Recent Blogs

Blog

Liberian Teacher ePayments: Stepping Stones to Inclusion

What if a teacher in rural Liberia could collect her salary instantly and remotely? USAID recently partnered with the Liberian Ministry of Education to roll out the first mobile salary payments, and the preliminary results are extremely promising.Blog

Ending Extreme Poverty: New Evidence on the Graduation Approach

SDG 1 is as exciting as it is daunting: End extreme poverty. The Graduation Approach has resulted in large and cost-effective impacts on ultra-poor households’ standard of living, ultimately enabling a sustainable transition to more secure livelihoods and an exit from poverty.Blog

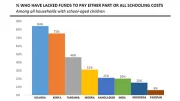

Paying for School: 6 Insights for Better Financial Services

The inability to pay fees and other education expenses keeps many children out of school. What is the extent of these challenges, who is affected and what kinds of financial services could help?Blog

How Financial Inclusion Can Boost a Nation’s Health & Well-Being

Low-income households often struggle with health expenses, and inadequate access to quality health care can drive families into poverty. To achieve good health and well-being, UN Sustainable Development Goal 3, financial inclusion can and should play a critical role.Blog

Delivering on Education for All: The Role of Mobile Money

For many low-income families worldwide, education can be out of reach. Mobile money and digital financial services have the potential to help families by providing them with better tools that can help them save, plan and make education payments.Blog

The Role of Financial Services in Reducing Hunger

Many of the world's 1.5 billion smallholder farmers lack access to basic financial services, leaving them vulnerable to shocks and prone to low-risk, low-return investments. Improving access to financial services can help farmers increase household income and food security.Blog

Headwinds and Tailwinds in Banking Small Businesses

Rapid “digitization” of business and investment in financial technology have the potential to significantly improve access to finance for millions of micro, small, and medium enterprises worldwide, yet challenges remain. Can FinTech solve the access to finance problem for MSMEs?Blog

Beyond Credit: Risk Management as a Strategy for Economic Growth

Well-functioning financial markets are essential for the growth of firms, including commercial farms. Efforts to improve financial markets in underserved localities must include an understanding of stakeholders’ risk management needs—not just access to credit.Blog

Advancing Financial Inclusion to Improve Access to Education

Worldwide, 124 million children between the ages of 6 and 15 are not in school. While financial inclusion cannot solve the many complex reasons all children are not in school, better financial tools can help families manage educational expenses.Blog

Energy and Water for All: The Last Mile Is the Longest Mile

New models for financing household connections to energy, water and sanitation are enabling more low-income households to access these essential services. Financial solutions are necessary for achieving access targets under the Sustainable Development Goals (SDGs).Blog

Financial Inclusion Has a Big Role to Play in Reaching the SDGs

The United Nations’ 17 Sustainable Development Goals (SDGs) include greater equality and access to clean water, among other objectives, but not access to savings accounts, loans, insurance and other financial services. Financial inclusion can play an important role in achieving many of the SDGs.Blog

Tugende: Analog Credit on Digital Wheels

In Uganda, Tugende has helped over 3,000 motorcycle taxi drivers on the path to ownership by leveraging new technologies that enable the purchasing of an asset over time. Tugende's success has four key lessons for other digital finance plus initiatives.Blog

Could Energy Service Be the Key to Banking the Rural Poor?

Driving financial inclusion and expanding energy access have traditionally been considered separate development objectives. But thanks to revolutions in the distribution and financing of off-grid solar, that may be about to change.Blog

Financial Inclusion and Off-Grid Solar: Three Takeaways

Pay-as-you-go solar energy is gaining popularity in sub-Saharan Africa, and it is also playing a role in driving financial inclusion.Blog

Building a Digital Finance Ecosystem in Zimbabwe

Mobile operators are increasingly looking toward a next generation of financial and non-financial services that leverage mobile money. In Zimbabwe, Econet is diversifying its products while simultaneously driving mobile money usage in other sectors, including energy, education, agriculture, and health.Blog

20 Years of Financial Inclusion in the Arab World

According to the Findex, the Arab World has the highest percentage of financially excluded adults. What are the regional obstacles? How has the field changed in the past 2 decades?Blog

20 Years of Financial Inclusion in Europe and Central Asia

In the past 20 years, microfinance in Eastern Europe and Central Asia has become understood under the larger umbrella of inclusive finance. During this shift, several important changes have occurred.Blog

20 Years of Financial Inclusion in East Asia and the Pacific

China, with its new business models for internet banking, may be the space to watch for financial inclusion progress in East Asia, but a lot has changed in the region over two decades.Blog

20 Years of Financial Inclusion in East Africa: 4 Major Shifts

Four major shifts have occurred in East Africa's financial services landscape over the past two decades.Blog