Recent Blogs

Blog

Interest Payments on Mobile Wallets: Bank of Tanzania’s Approach

One ongoing debate in digital financial services concerns whether customers should be able to earn interest on mobile money wallets. The Bank of Tanzania decided that the benefit of interest earned by MNOs should go directly to customers. Here are key lessons to date.Blog

Leveraging Social Cues to Encourage Digital Payments

By focusing on social proof, Juntos and Tigo Pesa are building confidence in mobile money technology and driving the use of digital payments in Tanzania.Blog

Tigo Nivushe, Tanzania: 5 Ways to Build Trust in Digital Lending

‘We will trust you until you give us a reason not to:’ Tigo launches an innovative mobile lending product in Tanzania.Blog

Five Fresh Facts from the Smallholder Diaries

How are smallholder families managing their money? What challenges do they face? What financial solutions can help? CGAP’s Financial Diaries with Smallholder Households ("Smallholder Diaries”) spent a year with 270 farming families in Mozambique, Tanzania, and Pakistan to find out.Blog

Digitizing Agricultural Value Chains: How Buyers Drive Uptake

Most companies don’t want to be the first in a sector to try something new and potentially unpopular. Dominant buyers must lead the way to drive large-scale mobile money uptake by smallholder farmers.Blog

New Data Finds Mobile Money "On the Cusp" in Rwanda and Ghana

New data provides the most comprehensive picture yet of digital financial services (DFS) access and usage in Ghana and Rwanda.Blog

M-Pawa 1 Year on: Mobile Banking Perceptions, Use in Tanzania

A year after the launch of M-Pawa, how are Tanzania's farmers using the savings and loan service? What improvements could lead to more uptake?Blog

Making Tough Decisions as a Smallholder Farmer

Smallholders often have to make touch financial choices regarding what to prioritize with limited resources.Blog

Four Ways Energy Access Can Propel Financial Inclusion

Now that mobile money platforms have become widespread, the private sector is using these services to power the delivery of additional services, such as pay-as-you-go (PAYG) solar energy.Blog

Financial Innovation and Solar Power: Conquering Energy Poverty

Early evidence suggests that more people can get electricity with the help of financial innovation. There are two key ways financial innovation is expanding access to electricity around the world.Blog

Which Markets are Ready for Digital Finance Plus?

Innovative businesses are leveraging Digital Finance Plus to link poor communities with essential services. The success of these businesses is driven by multiple market factors. We explore which factors matter most based on a framework CGAP developed with McKinsey.Blog

Digital Credit: Consumer Protection for M-Shwari and M-Pawa Users

Digital credit products are only going to become a more important element of financial services in emerging markets where expansion of mobile money platforms has created potential borrower segments of millions of consumers that are only an SMS away.Blog

Geography Matters When Talking about Smallholders

As a smallholder, geography not only determines the climate of your village and the farm-readiness of your land, but also plays a role in determining how well-connected you are to irrigation, inputs like seeds and fertilizer, buyers, markets, and training.Blog

Smallholder Households: A Financial Inclusion Imperative

A new Focus Note provides early insights into the Smallholder Households Financial Diaries project and highlights how smallholders weave together agricultural and nonagricultural sources of income to meet their needs.Blog

"It's About Life," Not Just Agriculture

Agriculture is just one of many sources of income for smallholder farmer households. This post focuses on how one family that has dealt with multiple unexpected financial demands and diverse sources of income.Blog

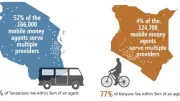

Tanzania: Africa’s Other Mobile Money Juggernaut

Tanzania has seen a rapid spread of mobile money and is hot on the heels of Kenya in terms of uptake and use of digital financial services.Blog

How Tanzania Established Mobile Money Interoperability

Tanzania’s mobile money industry is flourishing. With a new set of standards governing person-to-person payments across multiple networks, it’s now evident that interoperability is here to stay.Blog

USSD Access: A Gateway and Barrier to Effective Competition

To serve the unbanked, mobile financial service providers continue to rely on USSD technology to bring innovations like mobile money to the unbanked. CGAP research in Kenya and Tanzania identified several competition-relevant issues in USSD access.Blog

Talking Avocados, Spinach & Catfish with a Tanzanian Rice Farmer

Although Gideon, a participant in CGAP's financial diaries of smallholder families research, is technically a rice farmer, much of his income is comprised of income from other crops and and non-agricultural activities.Blog