Unintentional Consequences: Branchless Banking In Ghana

Ghana should be a ripe market for mobile money. It is one of the world’s fastest growing economies and a handful of providers have been aggressively competing and investing in mobile money for several years now. Yet, as CGAP has written about before, the market has been slow to take off.

Ghana Market Seller

Ghana Market Seller

So, how have the guidelines influenced the development of the market? In the four years since the guidelines were issued, three significant mobile money services emerged – Airtel Money, MTN Mobile Money and Tigo Cash – and each has partnered with between 3 and 10 banks. However, the guidelines have unintentionally distorted incentives for providers and do not match conditions on the ground. Banks by and large have declined to play almost any of the roles that the regulations envisaged. They hold the float in a pooled account, are legally responsible for agents and customer KYC and their branches provide passive support to agents in liquidity management. However, there is little incentive for banks to make any significant investments due to free rider concerns. In some ways, the guidelines had the opposite effect as intended – the more banks there are in each partnership, the lower the motivation to invest is and, ultimately, service to customers suffers.

Instead, MNOs have by and large been leading the mobile money services. They are developing the technology platform and front-end product, building the agent networks and investing in marketing. They face several major challenges. First, they are shouldering the vast majority of investment yet legally the service is bank-led and banks own the customer and the agents. In the words of one senior manager, ‘We’re building the industry but they’ll own it.” This is a risky position to be in. Second, they are wasting an incredible amount of time and energy trying to manage and cajole multiple reluctant bank partners. This impacts everything from cajoling banks to allow branches to be used for liquidity management to making product development decisions. One MNO told us that only one of their bank partners was willing to offer interest on a mobile savings account. How should they persuade the other bank partners to also offer interest and, if they are unsuccessful, do they need to drop the idea altogether? Finally, the MNOs have no direct reporting relationship to the Bank of Ghana and need to approach the Bank through indirect channels (partner banks) for every decision—which not only slows things down for the MNOs but leaves the Bank out of touch with the actors that are really driving the market.

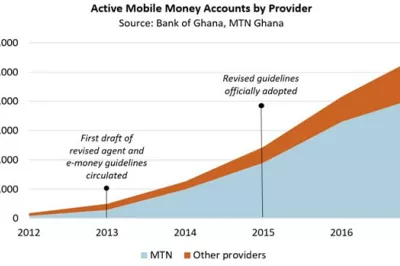

The Bank of Ghana recognizes the discrepancy of market developments from its original vision and has re-engaged the entire range of market players – including MNOs – in a dialogue around the regulatory framework.The private sector in Ghana has responded very positively to the overtures of the Central Bank and the prospects of a more flexible regulatory environment. In this video, Elly Ohene-Adu, Head of Financial Inclusion at the Central Bank of Ghana, speaks with CGAP about some of the issues with the current regulations and how the BoG is planning to tackle them. Of course, it is easy to see these challenges in hindsight but much harder to predict them in advance. One lesson everyone can take away is that in such a nascent industry, it is difficult for policy makers to predict who will want to pursue the market and how the industry will develop. They may be better off not trying to develop regulations ex ante or risk stifling the market by backing actors that are not interested while holding back more eager and potentially successful actors. A deliberate ‘test and see approach’, such as the one adopted by the Philippines, may be better suited in the early years.

Add new comment