Recent Blogs

Blog

Six Takeaways from Rwanda’s Financial Inclusion Insights Survey

Even though Rwanda has low rates of technical literacy and handset usage, digital financial services have reached the same levels of active usage as Ghana, which has a much more "mobile-ready" population.Blog

Technology Must Solve Real Problems for Low-Income Customers

We are just scratching the surface of what digital technology can do for low-income consumers. Mobile has been a game changer, but what's next? There are even more powerful digital tools in the pipeline.Blog

The Road to Financial Inclusion: Solid Progress, Big Challenges

It is not poverty that generates financial exclusion, but rather the opposite: financial exclusion generates poverty.Blog

The Five Most Dramatic Changes in 20 Years of Financial Inclusion

Since CGAP was formed 20 years ago, there have been dramatic changes in the progress of financial inclusion.Blog

From Microfinance to Financial Inclusion: Reflections on 20 Years

2015 marks a good year for financial inclusion and provides an opportunity for reflecting on what has happened in the sector in the past two decades.Blog

Four Ways Energy Access Can Propel Financial Inclusion

Now that mobile money platforms have become widespread, the private sector is using these services to power the delivery of additional services, such as pay-as-you-go (PAYG) solar energy.Blog

Financial Innovation and Solar Power: Conquering Energy Poverty

Early evidence suggests that more people can get electricity with the help of financial innovation. There are two key ways financial innovation is expanding access to electricity around the world.Blog

Which Markets are Ready for Digital Finance Plus?

Innovative businesses are leveraging Digital Finance Plus to link poor communities with essential services. The success of these businesses is driven by multiple market factors. We explore which factors matter most based on a framework CGAP developed with McKinsey.Blog

Unlocking Access to Critical Services Through Digital Payments

New solutions are emerging that use digital finance to provide essential services for people in places where the traditional models have failed them.Blog

Providing Last Mile Customer Service for Solar Home Systems

Off Grid Electric (OGE) is a solar company in Tanzania that provides low-cost energy services to households without energy access. The company is focused on breaking new ground in last-mile service.Blog

Educational Transparency through Digital Finance Plus

A chain of primary and pre-primary schools in Kenya offers parents the ability to pay and track school fees with their mobile phones. The service is aimed at increased efficiency and transparency.Blog

Digital Finance: Catalyzing New Energy Business Models

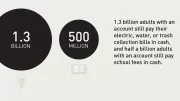

Over 1.3 billion people worldwide live without access to electricity. Modern, small-scale solar solutions are now on the market, and digital finance is going a long way toward making these more affordable and accessible in poor communities.Blog

Payment Innovations Improve Access to Solar Energy, Clean Water

A number of business model innovations that link poor households to better basic services are becoming economically viable through advances in digital payments infrastructure. This blog discusses three lessons on how to advance the nascent field of "Digital Finance Plus".Blog

M-Shwari in Kenya: How is it Really Being used?

In recent years, Safaricom has launched a number of value-added services through its M-PESA product in Kenya, aiming to move its customer base beyond basic money transfers. M-Shwari is by far the most popular of the offerings.Blog

Digital Finance Helps Expand Access to Electricity

Mobisol combines solar energy with innovative mobile technology and microfinance. Their lease-to-own solar home systems are paid off through a microfinance installment plan via the customer’s mobile phones – making them affordable for households with low incomes in developing countries.Blog

Water by Phone: Transforming Utilities in the Developing World

As World Water Day is being recognized around the globe this Saturday, we take a look at how mobile money is making clean water more affordable and accessible in Kenya.Blog

Financial Inclusion in Myanmar: 10 Things You Should Know

The financial inclusion ecosystem in Myanmar is changing rapidly. Here are 10 things you should know about financial inclusion in Myanmar.Blog

Global Landscape of Digital Finance Plus

To illustrate the global landscape of Digital Finance Plus, CGAP has identified 55 companies providing innovative solutions in the energy, water, health and agriculture sectors.Blog

Improving Education with Financial Innovation, Chapter-by-Chapter

Kytabu is a Kenyan-based company that offers a textbook subscription service where users can pay in small increments for individual chapters of textbooks and read the content on their cell phones. The company hopes to make educational materials much more accessible and affordable in Kenya.Blog