It’s Not Quantity but Quality: Consumer Research from Brazil

CGAP recently helped Bradesco, one of the largest banks in Brazil, to partner with award-winning global design firm IDEO to help design and develop a payments product that better serves the needs of C,D,E class. Bradesco had already developed a new payments product and was ready to pilot, while IDEO‘s objective was to test whether this product met the needs of this market segment and if they could help improve the overall product design in terms of consumer uptake and financial viability.

Is one of Brazil’s largest banks and a prominent design consultancy a match made in heaven? To find out, CGAP witnessed IDEO in action during their consumer research. IDEO is known for its unique approach to conducting interviews and its innovative tools and techniques that are different from traditional market research. Through our API work in Mexico, we had learned that the non-profit arm of IDEO (Ideo.org) used abstract drawings known as “sacrificial concepts”, which enabled more nuanced answers from consumers and helped link to better designed products catered to their needs (see here for more information).

Photo Courtesy of IDEO

Similar to the Mexican experience, IDEO targeted a small sample of well-segmented consumers in Brazil (12 individuals) and conducted in depth two-hour interviews. Repetitive trends and patterns among consumers begin to emerge after a certain threshold of interviews, and therefore the marginal value of interviewing additional customers appears to diminish. Below are some of the most interesting insights that stood out in terms of process and techniques utilized during this first stage of field research:

Protocol and Structure:

- Each interview was conducted as “informally” as possible with the purpose of making an emotional connection with the consumer. The interview was treated more as a casual conversation amongst friends rather than anything more formalized. Our translator was asked to translate every detail as effectively as possible (including jokes and chit chat), as this helps reach an essential emotional connection with the consumer . In order to make this connection, time was spent in the beginning asking conversational questions such as “what do you for fun?” Their answers to these questions often enabled seamless transition into talking with the consumer about personal matters such as their family situation, their line of work and ultimately salary and other more “uncomfortable” financial issues.

- Once conversations got going, we would record every single word/sentence/interesting quote to possibly dissect it in detail later. The reason is that an insight which may not seem particularly interesting during the conversation could in fact turn out to be later on. Especially at this stage of the process, our pre-set assumptions and biases must not cloud what we ultimately record in our notebooks. We were also asked to observe a consumer’s emotional reactions as well as more subtle body movements/language, since these reactions often provide useful fodder for further analysis later.

Diagrams:

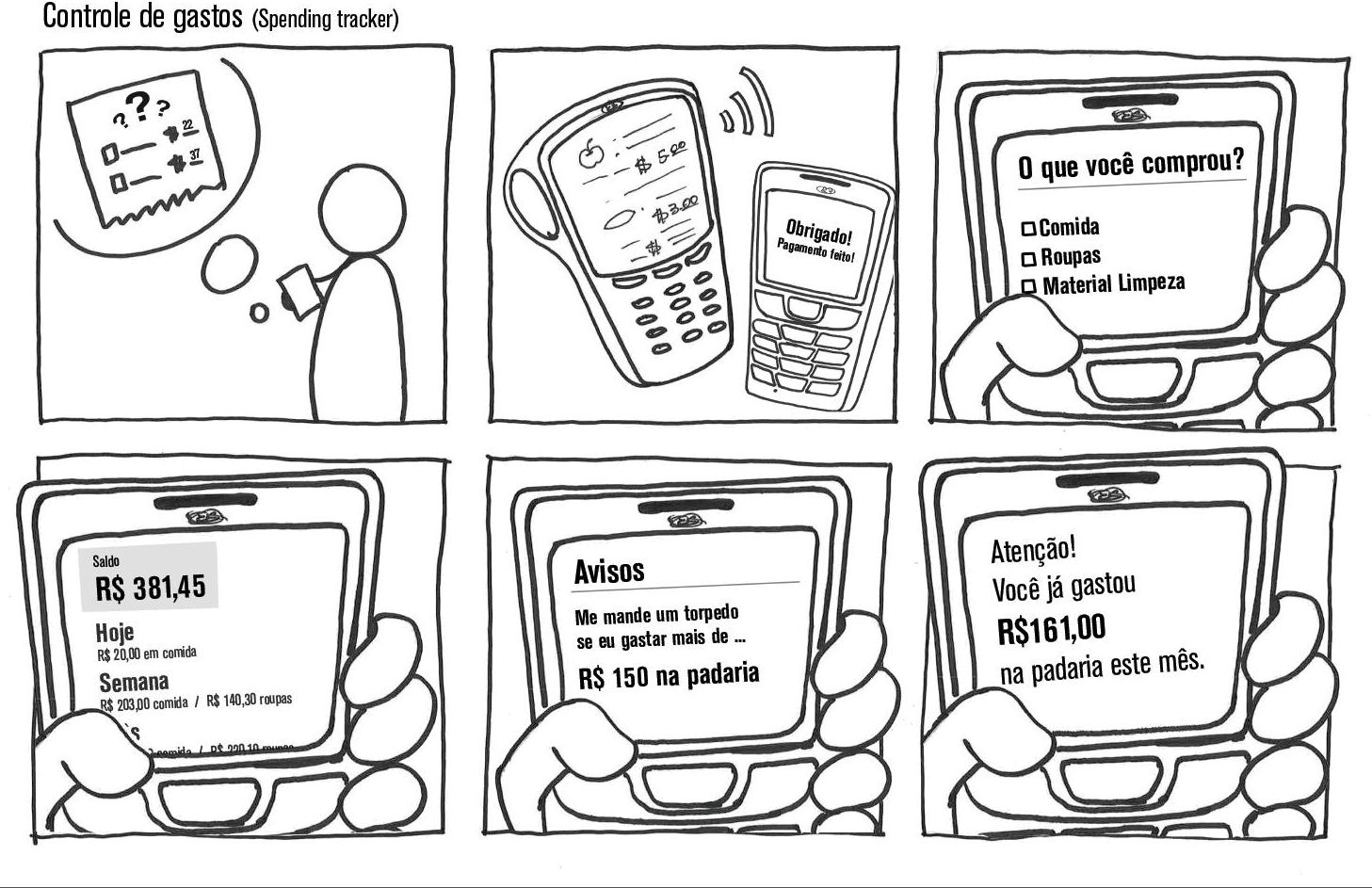

- A variety of “diagrams” were used to gather information, in a logical and sequential way depending on how the conversations evolved. These visual tools not only helped consumers have full clarity on what exactly was being discussed, but also allowed them to take a step back and provide a broader perspective by detaching themselves from their personal experiences. This allowed consumers to digest the issues and better reflected and translated their own experiences. Interestingly and unlike our API work in Mexico, the Brazil team in this first round of field research had already mapped out and drawn14 potential product concepts, and solicited feedback on each one (see image). While reactions were sought for each individual product concept, the reactions would be used as a way of refining the existing ones and creating new designs for specific themes echoed throughout. Additional reactions would be sought for the modified concepts in the second and final round of field research.

- When shown the various product concepts, the consumer sometimes asked clarification questions such as, “How is the money on the phone kept safe?”, Is there a fee and how much?”, “Will I get a paper receipt or some kind of text confirmation?”. Instead of answering the consumer’s questions and therefore imparting IDEO’s own thinking on the consumer, their answer almost always was, “what do you think it should be?” “How do you think it should work?” There was deliberate care not to feed any pre-set opinions onto the consumers, but rather the onus was on them to envision the concept according to their preferences.

While the insights from this initial consumer research were integral to designing final product concepts, the next challenge is to translate those customer insights into the correct product ideas and prototypes for testing. After each interview, customer stories and insights were put into colored flashcards – which were later grouped into different themes and categories. In these flashcards, special emphasis was given to “direct quotes” and real-life “stories,” so the customers’ original insights were not lost in later iterations.

This experience reminds us that that there are a variety of tools and techniques for conducting consumer research: quantitative vs. qualitative, large vs. small sample size, focus groups vs. individuals, market survey questions vs. deeper and longer conversations with a limited sub-set of target consumers. We should not overlook the fact that a branchless banking provider may receive valuable and more nuanced consumer insights from deeper conversations, though they may find it an unaccustomed methodology of doing their market research. Our experience has shown that time and again, insights from low income, un-banked or de-banked consumers are often not sufficiently and effectively gleaned before financial products aiming to target them are developed. Hence, these tools and techniques can be a simple yet effective way for companies to reinforce their existing insights collected from a target market. Or perhaps more likely, get better insights and avert the possibility of product failure later on.

For a Portuguese version of this post and other resources in the field of financial inclusion in Brazil, please visit the blog “Inclusão Financeira”. This blog is a joint effort by CGAP and the Centro de Estudos em Microfinanças (CEMF) at Fundação Getúlio Vargas

Add new comment