Understanding Microcredit Interest Rates in East Asia

Like in other regions, discussions on interest rates are always sensitive. While we all desire that the poor pay less than we do for our own loans, serving the poor with responsible and sustainable financial services is costly due to the multitude of small transactions that defines microlending.

The new CGAP publication Microcredit Interest Rates and Their Determinants sheds a lot of light on the evolution of microcredit interest rates between 2004 and 2011. This paper tells us some interesting things about interest rates in East Asia and the Pacific (EAP), but there are some specific considerations about East Asia that also deserve some attention.

A farmer stands next to a field holding an umbrella.

A farmer stands next to a field holding an umbrella.

Photo Credit: Stephen Gauebl

What does the paper tell us about microcredit interest rates in East Asia and the Pacific?

Firstly, it is encouraging to see that the interest yields of the sampled MFIs have decreased substantially between 2004 and 2011 in East Asia and the Pacific (EAP). With an average yield of 26% in 2011, the region has seen some of the steepest declines in interest yield, alongside Africa.

The paper also provides an excellent lens for analyzing the four drivers of interest rates. For example, in East Asia is similar to other regions in that operating expenses (i.e. staff, transport etc.) remain the most important driver of interest yield. These operating expenses have gone down from 24% to 15% of average loan portfolio between 2006 and 2011. While it is important for us to understand the other drivers of interest rates, such as profits, loan losses, and financial expenses, these factors haven't changed much in the past few years in EAP and don’t influence the cost of microcredit to the poor as much as operational costs.

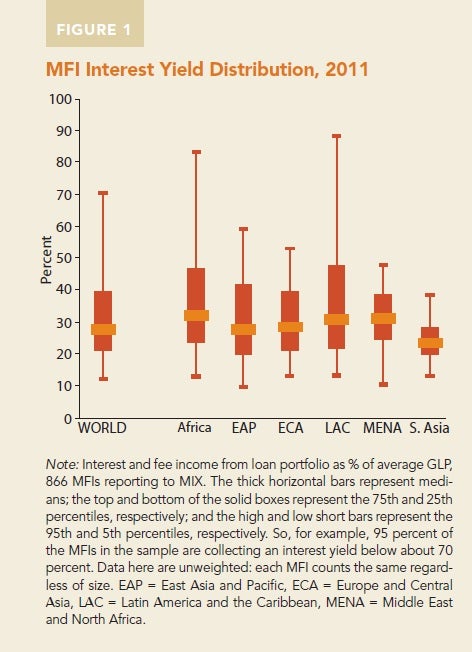

One of my most important takeaways related to East Asia from the paper is that “the devil is in the details." Microlenders come with a huge variety of interest rates depending on whether they target the poorest, are for-profit or not for-profit, regulated or non-regulated. These factors determine their business models and therefore their cost and pricing structures. Figure 1 in the report (copied below) shows that interest yields vary from 10 to 60 percent in the region. The information on the Philippines in figure 15 shows that the smaller the loans the higher the interest rates, due to high operating costs. As Rich Rosenberg says: “it usually costs more to lend and collect a given amount of money in many small loans than in fewer big loans."

What are some other important considerations to understand microcredit interest rates in EAP?

As explained in the methodology, the sample used for the research focuses on microlenders that aim at becoming sustainable. In East Asia, many poor people actually pay lower microcredit rates than those presented in the publication, due to the prominence of very large state banks that often (though not always) provide subsidized microcredit on a massive scale. In the largest markets in East Asia, state banks are the main providers of microcredit, and private MFIs are under-developed compared with other regions. In China, the People’s Saving Bank of China (PSBC) serves one Chinese out of three and the Rural Credit Cooperatives, often affiliated with local governments, are the main providers of microfinance as per a recent CGAP report. In Thailand the State banks such as Government Savings’ Bank of Thailand and Bank for Agriculture and Agriculture Cooperatives (BAAC) are the largest providers of financial services to low income populations. In Vietnam the Vietnam Bank for Social Policies (VBSP) is the largest provider of microcredit. Based on my observations, these state banks often lend at rates that are half or a third of “sustainable MFIs." These public institutions have largely contributed to expanding financial inclusion, but they create a difficult competition for private MFIs, especially when combined with government interest rate caps as is the case in Vietnam, Thailand and Myanmar for example. One can also wonder what may happen to their clients if the government discontinues the subsidies.

Another particular feature in the region, possibly partly related with the pressure described above, is the fact that in several countries some MFIs charge flat interest rates. As we all know flat rates do not provide an accurate idea of costs to the clients, and more transparency is desirable. But transparency will be difficult for MFIs in environments with strong policy pressures for low interest rates.

Even at current interest rates there is still a large potential demand for microcredit in the region.

There are still 73% of adults living on less than $2 a day in EAP who don’t have access to a bank account and many more who do not have access to credit. The relatively low number of large private MFIs in EAP means that the huge number of poor people who are not served by state banks continue to have only one source of microcredit available to them when their family or friends cannot help them: moneylenders. These moneylenders charge close to 100% per annum if not more in most of the countries I know in the region, nothing close to the rates highlighted in this publication unfortunately.

While interest rates from MFIs are higher than state banks in EAP, with hundreds of millions of poor people without formal access, there is room for MFIs to expand. They provide a good alternative to money lenders, and they often offer better services than some of the state banks. Many MFIs in the region provide services at people’s doorstep, which also means less transaction and opportunity costs for the poor than with a bank. Such costs also need to be taken into account.

----- The author is CGAP's regional representative in East Asia.

Comments

Dear Eric Duflos

Dear Eric Duflos

Two basics need to be appreciated in regard to micro credit interest rate before doing contextual analysis 1) whether it is ‘the cost’ or ‘the access’ that matters from poor clients’ perspectives? 2) If latter matters , the interest rate analysis has little value regardless the means of delivery and the incentives (subsidy) We had enough deliberations on interest much earlier in this blog ( Rich Rosen berg postings and responses)

Contextually in South East Asia, the status of MF client is not transparent – is it for rural people ( poor + non poor) or exclusively for rural poor /poorer. Many time the latter is camouflaged under the generic term ‘Rural people or low income clients. The information asymmetry on MF clients leads to complication in international comparison(MIX) and ambiguity in the extent of inclusion or exclusion of the vulnerable poor contextually.

It is universal truth that operating cost for ‘small loan’ is high for any institution . But does this factor act as barrier for financial inclusion? It needs to be probed for challenging this factor for making the candid poor gain inclusionary benefits .

Dr Rengarajan

Thank you, Eric. This is a

Thank you, Eric. This is a most interesting study.

Analyzing the cost structure of microcredit operations during the period revealed that the portion of the operational expenses is declining. I guess this is related to an expansion of the business as a whole, which has reduced the average overhead per loan with the increased total loan portfolio. Meanwhile, statutory costs like loan loss provision remained unchanged proportionate wise, as it is required in line with the growth of the loan portfolio.

There is still an ample room for the efforts to set up the benchmark of the interest calculation. Applying a fixed interest rate against the notional unchanged loan principal, while a typical microcredit goes with amortization of the principal amount, is misleading. Further, how to deal with compulsory deposits, front end fees and other charges should be clarified and standardized to enhance the pricing transparency for the sake of the customer protection.

In this regard, recent Philippine microfinance industry’s efforts are commendable, where BSP (the Central Bank) took an initiative in working together with the Microfinance Council of the Philippines, the leading association of microfinance-involved financial institutions, in developing the common interest rate calculating methodology that diverse types of microcredit operators, i.e., banks, NGOs and cooperatives, have to follow.

Excellent blog.

Excellent blog.

It is great to hear that interest rates have come down in the EAP region and that it has had the steepest decline along side Africa. Hopefully as there are further efficiencies rates will continue to come down providing more affordable services for clients rather than MFIs maximizing profits.

Are the interest rate calculations taking into account all the costs such as forced savings which greatly increases the actual rate people pay? Microfinance Transparency would certainly shed some light on this.

Still unfortunate that as an industry those receiving the smallest loans are still paying the highest rates. It makes sense due to the higher operational cost. Hopefully technology will play a role to make small loans less costly for those who need them most.

Add new comment