Private Sector Stepping Up Leadership in Financial Inclusion

Conventional financial services and institutions do not reach half of the world’s working-age adults. This is a massive market failure, because the underlying demand is there. The excluded half of the world are actually very active managers of their financial lives.

Here is how. Poorer households in developing countries and emerging markets typically live and work in the informal economy. In economi terms, they are producers and consumers at the same time – not by choice, but by necessity. As a result, they lack regular income streams and job-related protections and they have to use a broad range of financial services to create self-employed livelihoods, build assets, smooth consumption, and manage risks. Without access to formal financial services, they are forced to turn to the age-old informal mechanisms such as money under the mattress, rotating savings clubs, money lenders and pawnbrokers, which can be unreliable and very expensive.

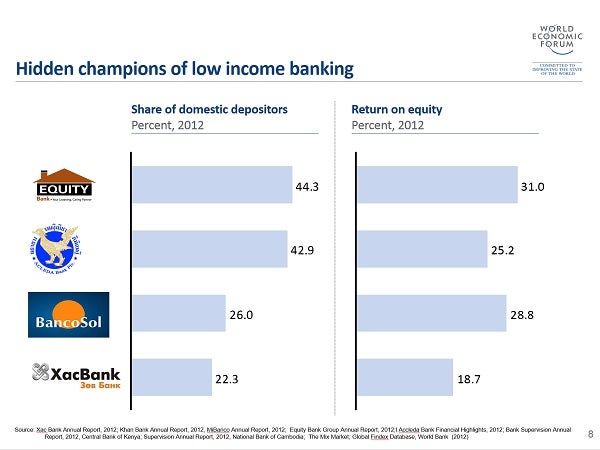

The private financial sector in many developing countries is increasingly recognizing and seizing the opportunity of reaching the other half of the world. Banks like Equity in Kenya or Acleda in Cambodia, for example, have introduced modern retail banking to the low-income majorities of their domestic markets. As a result of their market development leadership, they account for a large share of domestic depositors, and their business models have proven very profitable. Similarly, low-cost electronic retail payments systems, mostly via the mobile phone, have taken off in those countries, where regulators allowed for such innovations. The iconic success of mobile money is M-PESA in Kenya that reaches more than 80 percent of the adult population and has spawned numerous innovations riding on an essentially ubiquitous national, mobile retail payment system.

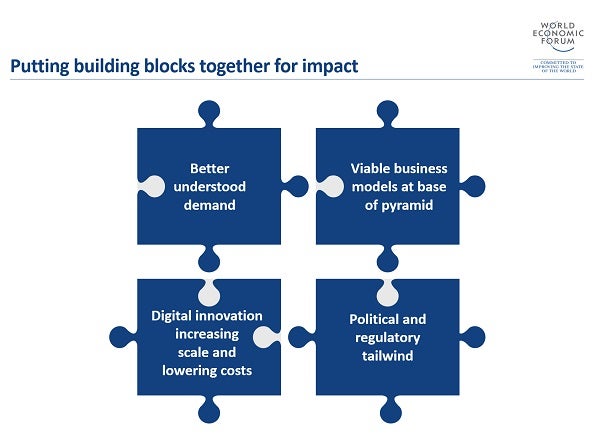

The puzzle pieces to dramatically expand the reach of formal financial services to the poor are on the table: increasingly better understood, latent demand; successful examples of viable business models; technology-led innovations that significantly reduce transaction costs; and political and regulatory tailwind with almost 50 countries having made public commitments to advance financial inclusion in their home markets.

On the sidelines of the World Economic Forum in Davos last week, some 60+ private and public sector leaders expressed their commitment to put these puzzle pieces together for real impact. At a meeting convened by MasterCard CEO Ajay Banga and the CEO of the International Finance Corporation (IFC), Jin-Yong Cai, they started to put together what it would take to reach half of the world which is financially excluded. The consensus was that progress must and will be made if new services are developed that truly meet the needs of poor households and small enterprises; if the industry works together to jointly develop the new market; and if the public sector helps with the right supporting policies.

Governments play an important role in financial inclusion, not just as regulators. They can provide essential infrastructure such as the National ID system India is developing that increases access for consumers and helps financial institutions reach new markets. Governments can also take advantage of new payment mechanisms when paying salaries to public servants or making social transfer payments to poorer families. As a result, they can link many poor households to the formal financial system for the first time.

While governments play a crucial role, private sector leadership as demonstrated in Davos, is required to reach the other half of the world with the formal financial services they need. For example, the IFC estimates the funding gap for the global micro, small, and medium enterprise sector to be in the order of $2+ trillion. Only sustainable, domestic, deposit-driven market development can meet the magnitude of the financial inclusion challenges we face.

Add new comment