Recent Blogs

Blog

How Hard Is It to Use Mobile Money as a Rural Bangladeshi Woman?

Women in Bangladesh have one of the lowest rates of mobile money usage in the world. Does the dearth of usage indicate a lack of appropriate products and services? Just how hard is it to use mobile money if you are a rural Bangladeshi woman?Blog

How Juntos Finanzas Engages Customers to Use Digital Finance

There is an engagement gap between customers and providers of financial services: customers lack necessary information and do not fully trust financial service providers. Juntos Finanzas is looking to change this with a new digital solution.Blog

Making Mobile Money Accessible in Pakistan

Mobile wallets could have a revolutionary impact on financial inclusion in Pakistan. However, success of this channel hinges on matching the abilities of the end users with appropriately designed products.Blog

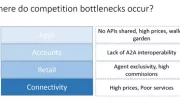

Addressing Competition Bottlenecks in Digital Financial Services

For mobile money regulators in developing countries, competition can be a complex balancing act. In particular, there are four areas where competition bottlenecks can occur.Blog

Pakistan: Is Mobile Money a Viable Alternative to Banking?

There is more to financial inclusion than convenience. In Pakistan, for mobile financial services to maximize their financial inclusion benefits, providers need to offer a wider variety of services.Blog

Voice of the Customers: a Two-Way Dialogue in Digital Finance

The relationship between digital finance service providers and their customers is broken. How can the voice of customers be better integrated in digital finance business models?Blog

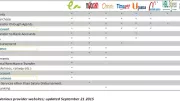

The Promise of Mobile Money in Pakistan

Mobile money - through over the counter services and mobile wallets - is helping to drive financial inclusion in Pakistan.Blog

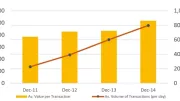

Interpreting the Financial Inclusion Numbers in Pakistan

Financial inclusion in Pakistan has improved slowly but steadily since 2008 according to most sources. However, depending on the source of data, the topline financial inclusion figure for Pakistan varies from 7% to 23%. Why?Blog

Driving Smallholder Savings through Digital Design in Senegal

After interviewing 65 smallholder farmers and savings groups, CGAP and Dalberg uncovered potential for alternative ways to offer financial services to farmers that go beyond credit.Blog

Did India’s Central Bank get Payments Bank Approvals Right?

India's Central Bank got many things right when it comes to the 11 new approvals for payments bank licenses. These approvals are big catch-up step for digital finance in India, but it may be challenging for the country to continue being innovation-friendly.Blog

Payment Innovations in Turkey: Not (Yet) Reaching the Unbanked

Innovations on payment systems in Turkey have the potential to move beyond the current reach of bank accounts and cards.Blog

Gaining Insights into Digital Design from Cambodia’s Smallholders

Insights from smallholders are informing the design of better digital financial services for farmers in Cambodia, through a human-centered design process.Blog

Partnership: Missing Ingredient to Mobile Money APIs

Open APIs bring the promise of expanding the reach and benefits of financial services for the unbanked. But there remain no real examples of widely adopted open APIs for mobile money.Blog

Turkish Banks at the Forefront of MSME Lending, but Gaps Remain

A look at lending to microenterprises in Turkey, in the second blog in a series about financial inclusion in the country in 2015.Blog

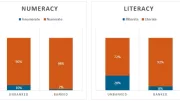

A Multi-Digit Divide? Building Basic Financial Numeracy

The behavior and practices of "oral communities" - where most people are illiterate - may help to explain both the scale of account dormancy in mobile money and the prevalence of over-the-counter (OTC) mobile money services.Blog

What Can Donors Do to Ensure Responsible Digital Finance?

For digital finance to be a transformative tool, consumers must have greater confidence in the markets and in providers that deliver those services, writes USAID's Matt Homer.Blog

Merchants and Agents: Apples and Oranges?

Digital financial services providers that pursue mobile merchant payments are creating acquiring networks of merchants able and willing to accept payment for goods and services. How can they build on existing agent networks?Blog

Supervisor’s Experience with Expanding Agent Networks: 4 Insights

As agent networks expand, they bring great opportunity by facilitating cutting edge digital financial products. But with this expansion comes risk and serious implications for financial supervision.Blog

How to Drive Merchant Payments? Build Solutions Merchants Want

When value-added services are added to merchant payment solutions, does usage increase?Blog