From Micro To Small: Do MFIs Have The Capacity To Serve Small Enterprises?

Many policymakers are focusing a lot of attention on small enterprises, in the hope that they could play an important role in creating much needed jobs. Also, many donors and investors view small enterprises as potential investees and engines of private sector growth.

Do MFIs have a role in delivering finance to these small enterprises?

Are they an important piece in the puzzle of providing better access to finance to small enterprises so that they can, in turn, grow and provide jobs?

To find out, CGAP surveyed over 300 MFIs in 69 countries December 2011. We also conducted interviews with selected MFIs and their networks to find out if and why MFIs are interested in serving this market segment. We asked about their motivations, obstacles and success factors for serving small enterprises, their risk assessment methodologies, and their internal capacity (staff resources, management information systems, etc.).

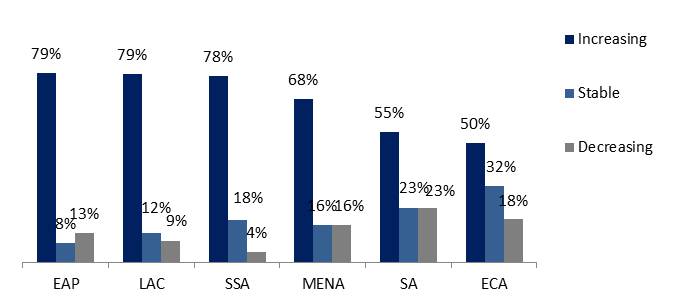

To our surprise, 78 percent of the interviewed MFIs reported that small enterprises (those with less than 20 employees) are already part of their strategy, and almost 70 percent expect to increase their small business portfolio. MFIs see small firms as business growth opportunities and investing in them as a way to cultivate long term clients. East Asia and Pacific (EAP), Latin America and the Caribbean (LAC), and Sub-Saharan Africa (SSA) have the most MFIs whose small business portfolios are increasing. In contrast, the small business portfolios of MFIs in Europe and Central Asia (ECA) and South Asia (SA) seem to be more stable (Figure 1).

Figure 1: Growth trend of MFIs’ small enterprise portfolio by region (percentage of MFIs surveyed)

Source: CGAP MSE Industry Survey 2011.

Small enterprises are clearly part of MFIs’ portfolios already. But how are MFIs serving this new market segment? Do they have the capacity needed? Is their product and service mix offering suitable for the needs of small businesses?

The answers were quite mixed. Most of the surveyed MFIs appear to be using their existing staff, risk management, and monitoring systems to serve this new client segment.

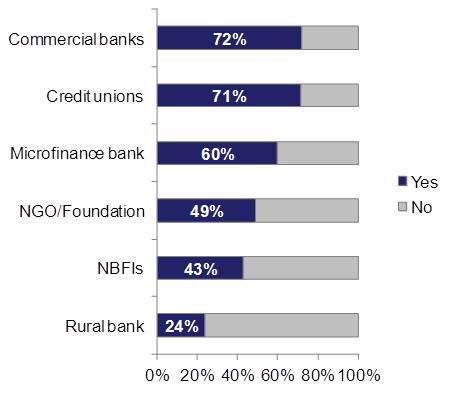

Many providers (51 percent) do not have separate methodologies for micro and small enterprise risk assessment. Non bank financial institutions (NBFIs) and rural banks seem particularly poorly prepared for the risks of small firms compared to other types of other providers (Figure 2). On the other hand, recent research with banks that have small business portfolios show that those that are high performers in terms of Returns on Assets (ROA) conduct additional “validation” checks for small businesses with weak financial records; they underwrite on average 7 times faster than low performers, and allocate more time to monitoring the small business portfolio (Small Business Banking Network, forthcoming)

Figure 2: Separate small/micro risk methodology by institutional type

Source: CGAP MSE Industry Survey 2011.

Most MFIs do not yet offer the variety of credit, savings, payment and insurance products needed by small firms. For example, less than half of the MFIs surveyed can offer overdraft facilities, transfers, or payment services. Similarly, almost 60 percent of the interviewed MFIs do not have dedicated staff or a department to serve small enterprises, which is a common success factor among mainstream commercial banks that are leaders in the small business market.

So, are MFIs ready for this new market segment?

MFIs have some advantages to serve small enterprises that they should use wisely. Compared to commercial mainstream banks for example, MFIs may have closer relationships with their customers, making it easier for them to overcome the “opaqueness” of small business clients (i.e., difficulty of ascertaining whether small enterprises have the capacity and the willingness to pay). MFIs often have faster lending procedures and require less collateral than their competitors. Finally, MFIs can reach customers who do not have access to banks or who face serious obstacles, such as their own informality or high bank fees.

There is no reason to believe that MFIs cannot effectively serve both micro and small clients. Yet, adding on a new segment successfully requires preparation, including new data, tools, and capacity. MFIs considering adding on the small enterprise client have much to learn from those before them that succeeded and perhaps even more so from those that failed.

For more information you can refer to the recently released focus note “Financing Small Enterprises.”

Comments

John Gutin

A key aspect regarding the actual risk of the small enterprise market for MFIs is whether they enter this segment by growing their offering along with existing portfolio clients needs or if they specifically target new small enterprise clients. In my experience, the latter approach has not worked very well for MFIs that have no prior experience with the small business segment.

Thank you John. We also heard

Thank you John. We also heard this from several MFIs during our research. Targeting new small business clients without adequate internal capacity and experience can be a risky strategy.

Raj, we did not come across a study that attempted to evaluate the impact of different funding sources on SMEs.

Add new comment