers and the speed of the digital channel; digital credit happens fast. Moving from an application to a credit decision happens within seconds or at most within 24 hours. The disbursement and collection of loan payments happens digitally and therefore very quickly. The instantaneous nature of the service means that it can be configured in new ways to be offered at the moment of need and for loan repayments to be made at opportune moments for the consumer. Speed also means loan terms can be very short; in some cases a matter of days or hours is possible.

- Automated. A customer’s journey from registration to application to eventual repayment requires decisions about credit limits, customer management and collections. Digital credit services make each of these decisions automated based on preset parameters. These parameters may evolve over time but case-by-case decisions are highly automated. This automation allows services to move quickly and to scale fast.

- Remote. This can remove (or greatly reduce) many geographical or infrastructure requirements. Instead of requiring a trip to a bank branch, digital credit transactions such as loan applications, disbursements, and repayments (or deposits) can be managed remotely. This functionality is made possible with strong national identification infrastructure already in place, for example to allow remote account opening Communications with the client can be handled over the phone through messaging and call centers, including repayment reminders and partial repayments that may have been too costly to be practical in traditional credit delivery models. Remote verification also is a critical risk management tool for digital lenders—who often lack robust information on borrowers before the initial credit offer is made.

These are powerful new attributes that allow for rapid scaling and also the ability to reach new unbanked people without having to build a costly brick and mortar infrastructure.

But we also ought to pause to consider other facts. The same attributes of speed and scale that power digital credit will also create some new risks and exacerbate longstanding ones long associated with credit. We are faced today with an important question - how can we harness the best that digital credit has to offer?

In the coming months CGAP will share findings that explore these questions in greater depth. We aim to provide more insight into how digital credit works and what it takes to deliver. We aim to provide more case examples of new digital lending products to learn from and document good practices. Based on this research and evidence base, we aim to offer up new proposals about how the power of digital credit can be maximized for responsible financial inclusion.

Listen to Greg Chen discuss digital credit in an episode of The CGAP Explainer podcast:

Comments

Excellent Post! Digital

Excellent Post! Digital Credit is going to be the biggest revenue generator for many DFS deployments struggling to arrive at a suitable business case. DFS players have a goldmine of customer data (savings history, transaction history, remittance history, bill payments history, etc.), which if analysed properly can facilitate offering new and innovative products to the end customers. Robust credit scoring tools can be designed using such data.

In the "Instant" attribute part, we can also talk about pre-approved loans based on customer's transaction history. Eagerly waiting for your next post on this subject!

Add new comment