Lessons from Aggregator-Enabled Digital Payments in Uganda

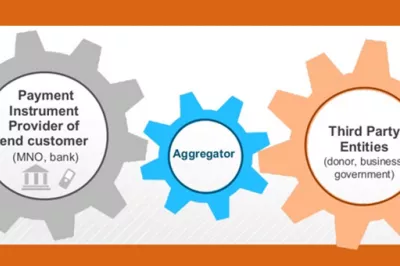

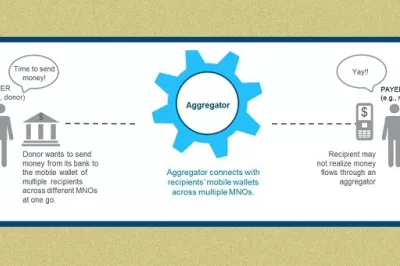

Bulk digital payments are gaining momentum in East Africa. An increasing number of businesses are digitizing salary payments to employees while donors and governments have begun digitizing payments to recipients. This movement from cash to digital payments in the region is being assisted by payment aggregators. As described in CGAP’s deck on aggregators, they facilitate payments into customer mobile wallets across multiple mobile network operators and sometimes even into multiple payment instruments, e.g. mobile wallet for some customers and bank account for others. This allows customers to choose how they want to receive payments.

The impact of digital bulk payments goes beyond customer convenience. Digital bulk disbursements bring significant short and long-term benefits both to the payer and the payee. Consider an agri-business company trying to pay thousands of farmers for the season’s coffee produce. Carrying sacks of cash and administering payments in far flung areas is a constant risk this company bears. Additionally, the payees are also susceptible to risk of theft or loss. By paying thousands of people instantly via digital finance through an aggregator this risk is eliminated for a small price (typically less than 2% of the total value of transactions). E-money now enters the ecosystem at low cost and at scale, connecting thousands of customers that were financially excluded from the formal grid via their digital wallets.

Unfortunately, aggregators are still struggling to make profits from this business segment due to the high costs of customer acquisition and service provision, and still low volumes associated with bulk disbursements.

To understand factors impacting aggregator profitability regarding digital bulk disbursements, we took a close look at a 2013-2014 pilot in Uganda, where six USAID funded organizations tested digital payments to end recipients via payment aggregators. The study of this pilot (commissioned separately by the Bill and Melinda Gates Foundation and the Better Than Cash Alliance) was conducted by Vital Wave Consulting. The study estimates that about $200,000 was successfully disbursed in digital bulk payments to 1,392 beneficiaries over an eight-month period. Listed below are some of the key learnings from the pilot.

Lessons from the pilot in Uganda:

1. Aggregator capacities are limited when it comes to bulk disbursements: Not all aggregator platforms are technically equipped to administer more than several hundred disbursements at one go. This may not necessarily be a limitation for businesses trying to disburse salary payments on the first of the month, but it does pose a challenge for time-sensitive, simultaneous large volume payments like pension payments. Large bulk collections from people to third parties, on the other hand almost never occur simultaneously. Utility bill payments are a good example. Customers of a utility are typically on different billing cycles and have the flexibility to pay any time before a due date, all of which help stagger payment collections through an aggregator’s system.

Operationally some aggregators, most of whom are small start-ups, have low human bandwidth -- directly impacting their ability to train government and donor personnel on using the backend system and providing 24*7 customer support. This situation is improving rapidly, as there are currently aggregators in the market that provide effective 24*7 customer support.

2. Aggregators in the region are vulnerable to mobile operator and bank processes: Mobile Network Operators (MNOs) hold the reins when it comes to digital payments. For example, MNOs in Uganda set aggregator mobile wallet size limits, meaning they impose a ceiling on the total value an aggregator can disburse at any given point in time. Depending on the size of each transaction this limit influences the volumes that aggregators can administer. Aggregators are also subject to inconsistent process timelines of both banks and MNOs. Settling payments from a donor bank account to an MNO bank account can take up to 3 days, while internal MNO processes can delay the crediting of aggregator mobile wallets or the resolution of pending payment issues. Going forward, these hurdles can make digital bulk payments challenging to employers, donors, big businesses and other big payers.

3. Current aggregator pricing models are unsustainable: MNOs and aggregators in the above mentioned pilot in Uganda were paid a total introductory fee of $0.20 per transaction by donors. This extremely low, flat-fee is not an uncommon pricing structure for most aggregator services and is typical to bulk payments. As mentioned in the previous blog post, aggregator commissions are primarily determined by MNOs, leaving them with little leverage.

Scalability of bulk payments is in everyone’s interest. MNOs experience higher volumes of payments flowing through their systems when people can receive bulk payments through their mobile money accounts, while large payers lower their risk and administrative costs of cash disbursements. In the current ecosystem, aggregators fill a necessary void. They not only facilitate payments across networks but also help bulk payers by streamlining their reporting and reconciliation requirements, while providing other important value added services. From a digital financial ecosystem and innovation point of view, a robust and thriving aggregator industry might be crucial. At the very least, aggregators provide a bridge between payers interested in accessing digital financial services and the MNOs, many of whom are unable to provide the type of in-depth and intensive customer support aggregators offer. Ensuring aggregators are able to fill this crucial void will require banks, MNOs, and aggregators to collaborate, think long term and come up with rational pricing models and process flows that incentivize all stakeholders of the digital financial services ecosystem.

Comments

An interesting read and very

An interesting read and very needed innovation in the DFS ecosystem, especially where interoperability is an issue. But Payment Aggregators should get creative in their business model by creative additives as product and service layers to boost profitability.

Low income from such transactions isbusually the norm as collaborations also connotes income sharing byball parties and the disbursement beneficiaries cannot be overburdened by high transaction charge.

It will be interesting to see regulators in all countries make room for this in the DFS ecosystem.

Add new comment